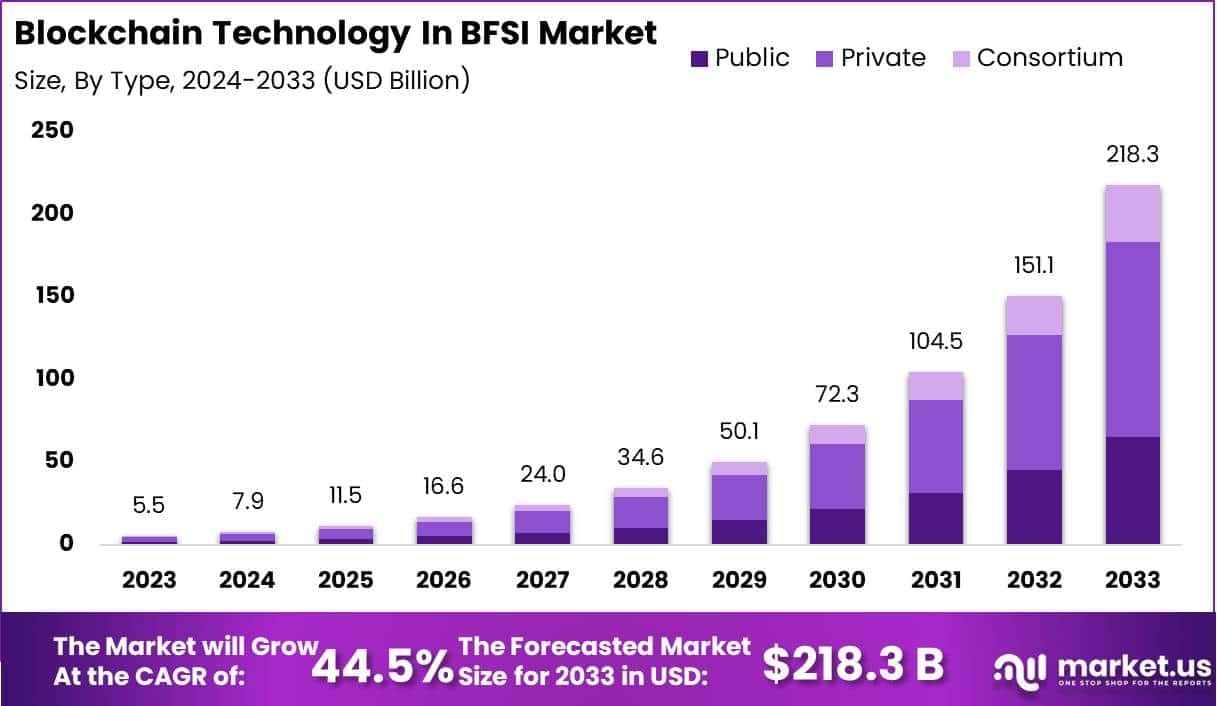

Banks spent $6.8 billion on blockchain in 2024. By 2026, that number will have grown to $22.5 billion.

This isn't hype anymore. JPMorgan processes over $1 billion daily through blockchain payments. The Australian Securities Exchange runs settlement infrastructure on it. AXA processes flight insurance claims in minutes instead of weeks.

Instead of asking "should we use blockchain?" the question now asks, "which applications deliver ROI fastest?"

This guide explains what works and what doesn't, as well as how to apply it without going over budget or schedule.

Three things made blockchain viable for banks and insurers:

SWIFT partnered with blockchain providers because they had no choice. Customers demanded faster, cheaper transfers.

Remember letters of credit? Paperwork going back and forth between banks, exporters, importers, shipping companies, and customs?

Blockchain killed that process.

Document fraud costs the industry $40 billion a year. Blockchain made that fraud impossible because everyone can see the same records in real time, and they can't be changed.

Here's why this matters: Every day a trade sits unsettled, banks tie up capital as collateral against counterparty risk.

For large investment banks, cutting one day from settlement frees $500 million to $2 billion in working capital. That's capital they can deploy elsewhere or return to shareholders.

Banks spend $500 million per year on identity verification. Customers fill out the same forms at every bank.

Blockchain-based digital identity lets customers verify once and share credentials across institutions.

HSBC's results:

Flight delayed more than 3 hours? Payment hits your account automatically.

Crop damaged by drought? Satellite imagery confirms it, smart contract releases payment.

AXA's flight insurance:

This isn't futuristic. It's live, processing real claims.

Every year, insurance fraud costs $80 billion. The problem? Fraudsters file the same claim with more than one insurance company because they don't share information.

Blockchain lets insurers share anonymized claims data. Someone files three auto accident claims for the same incident? Flagged instantly.

Projected impact: 15-25% reduction in fraud losses

Read more: How AI Agent Automates Fraud Detection?

Reinsurance involves complex contracts between insurers and reinsurers. Calculating payouts based on claims volume and severity takes months of back-and-forth.

Blockchain platforms automate the entire process through smart contracts.

B3i platform results:

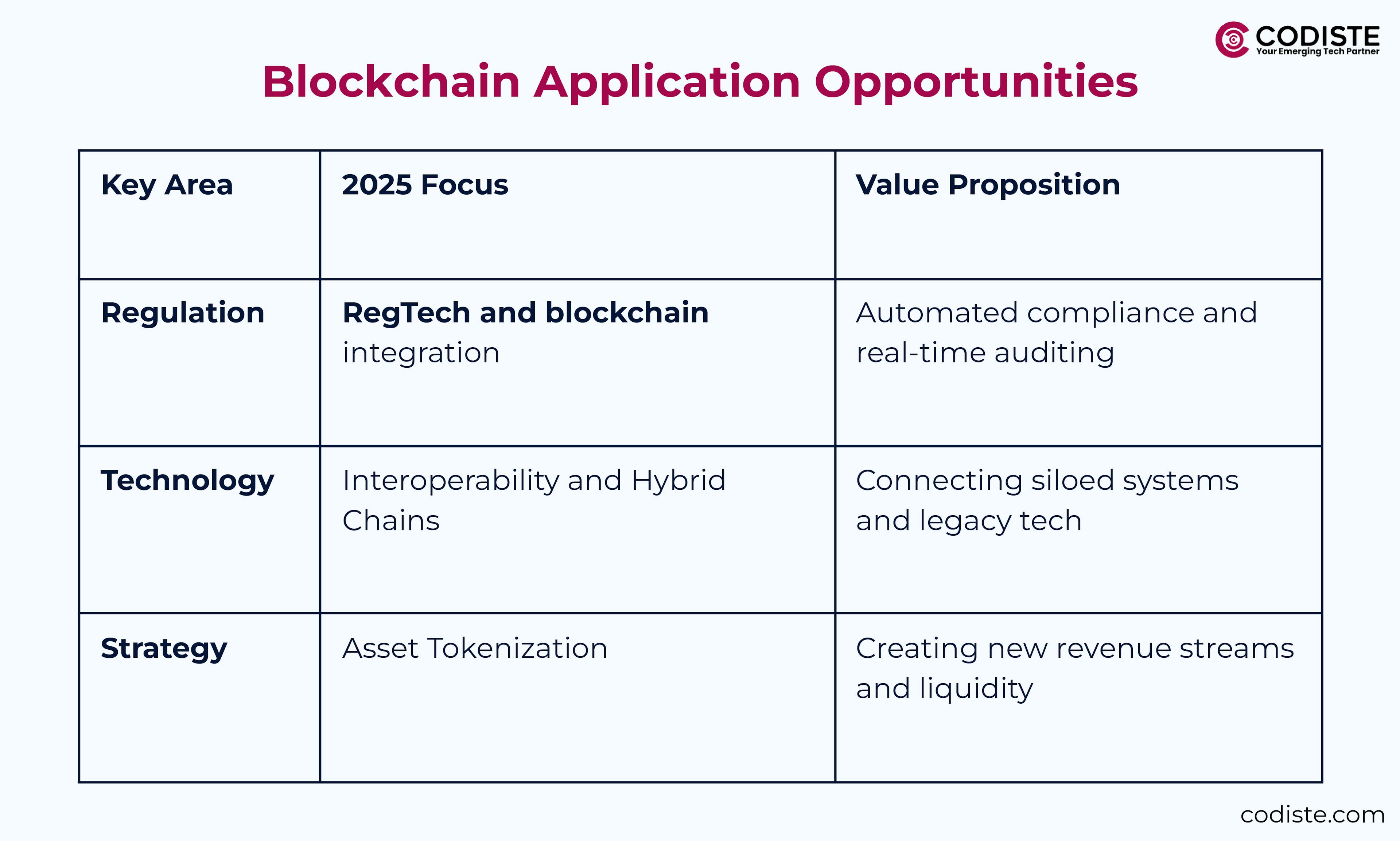

Take a $50 million commercial property. Tokenize it into 50,000 shares at $1,000 each.

Suddenly, investors who couldn't afford real estate can own fractional shares. The property owner gets liquidity. The bank earns fees as the platform and custodian.

JP Morgan tokenized $300 billion in repurchase agreements. This isn't experimental.

Banks are launching regulated DeFi products where customers earn 4-8% yields through liquidity provision or lending pools.

The bank manages compliance, risk controls, and customer protection. Customers get DeFi economics with traditional banking security.

Why this matters: Traditional deposit rates sit under 1%. DeFi yields offer 4-8%. Banks that don't offer competitive yields lose deposits.

Supplier ships goods to major retailer. Blockchain records delivery. Invoice generates automatically. Supplier gets paid immediately at a small discount instead of waiting 60-90 days.

Banks finance these early payments because blockchain provides perfect visibility into transaction status and risk.

Result: New lending opportunities for banks, solved working capital problems for suppliers.

Most blockchain projects fail because teams don't realise how hard it is or how much blockchain can do.

This is the realistic way:

Don't boil the ocean. Choose ONE high-value problem where blockchain clearly beats alternatives.

Good first projects:

Bad first projects:

Make a financial model that shows how to save money or make more money. Aim for a return on investment in 18 months and an annual benefit of $5 million to $50 million, depending on the size of the institution.

Platform options:

Most institutions should start with existing platforms. Building custom blockchain infrastructure is expensive and risky.

Design a hybrid architecture that integrates with existing core systems. Don't create new silos.

This phase kills more projects than technology issues.

Engage regulators early:

Regulators appreciate proactive engagement. They hate surprises.

Launch a limited pilot with real transactions but controlled risk exposure.

Test performance, security, user experience, and integration. Expect problems. That's what pilots are for.

Successful pilots show that the idea works and bring up problems with how it will work before it is fully put into use.

Expand to full production while maintaining parallel legacy systems initially.

This phase requires change management. Employees need training. Processes need documentation. Support teams need preparation.

Total timeline: 18-30 months for complex implementations (securities settlement, trade finance)

Simpler use cases: 12-18 months (KYC sharing, parametric insurance)

Different countries classify blockchain products differently. A tokenized security might be:

Global institutions must design systems flexible enough for multiple regulatory frameworks simultaneously.

The upside: Institutions navigating this complexity build competitive moats that smaller players can't replicate.

Moving an asset tokenised on Ethereum to Hyperledger Fabric is not easy. There are cross-chain protocols on the way, but real interoperability won't happen for another two to three years.

Choose technologies that prioritise interoperability to avoid having to move to new ones later at a high cost.

Finding people who understand blockchain, financial operations, AND regulatory requirements is hard.

Solutions:

The shortage creates opportunity. Professionals with blockchain skills command premium compensation.

Hacks cost DeFi $3 billion between 2022 and 2024. There are flaws in smart contracts.

Mitigation:

Blockchain in BFSI crossed from experiment to production infrastructure.

The institution's winning didn't wait for perfect clarity. They:

Blockchain isn't a differentiator anymore. It's becoming table stakes for operational efficiency.

Banks still running trade finance on paper lose deals to competitors offering 24-hour processing.

Insurers manually processing claims lose customers to providers offering instant parametric payouts.

Financial firms with week-long settlement lose margin to platforms offering same-day settlement.

The question isn't whether or not to use blockchain. It's which use cases give the best return on investment (ROI), how to deal with rules, and which partnerships speed up time to value.

The technology is proven. The ROI cases are documented. The regulatory path is increasingly clear. What's missing is your implementation plan. Connect with our experienced team at Codiste and get your project started and running.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.