An inside look at how Codiste created an AI-ready, safe, and context-aware experience for DeFi consumers.

The fintech and DeFi scene is on the rise, but there is a fundamental issue that has stifled meaningful innovation: fragmented interfaces that cannot communicate. We are failing to deliver on the promise of frictionless digital finance when AI assistants cannot access real-time wallet data, smart contracts with AI context run in isolation, and consumers must navigate multiple apps just to conduct a basic transaction.

We recently addressed this issue for a cutting-edge blockchain-based lending business, and the solution we created, the MCP protocol deployment, did more than just alleviate their immediate concerns. It completely altered their user experience and set a new bar for AI-powered banking applications.

On the backend, modern fintech applications are architectural marvels, with sophisticated KYC systems, smart contracts that execute complex financial logic, and loan processing engines that can analyze risk in milliseconds. However, from the perspective of the user, these systems frequently appear to be a collection of disconnected islands.

The next-generation blockchain-based lending platform that we work with, our customer, was directly affected by this divergence. Even with top-notch technology beneath the hood, their users were encountering three major problems:

In essence, their AI helper was oblivious to the user's true financial situation. It was unable to check loan statuses, get wallet balances, or access real-time smart contract data. When users inquired about their alternatives for loan repayment, their AI assistant would respond by telling them to "check your dashboard" or "contact support."

Multiple levels of permission were needed for smart contract interactions, but every action was viewed as high-risk by the current system. Whether they were starting a $10,000 loan repayment or checking their balance, users encountered the same difficulty. Although there was security, it lacked intelligence.

Due to the platform's natural growth, it now has dozens of endpoints that were intended for conventional web applications rather than AI-first interactions. In essence, the AI assistant was attempting to make its way through a confusing array of APIs that weren't designed for context-aware, automated processes.

While deploying Model Context Protocol, as an open, safe, and machine-readable standard that serves as a link between intricate backend systems and massive language models. Consider it a universal translator that enables AI agents to actively participate in your finance ecosystem rather than only comprehend it.

Conventional AI assistants are passive observers; while they can share their knowledge with you, they are unable to act on your behalf. AI agents are turned into active participants in your financial ecosystem by MCP. Rather than only responding to inquiries, they can:

Developing financial experiences that feel really intelligent and responsive is more important than merely automating tasks.

Modern Finance Runs on MCP. Does Yours?

See how a neo-bank unified 15 chains and 12 jurisdictions with one protocol.

We started by auditing the client's current API environment. We found 18 distinct endpoints, each intended for a distinct use case and interface, dispersed over multiple services. These were combined into eight simplified MCP tools that are all tailored for AI interaction:

Comprehensive information, including input/output schemas, validation logic, and concise descriptions, was included with each tool to help AI agents comprehend not only what each tool does but also when and how to utilize it properly.

With JSON-RPC and OAuth2 authentication, we built a strong MCP Server layer. The central nervous system is represented by this server, which connects to:

This architecture's versatility is what makes it so beautiful. It becomes a configuration update rather than a significant development effort to add more blockchain networks or wallet providers.

The goal of security in fintech is to create intelligent, context-aware security that doesn't irritate users, not only to stop unwanted access. An MCP Controller that we put in place offers:

The last step was integrating our MCP client with the platform's AI helper (originally Anthropic Claude, subsequently upgraded to incorporate GPT-4). This integration makes it possible for:

check current balances → analyze optimal repayment strategy → swap tokens if needed → execute repayment → update financial projections.

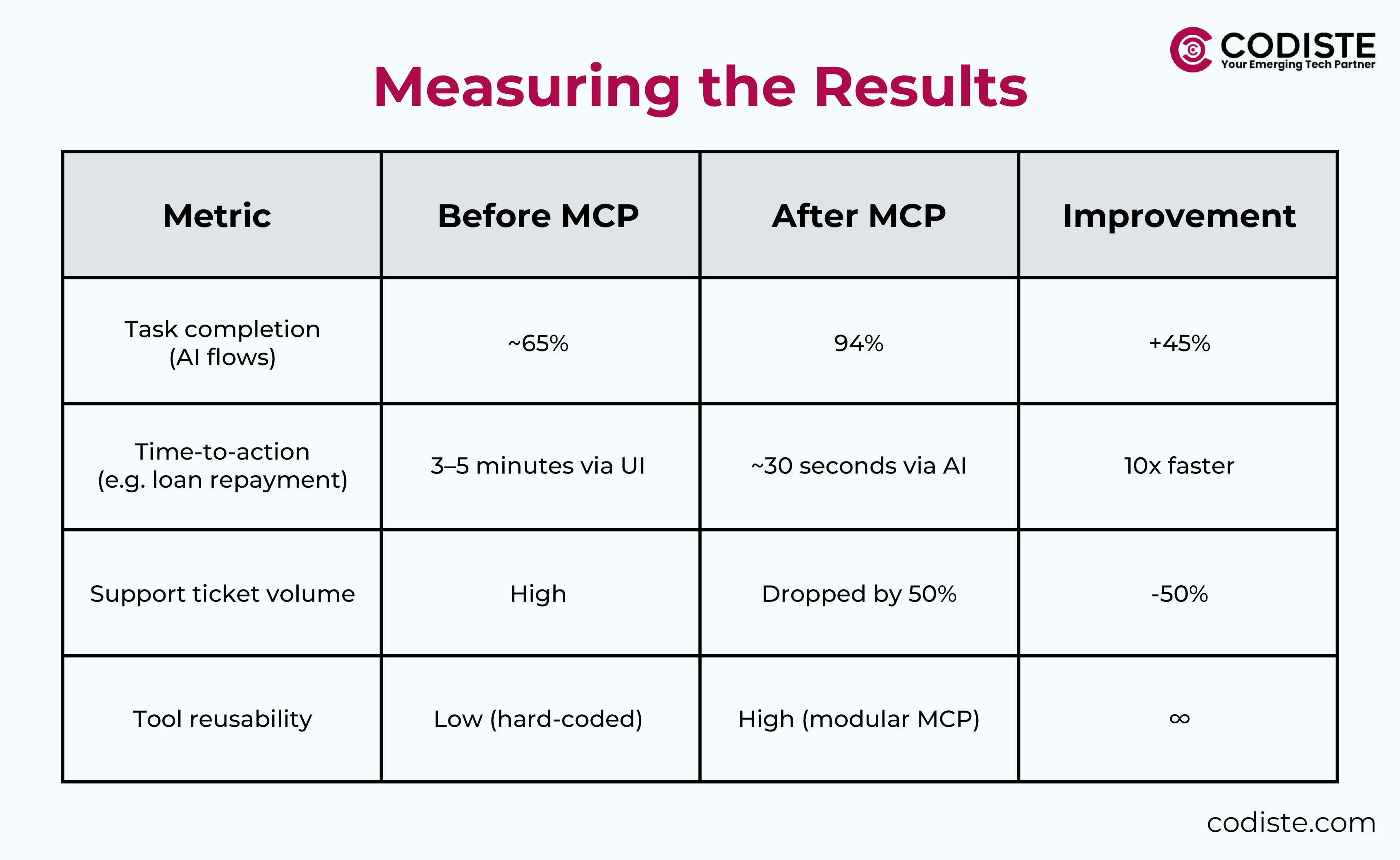

The impact was immediate and measurable:

However, the quantitative findings only provide a portion of the picture. The qualitative change was just as striking:

Ready to transform your fintech experience with MCP?

Let's build the future of finance together.

1. Start Small, Think Big

Before growing, we only had six essential tools at first. Before moving on to more intricate procedures, this strategy enabled us to refine the fundamental patterns and user experience.

2. Tool Descriptions Are Critical

Tool descriptions are crucial to the finding and proper use of large language models. The quality of AI behavior improves when time is spent on thorough, understandable explanations.

3. Plan for Confirmation Workflows

User confirmation is frequently required by law in the financial industry, making it more than just best practice. Design secure but unburdensome confirmation flows.

4. Security Must Be Layered

Make use of role-based access control, thorough logging, MCP controllers, and astute risk assessment. Every encounter should incorporate security; it shouldn't be an afterthought.

MCP is the cornerstone of a new era of agent-to-agent (A2A) financial transactions, not merely a fintech solution. There are now bold projects on our client's pipeline that would not have been feasible with conventional architectures:

Multi-tool atomic transfers are capable of autonomously carrying out intricate cross-chain financial transaction swaps, identifying the optimum rates and best routes between several blockchain networks.

DAO-based credit assessment using sophisticated workflows:

fetch_score → analyze_risk → issue_loan → mint_receipt → update_credit_history.

AI systems that are capable of actively managing treasury operations, portfolio rebalancing, yield strategy optimization, and the autonomous execution of intricate financial plans under the proper supervision.

What we've achieved with this MCP protocol deployment is a fundamental change in the way we look at fintech AI automation, not merely a technological fix. AI becomes a part of the financial infrastructure itself rather than an add-on to pre-existing systems.

This change creates opportunities that we are just starting to investigate. Consider AI agents that are able to:

As demonstrated by the Model Context Protocol, AI-native financial experiences are not only feasible but also unavoidable. The next generation of financial services will be shaped by the companies who adopt this change now.

The message is clear for fintech companies that are still having trouble with disjointed user experiences and fragmented interfaces: conversational, intelligent, and fully integrated finance is the way of the future. Whether you will lead or follow the transition is more important than whether you will employ these technologies. Codiste specializes in building AI-native financial platforms that don't just meet today's needs but anticipate tomorrow's possibilities. Start your journey here.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.