Before they became our client, this UAE-based neobank was in a tough spot.

Their CTO still remembers the boardroom moment when the compliance audit findings landed. What everyone assumed would be a routine check had turned into a crisis. The plug-and-play SaaS tool they’d deployed six months earlier wasn’t just failing to meet UAE Central Bank guidelines; it was exposing them to risks that could cost their license. It was a painful reminder of how critical neobank technology choices can be in a tightly regulated market like the UAE.

The CEO admitted what the whole leadership team already knew: in their rush to market, they’d taken shortcuts. SaaS got them live fast, but now it was putting everything at risk: the trust of 200,000 customers, the license that allowed them to operate, and the credibility they’d worked so hard to build. For a business betting its future on AI for neobanks in the UAE, this wasn’t just a tech hiccup but an existential threat.

The head of compliance put it bluntly: “We can’t keep throwing patches at this. Regulators won’t accept excuses.” The reality of AI vs SaaS tools in banking was staring them in the face: quick wins through SaaS couldn’t compete with the reliability and control of a purpose-built AI stack.

They were at a crossroads. On one side, the familiar but flawed option is doubling down on SaaS and hoping the issues wouldn’t snowball. On the other hand, a harder but smarter path is about investing in a custom AI stack that could scale, stay compliant, and actually give them control. That decision would go on to define their entire journey in neobank digital transformation in the UAE.

That’s the moment they started looking for a partner who could help them make that shift. And that’s where Codiste came in.

Three major issues forced the decision:

The compliance team delivered an ultimatum: fix these issues within 60 days or face regulatory action. Generic SaaS tools that worked perfectly for US or European markets suddenly felt like square pegs in round holes.

Fintech innovation UAE requires more than copy-paste solutions. Here's what became crystal clear:

UAE financial regulations aren't just different, they're evolving rapidly. The Central Bank's AI in fintech guidelines require:

SaaS tools built for global markets couldn't handle these nuances without expensive customizations that defeated the purpose of plug-and-play.

Every neobank using the same SaaS stack offered identical features. Customer acquisition costs were climbing because there was no real differentiation. AI-powered neobanks needed unique value propositions, not cookie-cutter experiences.

As transaction volumes hit 50,000 daily, the SaaS platform's per-transaction fees became unsustainable. What started as cost-effective quickly turned into a profit killer.

Instead of fighting SaaS limitations, they partnered with Codiste to build custom AI solutions for banks tailored specifically for UAE operations.

The machine learning in UAE banking implementation delivered:

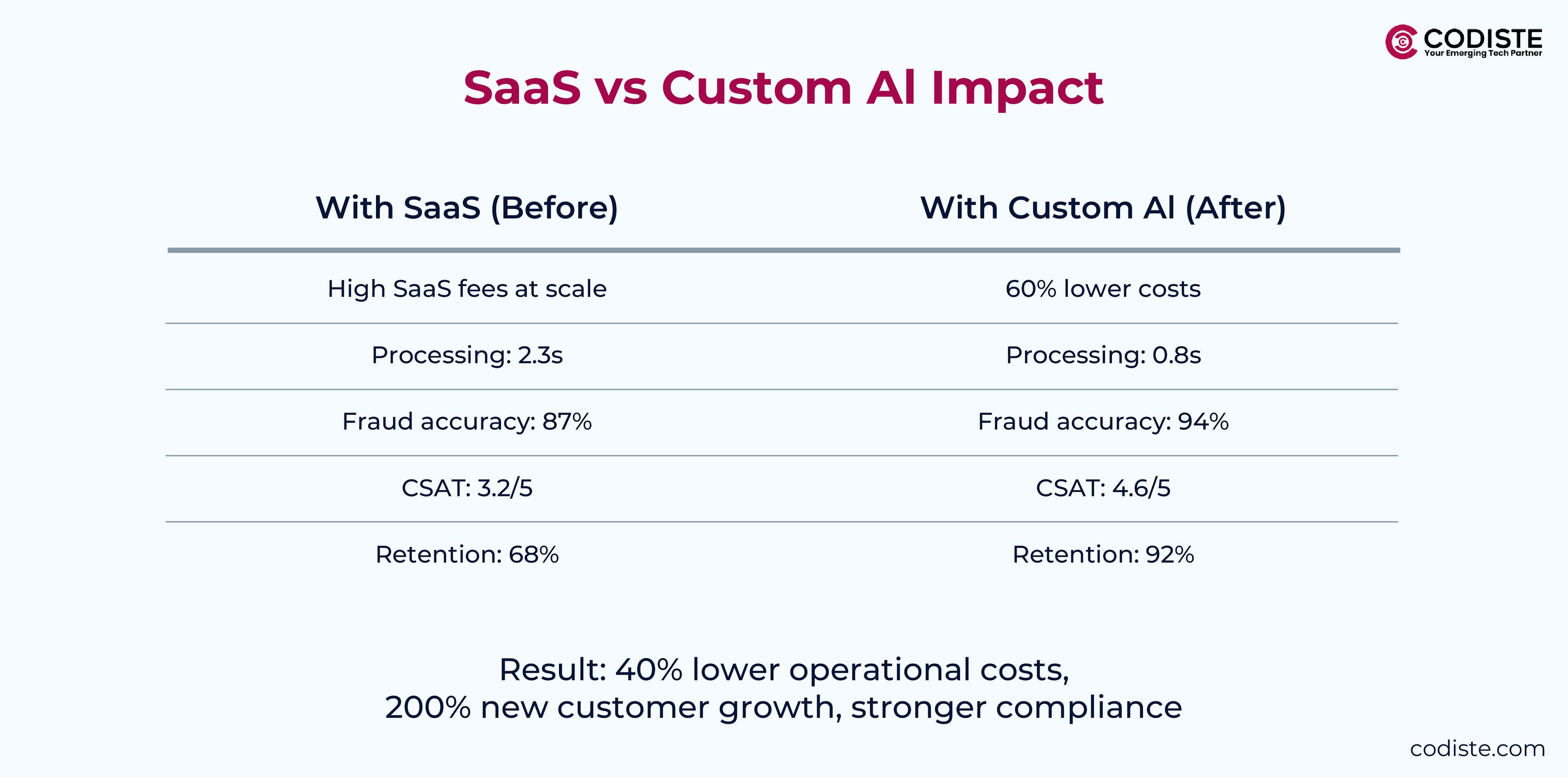

Monthly costs decreased 60% compared to SaaS fees at scale, while performance improved dramatically:

Six months post-implementation, the results spoke for themselves:

Financial Performance:

Customer Experience:

Competitive Position:

What this UAE neobank learned applies to any fintech innovation UAE initiative:

SaaS tools seem cheaper upfront, but become expensive as you scale. Custom solutions require higher initial investment but deliver better unit economics over time.

Cloud-based AI for banks must meet local requirements from day one. Retrofitting compliance into SaaS tools costs more than building it right initially.

In saturated markets, unique features matter more than speed to market. Banking AI customization benefits include proprietary capabilities that competitors can't replicate.

For UAE neobank leaders evaluating their options, consider these factors:

Choose Custom AI When:

Stick with SaaS When:

Best AI for neobanks UAE isn't about the fanciest technology, it's about solutions that solve real business problems while meeting local requirements. This neobank's custom stack delivered something no SaaS tool could: a sustainable competitive advantage.

Their success shows that AI for neobanks works best when it's made for the needs of local markets, regulations, and customers. The original investment in bespoke development paid off in the form of lower operating expenses, better compliance, and better customer experiences.

The lesson for neobank CEOs who have to make similar choices is clear: the easiest way isn't always the best way. Custom AI for neobanks UAE solutions need more planning and money up front, but they offer flexibility, compliance, and competitive benefits that SaaS technologies can't match in niche markets.

Codiste provides you with the answer on how custom AI can transform your neobank's operations. Let's discuss your specific requirements and build a solution that gives you the exclusive edge you need in today's demanding financial services landscape.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.