,

Tokenization is nothing, but a transformative concept in the blockchain world that has introduced a new way to perceive assets and investments. During the phase of decentralised finance, Tokenization provides a gateway to open up liquidity, allowing for fractional ownership, and brings unparalleled transparency.

ERC3643 is an essential standard poised to shape the future of asset tokenization. In this blog, we will shed light on a comprehensive understanding of ERC3634 and its significance. We will also discuss how it responds to the crucial problem of compliance in the tokenization ecosystem. Scroll down to explore the nitty-gritty of ERC3643 and its front role in establishing trust and security in the blockchain-driven financial landscape.

Understanding Tokenization

What is Tokenization?

Tokenization is the process of converting real-world assets like real estate, commodities, and intellectual properties into digital tokens on a blockchain. These tradable tokens represent ownership rights. This transformation enables fractional ownership, i.e. high-value assets can be divided into smaller and more affordable portions.

Benefits of Tokenization

- Liquidity

Tokenization improves liquidity by facilitating the trading of traditionally illiquid assets. Investors can now get their invested funds without waiting for lengthy settlement processes. - Fractional Ownership

It makes investing more accessible and inclusive by enabling individuals to own a fraction of high-value assets. - Transparency

Blockchain technology offers a transparent, immutable ledger that ensures the accuracy of ownership records. - Efficiency

Tokenized assets can be exchanged 24/7, removing the need for intermediaries and speeding up transactions.

The Need for Compliance in Tokenization

Tokenization, no doubt, has gained important traction, however, it also presents a range of challenges.

Regulatory Challenges

- Legal Frameworks

Existing regulatory frameworks often struggle to adapt to the unique nature of tokenized assets. To ensure legal compliance, clear guidelines are essential. - Investor Protection

Without adequate safeguards, investors risk falling into shady scams. To defend their interests, compliance measures are essential. - Market Integrity

For long-term success in tokenized markets, maintaining trust and integrity is essential. An essential component of market integrity is regulatory compliance.

The Importance of Compliance

Compliance acts as a protective shield in the tokenization ecosystem. This will guarantee that tokenized assets adhere to applicable laws/regulations to safeguard the interests of investors and market participants.

Compliance is an essential component of trust and is more than just a legal obligation. Investors need assurance that the environment in which their investments are made is safe and regulated. This trust forms the bedrock upon which the tokenization ecosystem can thrive.

ERC3643 stands out as a crucial standard that tackles compliance challenges head-on. It provides issuers with a framework for minting and managing identity-based permissions tokens, ensuring that only authorized users possess these tokens.

ERC3643 in a Nutshell

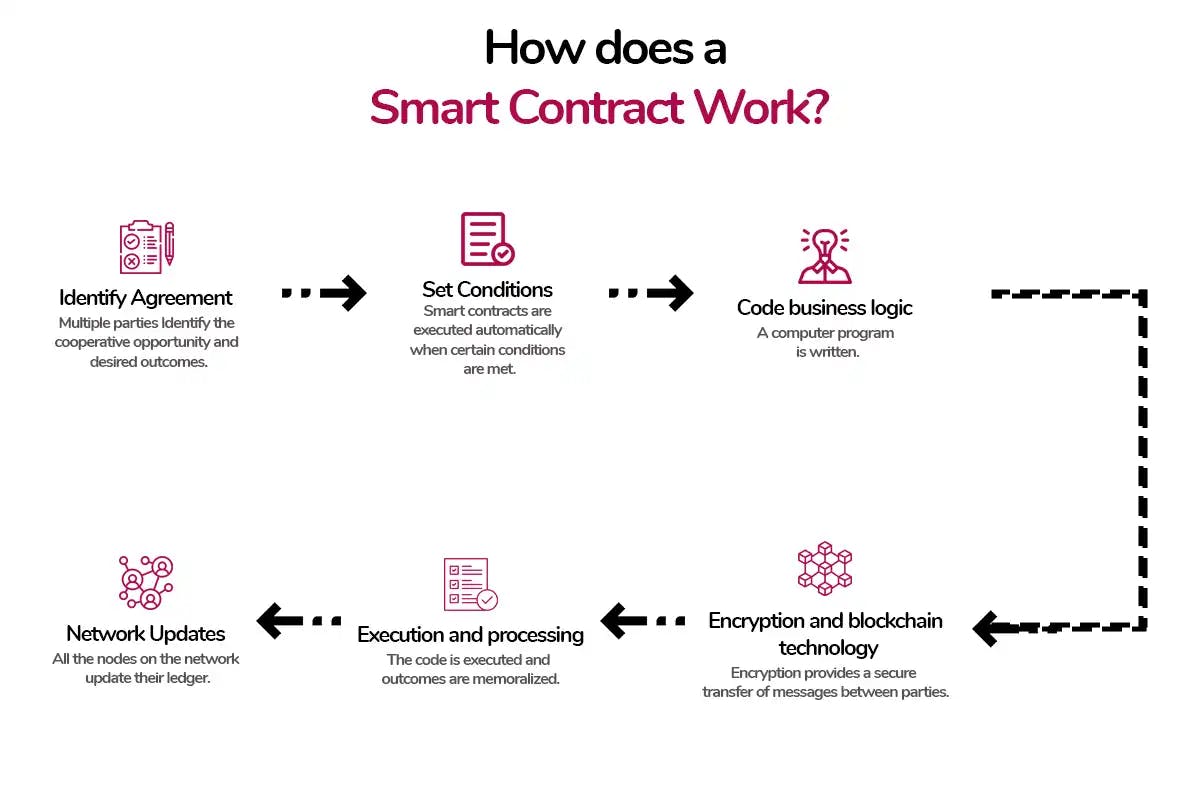

ERC3643 is a suite of smart contracts and not a single contract created to facilitate compliance tokenization. Further, these contracts create the backbone of identity-based permissions tokens by adding a layer of security and trust to the tokenization process.

What is ERC3648??

Previously known as the T-REX protocol, ERC-3643 protocol is an open-source suite of smart contracts enabling the issuance, management, and transfer of permissioned tokens.

The primary goal of ERC3643 is to facilitate compliance through the issuing of permissioned tokens based on identity. These tokens have a unique twist that only users who meet certain eligibility criteria are permitted to hold tokens. This eligibility is determined by verifying the digital identities of users, ensuring that compliance is embedded into the token itself.

The purpose of ERC3643 is to close the gap between the innovative potential of tokenization and the requirement for strict regulatory compliance.

The Components of ERC3643

There are several key components that work together to strengthen ERC3643. They are

ONCHAINID

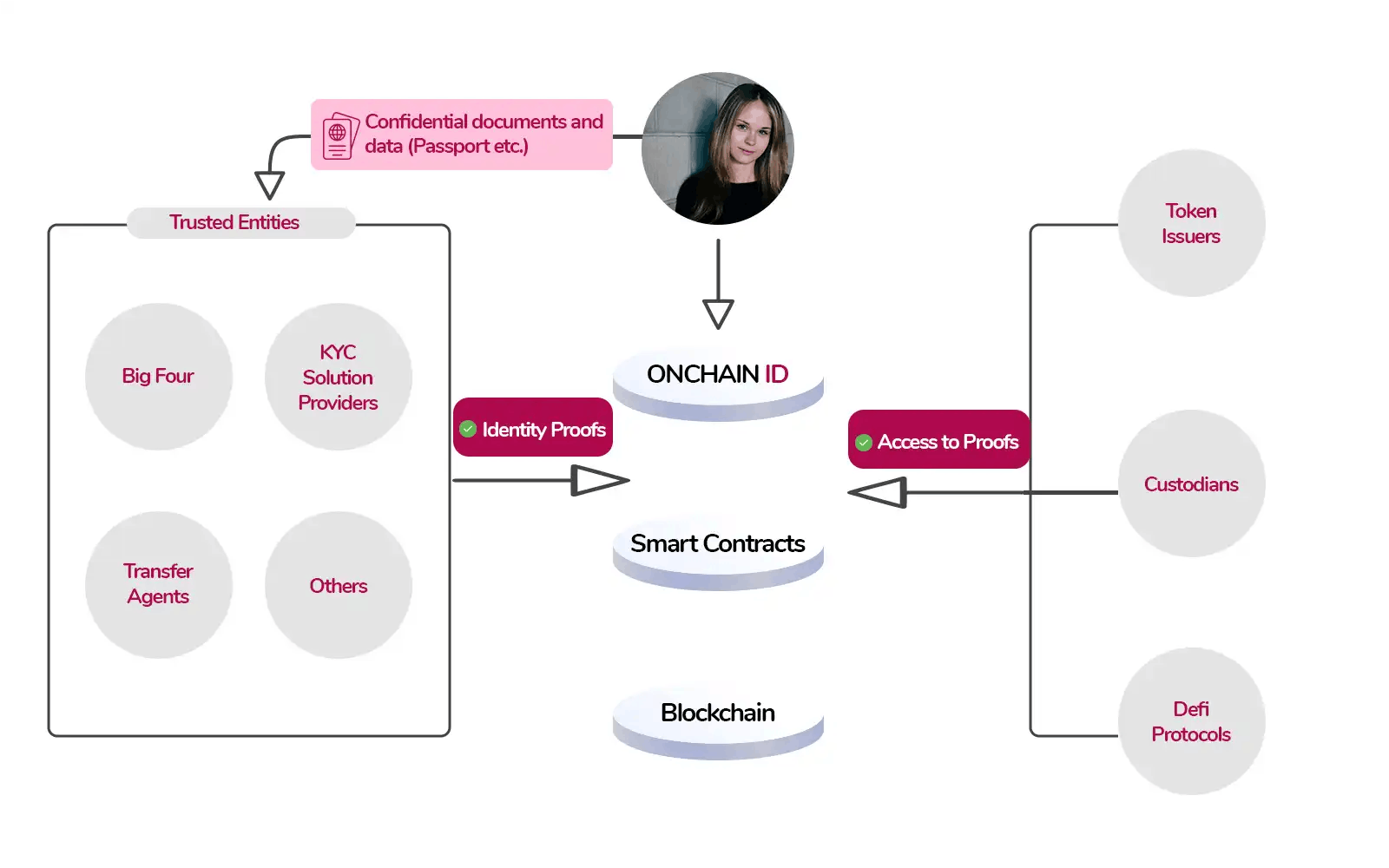

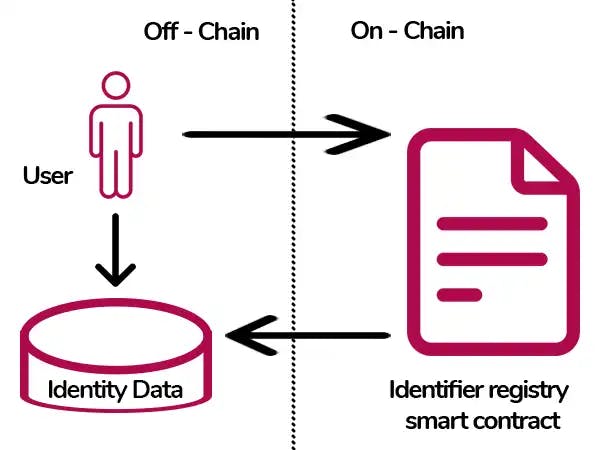

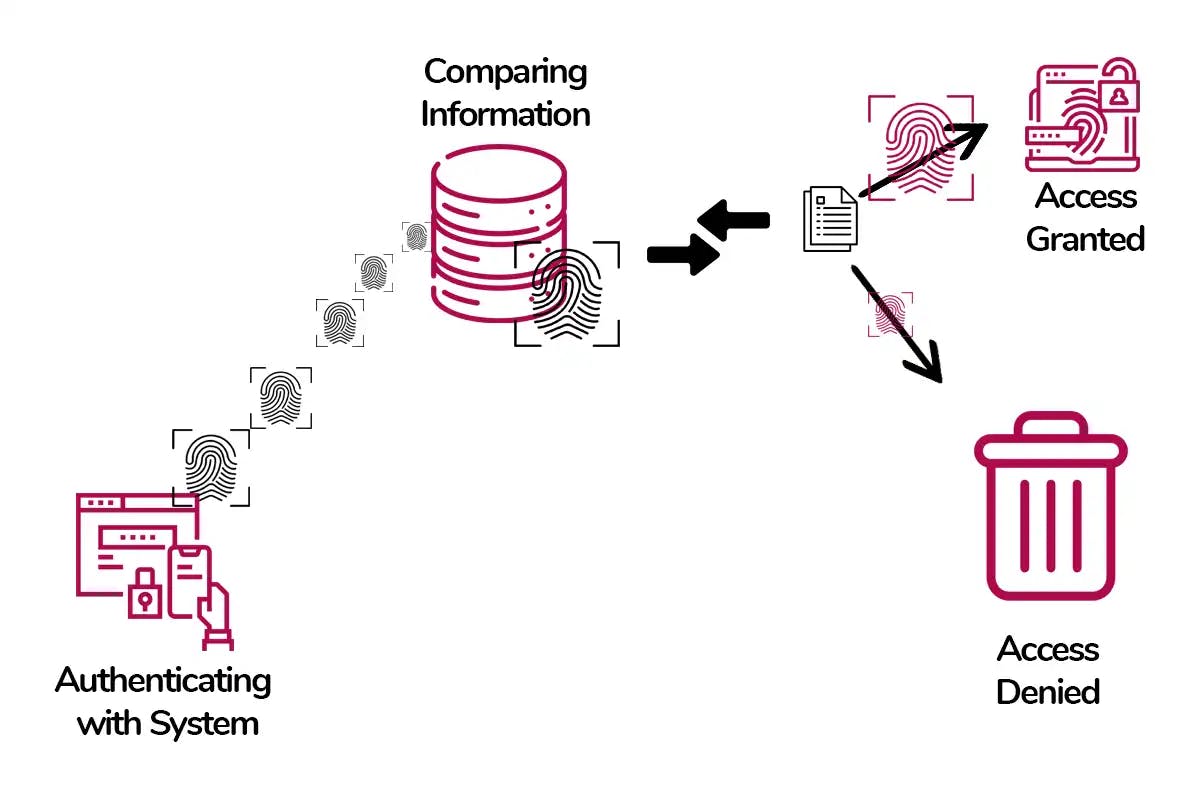

ONCHAINID is a decentralized system acting as the foundation of ERC3643. Using ONCHAINID, users can create their self-sovereign identities on the blockchain. Most importantly, private data remains off-chain with trusted parties, preserving confidentiality. Identity proofs, in the form of data validations, are securely published on the blockchain, providing a trustworthy record of user identities.

ONCHAINID works by allowing users to establish their self-sovereign identities using blockchain technology. This protocol securely stores private data off-chain with trusted entities rather than storing it on the blockchain. Blockchain technology is used to record encrypted identity proofs that deliver a transparent validation of data authenticity.

This component stores the addresses of all trusted claim issuers associated with a specific token. These claim issuers are crucial in verifying user identities while also making sure that only eligible individuals hold the token.

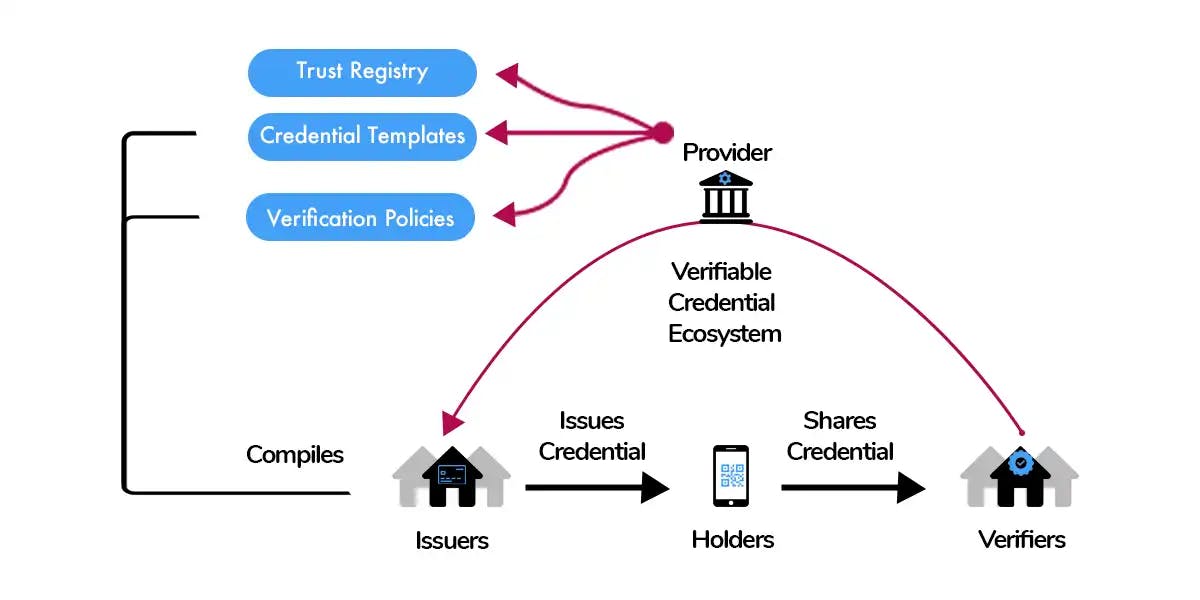

Being a decentralized repository, Trusted Issuers Registry (TIR) is designed to store details pertaining to trusted issuers, including public information and accreditations. All data is compressed in the form of Verifiable Accreditations within the Trusted Issuers Registry.

- Claim Topics Registry

A complete list of trusted claim topics related to the security token is kept up to date by the Claim Topics Registry. These claim topics outline the precise attributes and information that must be verified for compliance. It helps to create transparent methods for validating claims and improving accuracy across a range of applications, including academic achievements, professional certifications, etc. within the blockchain ecosystem. - Identity Registry

All eligible users who are authorized to hold the token are listed in the Identity Registry. It serves as a single repository of identity contract addresses. Its primary function is to confirm user claims and make sure they adhere to the requirements for token ownership. Users store their identification credentials and data within a decentralized identity wallet application, and blockchain technology enables hassle-free verification without communicating with the credential issuer.

Security Token Contract

This contract closely interacts with the Identity Registry to verify the investors’ eligibility status. It facilitates token holding and transactions, ensuring that only compliant investors can engage with the asset.

Security Token Contract

This contract closely interacts with the Identity Registry to verify the investors’ eligibility status. It facilitates token holding and transactions, ensuring that only compliant investors can engage with the asset.

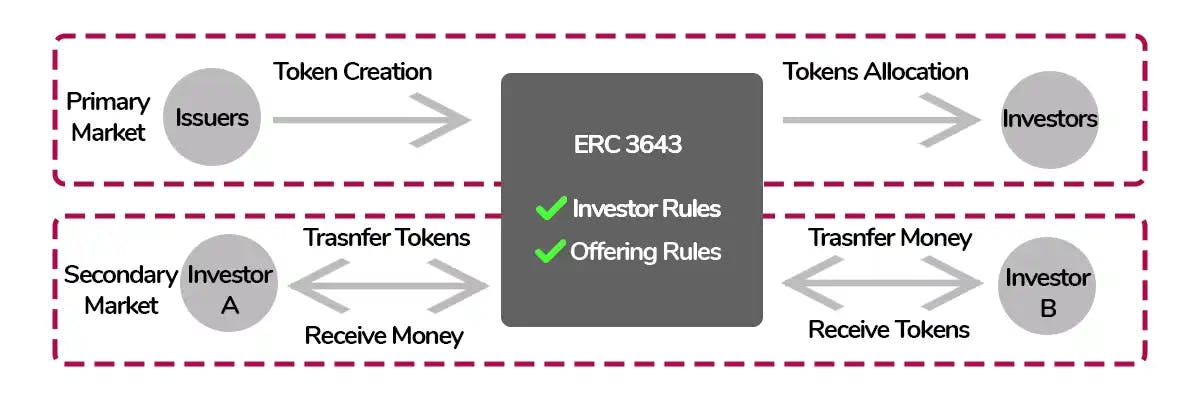

How ERC3643 Tokens Works

With the creation of tokens, ERC3643 sets out on its voyage. The components of the suite are used by asset issuers to mint identity-based permissioned tokens. These tokens represent a unique asset like real estate, goods, intellectual property and more. These tokens are intended to enforce compliance from the moment they are created, making sure that only eligible individuals are able to hold and transfer them.

The ONCHAINID component is an essential part of ERC3643. An investor’s digital identity is meticulously verified using ONCHAINID when they want to purchase these tokens. This decentralized identity system plays the role of a gatekeeper, ensuring that investors meet the eligibility criteria established for the token. To determine whether the investor is authorised to hold the specific asset-backed token, this verification is important.

ERC3643’s ability to enforce compliance at the level of smart contracts is one of its main strengths. The Compliance Smart Contract, operating independently, becomes the final arbiter when it comes to validating token transfer requests. It verifies that each transfer complies with the token’s set conditions and rules. This entails confirming the investor’s eligibility (through ONCHAINID) as well as the specific offering rules set for the token.

Practically, ERC3643 automates the compliance procedure, which is essential for providing safe and reliable transactions within the tokenized asset ecosystem. ERC3643 considerably reduces the risk of fraudulent activity by enforcing compliance at the smart contract level and ensures that only authorised investors can take part in the token economy.

Overall, ERC3643 stands out as a strong standard for asset tokenization because of its thorough and automated approach to compliance, providing a secure and effective way to handle and trade tokenized assets while maintaining regulatory compliance. This level of complexity in compliance is essential in building trust and confidence in the rapidly evolving world of blockchain-based finance and asset management.

Use Cases of ERC3643

It’s better to look at the practical use cases of ERC3643 to analyse its potential impact across various industries.

- Tokenizing Real Estate

ERC3643 can be used to tokenize commodities like gold, oil, or agricultural items. This allows for effective ownership and transaction tracking on the blockchain. Investors can own commodities in fractions, making them more readily available and liquid. ERC3643 ensures that only eligible parties participate in these tokenized commodity markets, maintaining regulatory compliance. - Implementing Loyalty Programs

The identity-based permissions tokens of ERC3643 can also be used for executing loyalty programs within the cryptocurrency and blockchain ecosystems. These programs can be tokenized to provide loyalty tokens for supplying liquidity, active participation, making transactions using particular platforms and/or currency, and so on. Implementing loyalty programs in tokenization will not only increase token utility or increase customer retention, but also help in attracting new users, building community, and more. - Tracking Commodities Ownership

ERC3643 can be used to tokenize commodities like gold, oil, or agricultural items. This allows for effective ownership and transaction tracking on the blockchain. Investors can own commodities in fractions, making them more readily available and liquid. ERC3643 ensures that only eligible parties participate in these tokenized commodity markets, maintaining regulatory compliance. - Protecting Intellectual Property

ERC3643 can also be applied to protect intellectual property rights, such as patents or copyrights. These assets can be tokenized, and the blockchain can be used to safely record ownership information. This not only simplifies the management and licensing of intellectual property but also ensures that only authorized parties have access to these digital assets.

The Benefits of ERC3643

ERC3643 brings a lot of advantages to the table, making it a considerable choice for those involved in asset tokenization. Here are the benefits of ERC3643

- Enhanced Security

The identity-based permissions tokens of ERC3643 provide an increased degree of security. The standard considerably lowers the risk of fraudulent transactions and unauthorized access by mandating user identity verification through ONCHAINID and enforcing compliance at the smart contract level. This not only protects the assets themselves but also the ecosystem of tokenized assets’ credibility and reputation. Investors’ worries about possible breaches or unauthorized transfers are diminished because they have faith that their investments are held and transferred securely. - Investor Protection

ERC3643’s emphasis on investor protection is one of its most important advantages. Compliance is considered a vital factor of this protection. ERC3643 reduces the chance of fraudulent schemes, scams, and asset mismanagement by ensuring that only eligible and authorized individuals can participate in the tokenized asset market. Knowing they are operating in a regulated and secure environment ensures investors feel more trust and confidence. Investor protection is not just a legal requirement but a cornerstone of the standard’s design. - Regulatory Compliance

ERC3643 is a useful tool for asset issuers looking to maintain compliance with pertinent laws and regulations because it is designed to be aligned with current regulatory frameworks. Compliance can be a complex and evolving landscape, and ERC3643 simplifies this process by embedding compliance measures into the token itself. By taking this proactive strategy, issuers can reduce their legal risks and potential liabilities while also maintaining good standing with regulatory bodies. - Fractional Ownership

ERC3643 makes it possible to divide high-value assets into smaller and more affordable portions. This democratizes investing and opens it up to a broader spectrum of potential investors. Fractional ownership has the capability to create a more inclusive and diversified investment landscape, as individuals can invest in assets that were previously financially out of reach.

Adoption Trends and Future Prospects

Current Adoption Trends

As the blockchain and tokenization ecosystem continues to evolve, ERC3643 is gaining acceptance across a variety of businesses. Its robust compliance features make it an attractive choice for asset issuers and investors looking to navigate the regulatory landscape confidently.

Future Prospects

- Regulatory Evolution

The compliance features of ERC3643 position it well to be by evolving regulations as regulatory frameworks continue to adapt to blockchain technology. This adaptability makes it a sustainable choice for long-term compliance. - Global Adoption

The usage of ERC3643 is likely to increase globally as more people become aware of its advantages. This might lead to the creation of an international standard for tokenization compliance. - Interoperability

ERC3643’s potential to work seamlessly with other blockchain standards and protocols could lead to greater interoperability in the blockchain ecosystem. As a result, new applications and use cases can be found. - Broader Asset Classes

The use of ERC3643 is not restricted to any particular category of assets. In the future, ERC3643 could be used to tokenize a wider variety of assets, such as works of art, collectibles, and even individual pieces of data.

SuperRare (ERC721A)

SuperRare is an online art platform that utilises blockchain technology to enable the sale and trade of digital artworks as Non-Fungible Tokens. Artists can create and authenticate their artwork as NFTs, which collectors can then buy and trade as unique digital assets.

Usage

SuperRare uses the ERC721A standard for its NFTs, which brings several enhancements. This upgraded standard enables batch transfers and royalty support, allowing artists to receive continuous revenue streams from their art. Additionally, metadata management is improved, ensuring a more seamless experience for users.

Importance

SuperRare demonstrates how the ERC721A standard can empower creators in the digital art industry. It offers a sustainable method for artists to monetize their work and ensure their continued involvement in the resale of their pieces.

Conclusion

So, as we wrap up this topic of ERC tokens, remember that Token standards are essential in the Ethereum ecosystem as they impact how assets are generated, controlled, and exchanged. Four key standards – ERC-20, ERC-721, ERC-1155, and ERC721A – serve as the foundation for decentralised applications and digital assets. Each standard brings its benefits and limitations, addressing various use cases. And guess what? That’s exactly where Codiste comes into play. Being a Top blockchain development company, we help blockchain development companies, investors, and enthusiasts to comprehend these standards along with their roles within the constantly evolving blockchain technology landscape.

As Ethereum and its ecosystem progress, the standards for tokens will evolve to align with the dynamic landscape and we can help you to utilise the complete power of these ERC Tokens. These token standards on Ethereum pave the way for innovation in various areas such as fungible assets, non-fungiblecollectibles, versatile contracts, and efficient royalties. This enables limitless opportunities for creative advancements within the blockchain world.