AI in fintech use cases are transforming how financial services deliver customer experiences, with 73% of financial institutions already implementing some form of artificial intelligence, according to McKinsey research. From instant loan approvals to personalized investment advice, artificial intelligence in fintech is no longer a future concept - it's driving competitive advantage today.

The financial services landscape has fundamentally shifted. Neobanks use AI in finance to sign up consumers in minutes instead of days, whereas traditional banks have trouble with old processes. Use Cases of AI in Fintech span everything from finding fraud to rating credit. This creates chances for organizations that act swiftly and problems for those who don't.

For fintech leaders, the question isn't whether to adopt AI, it's how fast you can implement the right AI fintech market solutions before competitors gain an insurmountable advantage.

Customer onboarding represents the first impression and biggest friction point for financial services. Deloitte data shows that 40% of potential clients drop out of applications halfway through when they use traditional KYC methods.

AI virtual assistants now help consumers through complicated onboarding processes by explaining what they need to do and gathering papers without a hitch.

JPMorgan Chase reduced their account opening time from 20 minutes to under 5 minutes using intelligent document processing and automated identity verification.

Key improvements include:

Fintech and Banking institutions implementing AI-powered onboarding report 65% higher completion rates and 80% faster processing times. The technology eliminates manual document review bottlenecks while maintaining compliance standards.

Fraud costs banks and other financial organizations more than $32 billion a year; therefore, finding and stopping it is very important for their existence. AI in fintech excels at pattern recognition, analyzing thousands of transaction variables in milliseconds to identify suspicious activity.

Customers get angry, and resources are wasted when traditional rule-based systems make mistakes. AI algorithms learn from past data and adapt to fit new patterns of fraud without any help from people.

Advanced fraud prevention capabilities:

PayPal's AI system handles more than 29 billion transactions a year, stopping $750 million in possible fraud while keeping the false positive rate below 0.1%. Their machine learning models are getting better at being accurate without stopping real transactions.

Generic financial services no longer satisfy modern consumers who expect Netflix-level personalization. AI in finance provides highly relevant product suggestions by analyzing spending trends, life events, and financial objectives.

The Erica assistant at Bank of America handles more than 100 million customer interactions every month, giving them individualized advice and proactive financial help. The AI finds unusual spending patterns, advises ways to better budget, and proposes financial solutions that are right for each person.

Personalization strategies that work:

Finance evolving with AI means moving from reactive customer service to proactive financial wellness partnerships. Companies implementing comprehensive personalization see 25% higher customer lifetime value and 40% improved retention rates.

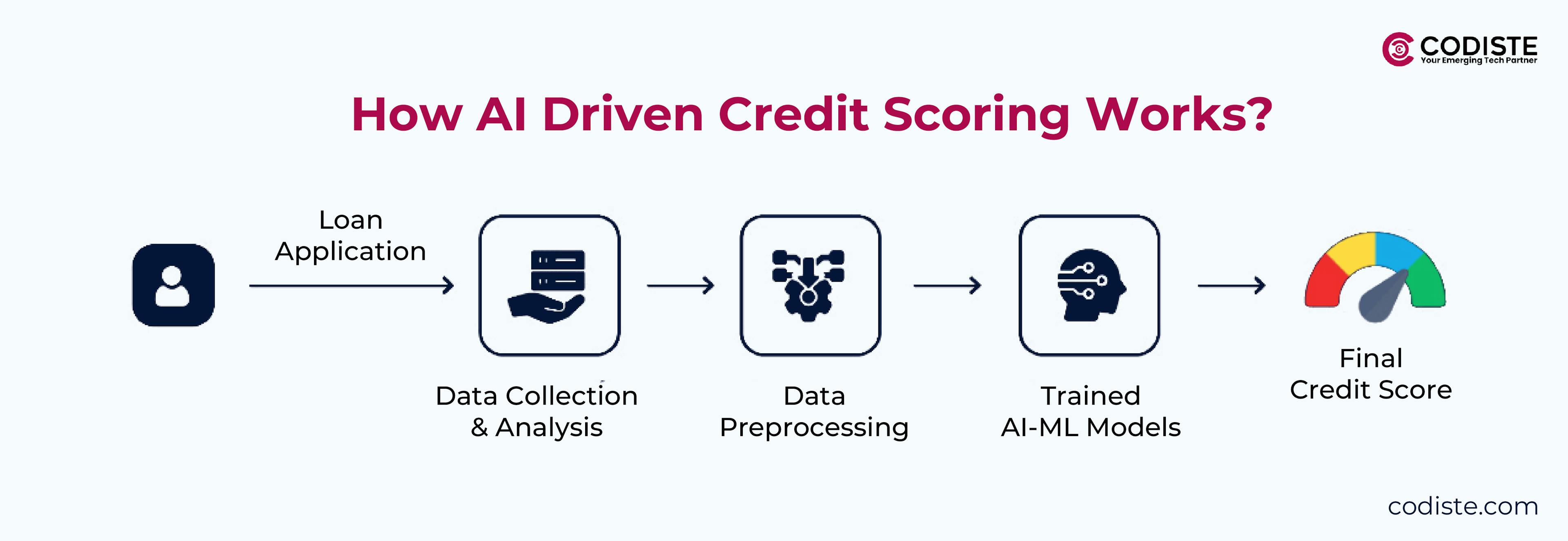

Traditional credit scoring relies on limited historical data, excluding millions of creditworthy individuals with thin credit files. AI for credit risk assessment uses several types of data to make loan judgments that are fairer and accurate.

Upstart employs machine learning to look at more than 1,000 pieces of data for each application, such as the applicant's education background, work history, and transaction history. Their AI models approve 27% more applicants than traditional techniques while keeping the number of defaults lower.

Revolutionary credit assessment features:

Use cases for AI in fintech lending extend beyond approval decisions. AI helps set the best prices for loans, forecasts the chance of default, and automates the process of collecting payments. LendingClub's AI-powered platform speeds up loan applications by 90% and lowers charge-off rates by 15%.

Robo-advisors made it possible for regular investors to get professional help in managing their portfolios, which made investment management more accessible to everyone. But modern AI in fintech platforms offer full wealth management services that go much beyond just basic portfolio allocation.

Betterment's AI looks at each person's finances and suggests the best savings rates, ways to take advantage of tax losses, and ways to save for retirement. Their platform manages more than $33 billion in assets and charges much less than human advisors do.

Advanced wealth management capabilities:

Artificial intelligence in fintech wealth management eliminates human bias while scaling personalized advice to millions of customers. Wealthfront's AI handles complex tax optimization strategies that would require hours of human advisor time, delivering these services automatically to every client.

Ready to explore how AI can transform your fintech customer experience?

Start by identifying your biggest customer friction points today.

Customer support represents a massive cost center for financial institutions, with human agents handling routine inquiries that AI can resolve more efficiently. AI virtual assistants now handle 67% of customer service interactions across leading financial institutions.

Ally Bank's virtual assistant resolves over 90% of customer inquiries without human intervention, from account balance checks to transaction disputes. The AI handles complex multi-step processes like loan applications and investment account setup through natural conversation flows.

Conversational AI advantages include:

When AI takes care of simple tasks, customer experience gets a lot better because human agents can focus on creating relationships that are more complicated. Eno, Capital One's assistant, alerts customers about suspicious charges before they happen and helps them make better spending decisions by giving them predictive insights.

Payment processing requires split-second decisions, balancing fraud prevention with transaction approval rates. AI in banking payment systems looks at transaction patterns, merchant categories, and user behavior to make real-time choices on whether or not to approve a payment.

Visa's AI handles more than 150 billion transactions per year, stopping $25 billion in fake charges while keeping approval rates above 95%. Their machine learning models adapt to emerging fraud patterns without impacting legitimate transaction flows.

Payment AI capabilities transforming the industry:

Square's AI examines seller transaction trends to give tailored lending offers and next-day funding. Through the use of payment processing history, their prediction models evaluate credit risk, giving small firms immediate access to cash.

Old manual methods can't handle the more intricate rules that financial services have to follow.. AI in finance automates compliance monitoring, risk assessment, and regulatory reporting while reducing human error.

Every day, Deutsche Bank's AI system looks at 70 million transactions for signals of money laundering. This makes it easier to find real money laundering and cuts down on false positives by 20%. Without requiring significant manual reconfiguration, the system adjusts to new regulatory requirements.

AI compliance applications include:

As finance changes to comply with AI, proactive risk identification replaces reactive problem solutions. AI technologies protect organizations from fines and damage to their brand by finding potential problems before they become legal issues.

CB Insights says that global investment in the AI fintech market will reach $12 billion by 2024, and the market is still developing swiftly. While AI-native competitors are putting more and more pressure on late movers, early adopters have long-term benefits over them.

To successfully use AI, you need to plan instead of focusing on technology initially. Focus on particular problems your customers are having and create AI solutions that add real value to your business. Pilot projects let you test and improve things before they are fully rolled out.

Strategic implementation priorities:

As technology advances and legal frameworks change, AI in fintech use cases will only grow. Businesses that invest in AI now will be able to maintain their growth in the increasingly competitive financial services sector.

Evaluating which AI solutions deliver the highest impact for your specific use case and customer base? Codiste is here to help you out.

Businesses considering AI as a strategic enabler rather than a technology experiment will always have a competitive edge. From initial onboarding to continuous relationship management, artificial intelligence in fintech revolutionizes the entire customer experience. Get in touch with us to know more about AI in Fintech.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.