The fintech world is currently caught in a high-stakes tug-of-war. On one side, the push for AI in Fintech Regulation promises to slash operational costs; on the other, global regulators are demanding unprecedented transparency. For many firms, the "black box" nature of AI agents is a compliance disaster waiting to happen.

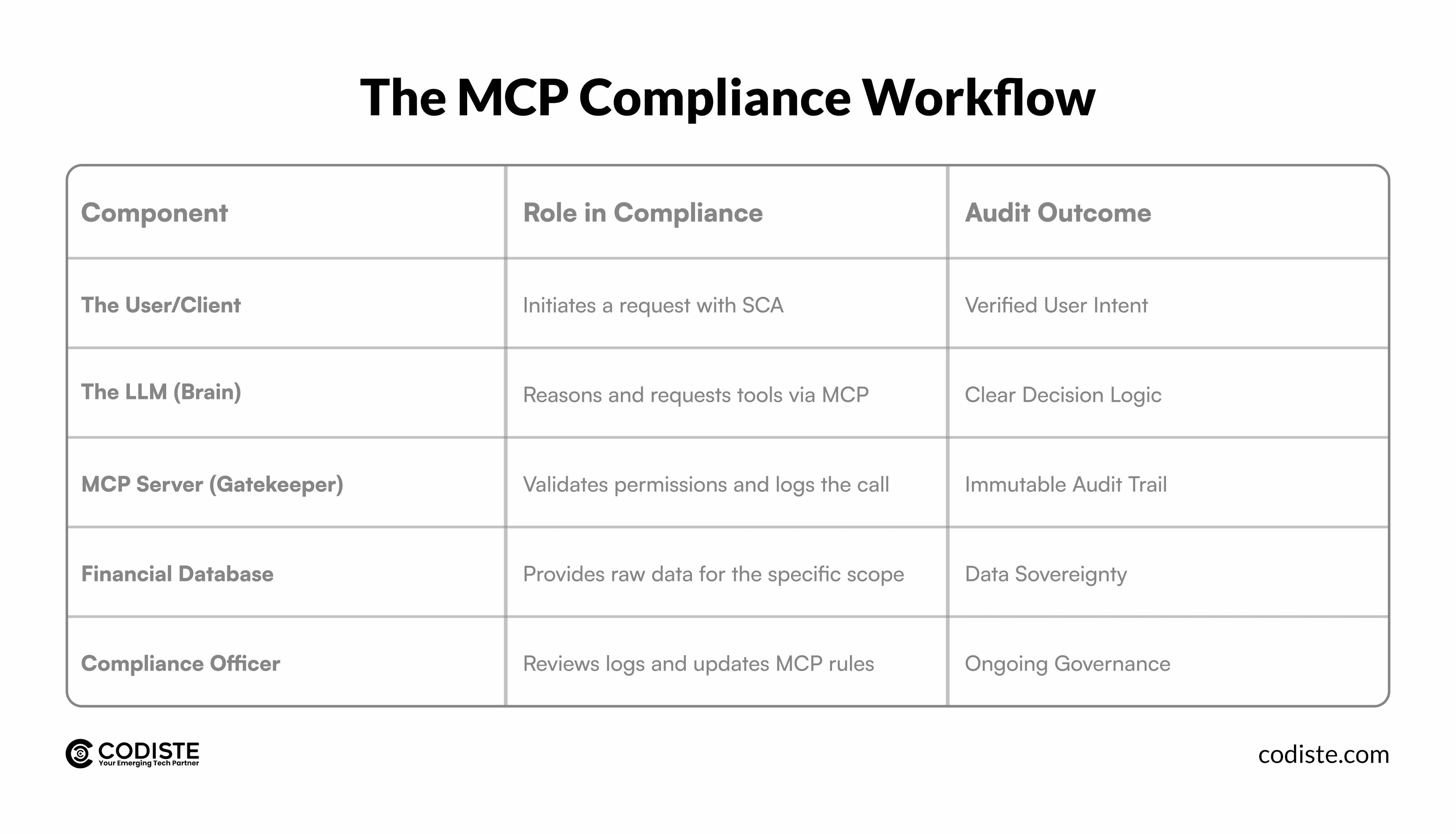

When an AI agent makes a decision, whether it is flagging a transaction for fraud or calculating a credit limit, regulators want to know exactly what data it accessed and why. This is where the Model Context Protocol (MCP) changes the game. By moving away from brittle, custom-coded integrations and toward a standardized framework, MCP Servers and Compliance are becoming the new gold standard for financial stability.

To stay audit-ready, fintechs must treat their MCP infrastructure not just as a data bridge, but as a digital paper trail that proves every action was authorized, monitored, and compliant.

In the past, AI in finance was mostly "read-only." It analyzed trends and reported them. Today, we are entering the era of Agentic AI models that can use tools, query databases, and execute actions. For a fintech company, this might mean an AI agent that can pull a customer’s AML/KYC Reporting history and then decide whether to approve a high-value transfer.

Without a standard like MCP, these agents operate through a mess of custom APIs. This creates "visibility gaps" where it is impossible to see exactly how the AI moved through your systems. Fintech Compliance requires that every step of this journey is logged. MCP provides the "standardized plumbing" to make this possible, ensuring that the AI never acts outside its designated sandbox.

The Model Context Protocol allows for a decoupling of the "brain" (the LLM) from the "hands" (the data and tools). In a regulated environment, this separation is vital for Financial AI Governance.

When you use a Compliance MCP server, you are essentially creating a secure vault for your data. The LLM does not have "access" to your database in the traditional sense. Instead, it asks the MCP server for specific pieces of information. The server then evaluates that request against your internal compliance rules before handing anything over.

This architecture allows you to:

Would you like to see how Codiste can secure your AI roadmap?

To maintain a robust Regulatory Audit Trail, fintech developers and compliance teams should collaborate on these five technical safeguards.

Never give an AI agent a "Master Key." Your MCP tools compliance in regulated industries strategy must be built on the principle of least privilege. If an agent is assigned to handle customer support, its MCP server should only expose tools related to account status and FAQs. It should never have the "scope" to see internal liquidity reports or corporate payroll.

In a fintech audit, "we think it happened this way" is a failing grade. You need proof. Your MCP implementation should generate immutable logs. This means every JSON-RPC request and response between the LLM and the MCP server is hashed and stored in a secure log management system. This provides a step-by-step record of the agent's "thought process" and the data it used to conclude.

When Securing MCP Server Data, especially in a cloud environment, encryption at rest is not enough. For high-stakes fintech apps, use HSMs to manage the keys that sign MCP requests. This ensures that even if a server is compromised, the attacker cannot forge requests to your financial databases.

AI agents can process data faster than any human, which makes them perfect for Financial Crime Prevention. However, they must be fed high-fidelity data. An MCP server can act as a real-time validator, checking every piece of data against global sanctions lists before the AI agent even sees it. This prevents the AI from making decisions based on stale or "dirty" data.

Under PSD2/SCA Compliance, strong customer authentication is a requirement for many actions. When an AI agent acts on behalf of a user, the MCP server must verify that the user’s session is still valid and that the specific action (like a wire transfer) has been explicitly authorized through a multi-factor check. The MCP server acts as the "gatekeeper" that refuses to execute the tool if the SCA token is missing.

The biggest fear for regulators is the "Black Box", the idea that AI makes decisions for reasons no human can understand. MCP Servers and Compliance frameworks solve this by forcing the AI to work through a structured, logged interface.

If a regulator asks, "Why did this agent flag this account?" a firm using MCP can show the exact data points the agent requested from the MCP server. This turns a "probabilistic" AI decision into a "deterministic" audit trail.

The future of finance is agentic, but that future cannot exist without trust. By adopting MCP Servers and Compliance early, fintechs move from a defensive posture to an offensive one. You aren't just "trying not to get fined" you are building a superior, more transparent financial engine.

At Codiste, we understand the unique pressure of building mcp compliance systems that satisfy both the dev team and the legal team. We specialize in building custom MCP servers that integrate seamlessly with your existing financial stack, ensuring that your AI transition is smooth, secure, and above all audit ready.

Don’t let regulatory fear stall your AI roadmap. Let’s build a compliant future together.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.