Imagine it’s 2 AM, and Alex, a small business owner, is trying to figure out why her loan application was rejected. She’s flipping between her bank’s mobile app, a clunky web portal, and a customer service chat, growing frustrated with every tap. This disjointed experience is all too common in today’s banking world, where outdated technology creates barriers between customers and their financial goals. But a new standard called the Model Context Protocol (MCP) is changing that, promising a future where banking feels like a natural conversation with a smart assistant.

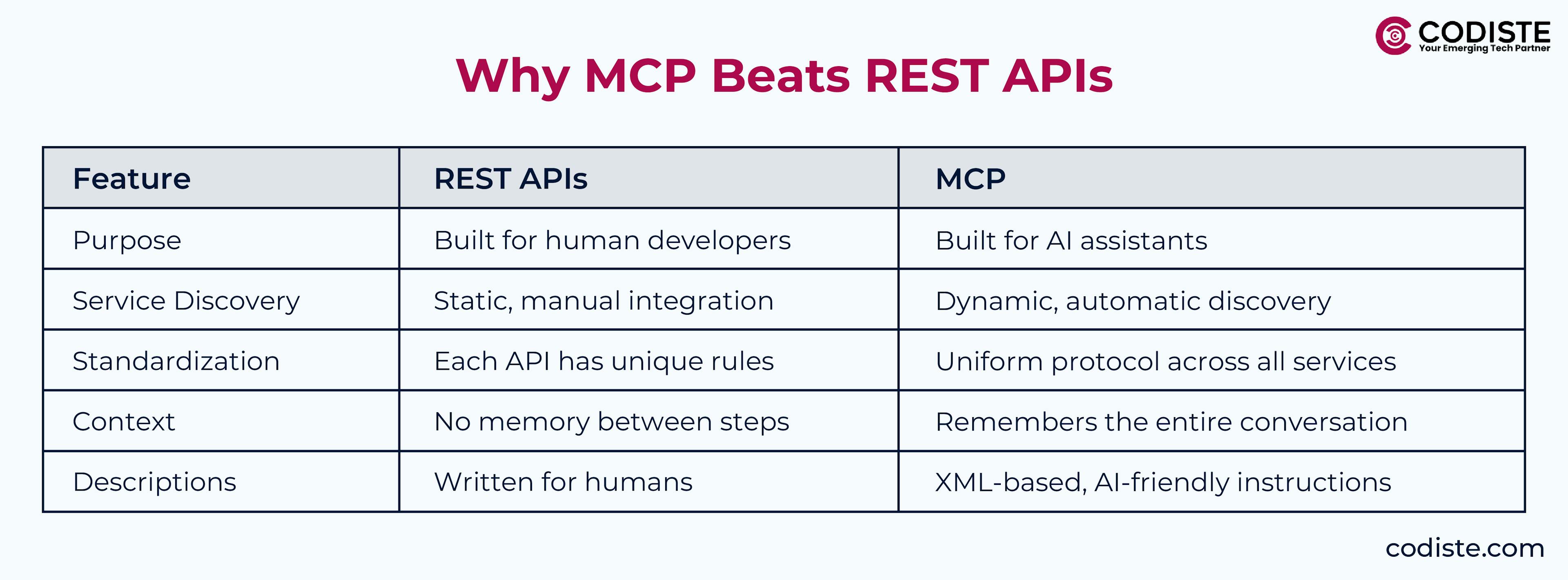

MCP, an open-source protocol developed by Anthropic, is like a universal charger for AI-powered banking. It connects AI systems to financial services seamlessly, making tasks like checking balances, transferring money, or applying for loans faster and more intuitive. In this blog, we’ll explore how MCP is revolutionizing banking, why it’s better than the current REST API systems, and what it means for customers, developers, and the financial industry.

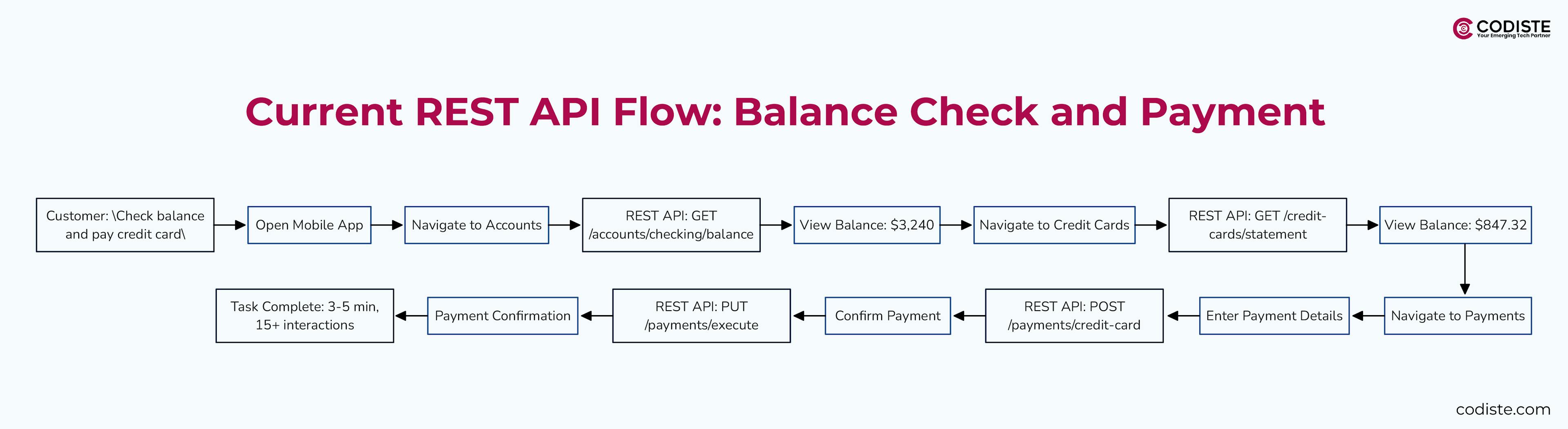

Most banks today rely on REST APIs—think of them as the internet’s way of letting apps talk to each other. While REST APIs get the job done, they’re not built for the modern world of AI and instant customer expectations. Let’s look at how NeoBank, a fictional digital bank, operates today:

For Alex, checking her account balance, viewing transaction history, or applying for a loan means navigating a maze of interfaces, entering the same information repeatedly, and often waiting days for responses. For banks, this leads to high customer service costs, slow innovation, and frustrated users.

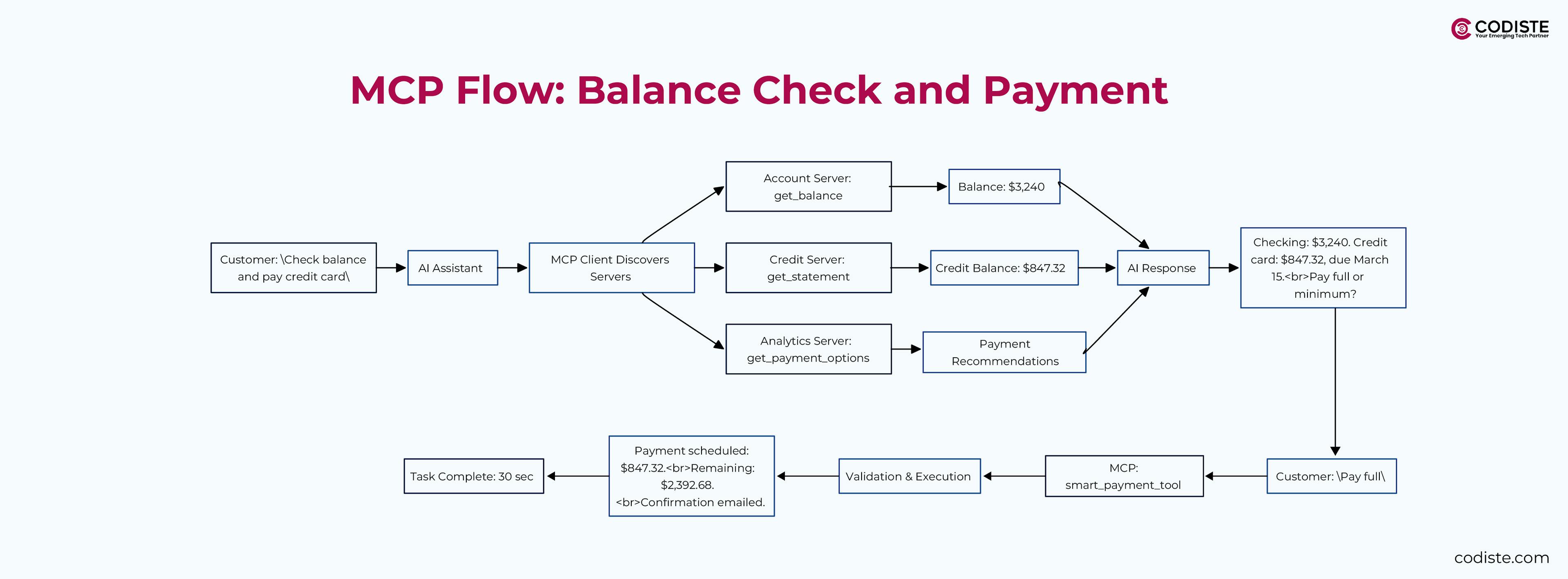

MCP is like a universal language for AI in banking. Just as USB-C simplified connecting devices, MCP standardizes how AI systems interact with financial services. It’s built to let AI assistants understand customer needs, access the right tools, and complete tasks in one smooth conversation. Here’s how it works:

Here are some MCP tools that NeoBank could use, written in a format AI understands:

XML

<account_management_tool>

<name>comprehensive_account_overview</name>

<description>

Gives a full picture of a customer’s finances:

- Checking, savings, and credit card balances

- Recent transactions

- Pending payments

- Available credit

Use when someone asks, “How much money do I have?” or wants a financial summary.

</description>

<input_schema>

<customer_id>string</customer_id>

<include_projections>boolean</include_projections>

</input_schema>

</account_management_tool>

<smart_transfer_tool>

<name>intelligent_fund_transfer</name>

<description>

Transfers money with built-in safety checks:

- Verifies account balances

- Suggests the best time to transfer

- Handles currency conversion

- Sends a confirmation with a reference number

Use for moving money between accounts or to others.

</description>

<input_schema>

<from_account>string</from_account>

<to_account>string</to_account>

<amount>number</amount>

<currency>string</currency>

<transfer_date>date</transfer_date>

</input_schema>

</smart_transfer_tool>

<emergency_card_block>

<name>emergency_card_block</name>

<description>

Blocks a lost or stolen card and orders a replacement:

- Instantly freezes the card

- Sends SMS/email confirmation

- Ships a new card within 24 hours

- Offers a temporary digital card

- Monitors for suspicious activity

Use when a customer says, “I lost my card” or reports suspicious transactions.

</description>

<input_schema>

<customer_id>string</customer_id>

<card_id>string</card_id>

</input_schema>

</emergency_card_block>

With MCP, Alex’s banking becomes a breeze. Instead of juggling apps, she talks to an AI assistant that handles everything in one go. Here’s how it looks:

Today (REST APIs):

With MCP:

Today (REST APIs):

With MCP:

This boosts task completion rates from 73% to 94% and cuts the Customer Effort Score from 4.2 to 2.1 on a 5-point scale.

Start Building Secure, Decentralized Apps with MCP.

Discover how the Modular Communication Protocol works for your Blockchain Platform

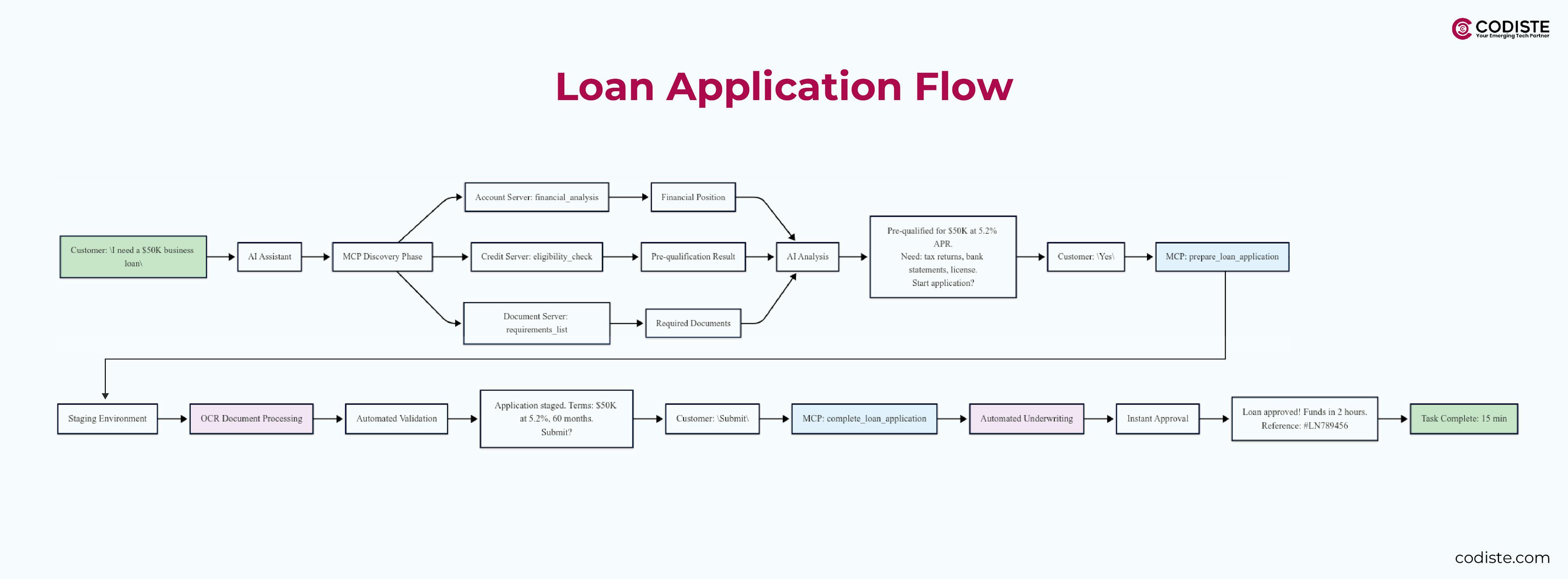

To see MCP’s impact, let’s compare how tasks flow with REST APIs vs. MCP.

REST API Flow (3-7 days):

MCP Flow (15 minutes):

Here’s how MCP compares to REST APIs:

Switching to MCP isn’t just about flipping a switch. Banks like NeoBank face hurdles when moving from REST APIs to MCP, but there are smart ways to tackle them.

Some tools (e.g., Mintlify, Stainless) can automatically turn REST APIs into MCP servers, but they often create problems:

Here’s how NeoBank could build an MCP tool for loans, showing the shift from multiple API calls to a single, smart workflow:

<advanced_loan_processing>

<prepare_loan_application>

<description>

Stages a loan application:

- Checks eligibility in real-time

- Processes documents with OCR

- Creates a secure staging area

- Shows personalized loan terms

- Guides the AI on next steps

</description>

<workflow>

<step>Create temporary processing branch</step>

<step>Validate application completeness</step>

<step>Run preliminary credit checks</step>

<step>Generate personalized terms</step>

<step>Provide feedback to AI</step>

</workflow>

</prepare_loan_application>

<complete_loan_application>

<description>

Finalizes the application:

- Reviews all checks

- Submits to main processing

- Starts automated underwriting

- Sets up status notifications

- Gives a tracking number

</description>

</complete_loan_application>

</advanced_loan_processing>

Banking is serious business, so MCP tools are designed with safety in mind:

MCP isn’t just a tech upgrade—it’s a whole new way of banking. Big names like Microsoft, Google, and OpenAI are already using MCP, and banks are jumping on board. Here’s what it means:

The Core of Trustworthy, Decentralized Communication is Here.

Start integrating a secure digital infrastructure that allows developers and users to create, deploy, and interact with dApps.

MCP is young—just six months old—but it’s gaining steam fast. In the future, expect:

MCP is turning banking into something simple, fast, and intuitive. Instead of wrestling with apps and forms, customers like Alex can say, “I need a loan,” and have funds in hours. For banks, it means lower costs, quicker innovation, and delighted customers. Whether you’re a developer building the next banking app, a product manager dreaming up new features, or just someone who banks, MCP is making finance smarter and more human.

The future of banking is here, and it’s conversational. With MCP, that future is closer than you think.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.