What is the project about?

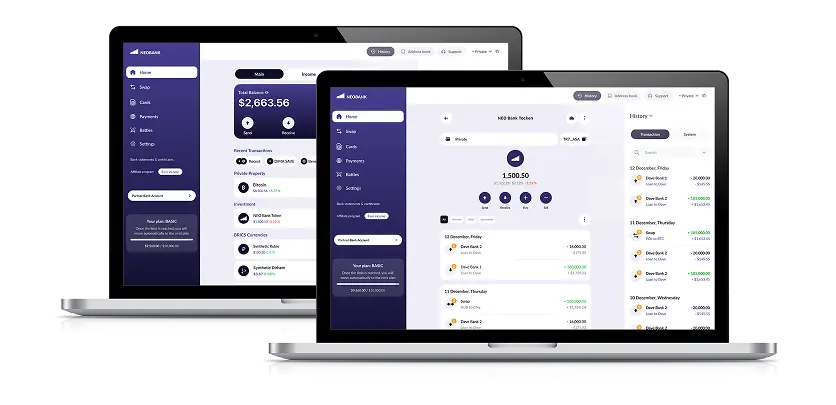

Neo Bank is a pioneering financial services initiative that was developed for the Russian and UAE markets. This ambitious endeavour combines traditional banking principles, artificial intelligence, and blockchain technology to establish what is marketed as "the world's first fully AI-powered bank." The objective of Neo Bank is to address the fundamental challenges in both the conventional finance and cryptocurrency ecosystems by bridging critical gaps through the use of a sophisticated tech stack that includes Blockchain, Telegram Bot integration, NodeJS, ReactJS, AI capabilities, and AWS infrastructure.

What was Neo Bank's concern?

Traditional banking has high costs, slower processing times, and limited accessibility, while cryptocurrency deals with security flaws, regulatory uncertainty, and difficult user experiences. NEO Bank highlighted the 3 major challenges.

Traditional Finance Limitations

Accessibility issues, lengthy processing times, expensive transaction costs, and aversion to innovations.

Cryptocurrency Ecosystem Weaknesses

Risks to security from scams and hackers, technical difficulty, confusing legal frameworks, and inadequate interface with current financial systems.

Stablecoin Infrastructure Gaps

Absence of strong, legal platforms for the stablecoin technology adoption in institutions.

An integrated platform that combined traditional and blockchain finance to provide future-proof financial services and meet with banking regulations.

Codiste's Solution Offered

Developers at Codiste then created an integrated financial ecosystem for Neo Bank with multiple service pillars serving various client needs:

AI-optimized investment portfolios combining traditional and digital assets.

Dynamic asset allocation across stocks, cryptocurrencies, and real estate.

Market-adaptive strategies maximizing growth potential.

Personal and business loan systems with AI-calculated interest rates.

Escrow services powered by smart contracts.

Trust account frameworks for asset consolidation and management.

Bank-grade cold storage for cryptocurrencies and NFTs.

Multi-currency accounts supporting both fiat and digital currencies.

Stablecoin integration for instant international transfers.

Global operational support with international transfer capabilities.

Multi-currency account management.

Payroll and business financing tools.

Comprehensive AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) protocols.

Customer Due Diligence (CDD) processes.

Risk assessment and management systems.

Technology Stack

REACT JS

FLUTTER

REDIS

NODE JS

AWS CLOUD

PYTHON

SOLIDITY

Neo Bank's Target Audience

Neo Bank was designed to serve multiple client segments:

High-Net-Worth Individual

Seeking comprehensive wealth management, particularly those meeting the specified minimum net worth requirements.

Business Clients

Companies requiring international banking capabilities, multi-currency accounts, and financing solutions.

Fintech Enthusiasts

Early adopters and enthusiasts interested in the AI powered banking and blockchain integration.

Digital Asset Investors

Users seeking secure custody and management of cryptocurrencies and tokenized assets specifically, digital asset investors.

An integrated platform that combined traditional and blockchain finance to provide future-proof financial services and meet with banking regulations.

Want to develop a secure blockchain banking network?

Meet our blockchain team today.

Project's Unique Proposition

Neo Bank stands out due to three main value propositions:

AI-Powered Financial Ecosystem

Seamlessly integrating traditional banking reliability with blockchain efficiency.

Inclusive Access Model

Eliminating barriers to sophisticated financial services through technology.

Unified Asset Management

Consolidating diverse asset types (fiat, crypto, real estate) under a single AI-managed trust framework.

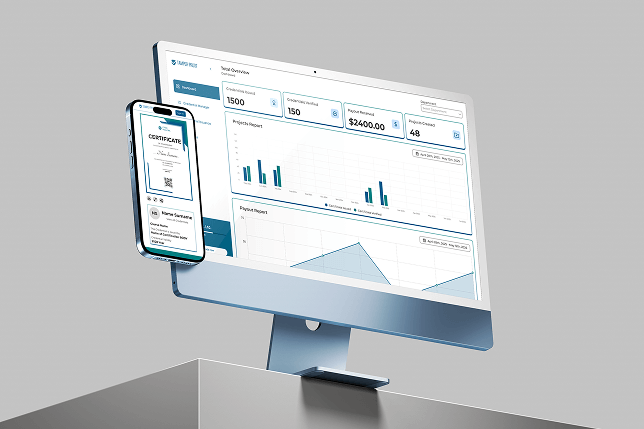

The Project Development Phase

The 12-month project development timeline included:

Establishing the foundational technology and regulatory structures.

Building primary financial service capabilities.

Implementing and training artificial intelligence components.

Creating secure digital asset management systems.

Ensuring intuitive interfaces across client segments.

Confirming adherence to regulatory standards.

Neo Bank's Key Features

The platform delivers several notable innovations:

AI-Optimized Portfolio Management

Dynamic investment strategies adapting to market conditions.

Smart Contract Escrow Services

Automated transaction security for high-value exchanges.

Integrated Digital Asset Custody

Bank-grade security for cryptocurrency holdings.

Strategic Profit-Sharing Model

Redistributing platform profits to clients through Neo Tokens.

Special Purpose Vehicles (SPVs)

Specialized structures for clients with $5M+ in assets.

Exclusive VIP Concierge Services

Premium offerings for high-value clients.

Business Impact

While specific performance metrics aren't available, Neo Bank delivers substantial value by:

Bridging Traditional and Digital Finance

Creating seamless pathways between established financial systems & blockchain innovations.

Reducing Transaction Costs and Time

Leveraging blockchain efficiencies to minimize fees and processing delays.

Enhancing Financial Inclusion

Providing sophisticated financial services to previously underserved segments.

Strengthening Security and Compliance

Implementing robust protection against financial crimes while maintaining regulatory adherence.

Conclusion

Our team of developers at Codiste combined AI, blockchain, and traditional banking concepts in Neo Bank's quest to transform financial services. It offers a compelling alternative to professional financial services by addressing significant pain points in conventional banking and cryptocurrency ecosystems.

Codiste here proved how careful incorporation of new technologies can solve industry problems while meeting regulatory requirements. The merger of traditional and digital finance is illustrated by NEO Bank's successful financial innovation using AI & blockchain technologies.

The Clients Opinion

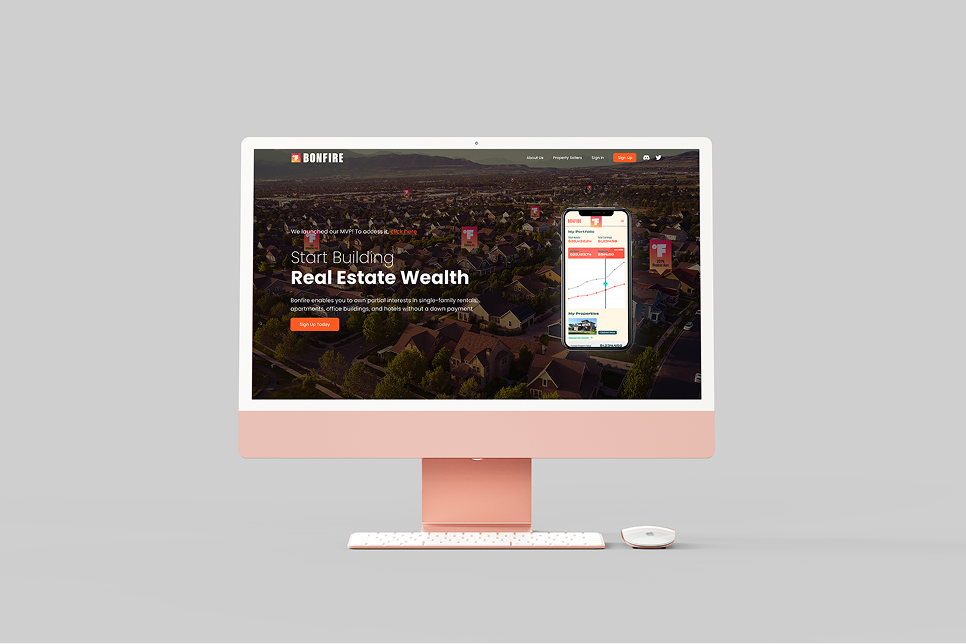

Vai Gupta

CTO & Co-Founder | The Real Estate Investment platform

They truly do everything up to a very high standard. Codiste pvt ltd has successfully delivered a functional app praised in many publications for its neatness and speed. They have frequently communicated via Slack and managed the project efficiently using Jira. Their extensive knowledge and humble attitude have been hallmarks of their work.

Gavin Langston II

CEO | DiveWallet

I am pleased to say that working with Codiste has been a positive experience for our community. The project is now complete and the feedback we have received on the platform has been overwhelmingly positive. Throughout the project, the team maintained open communication lines regularly updating us on progress and following the agreed timeline. They delivered an app with impressive functionalities and accepted every challenge we gave them. Overall we are satisfied with the outcome.

Annemarie Maidment

CEO | Medizen App

Codiste pvt ltd delivered the project within the given timeline and budget. Their communication and collaboration were outstanding using Slack Lucidhart and Miro. The team was reliable well-organized and proactive.

Zushan Hashmi

CoFounder | Ninza NFT

They communicated clearly and outlined the product roadmap for us. It has been very easy to work with them. Made us profitable on NFT Marketplace that made an amazing journey.

Michael Lawton

Founder | ML Estimation

They communicate clearly and outline the product roadmap for us. It has been very easy to work with them. Made us profitaable on NFT Marketplace and which made amazing journey.

Isla Munro-Hochmayr

Founder | FTW Dao

Codiste Team was very much helpful and they went detailed oriented and successfully launched our venture investment platform which helped us to achieve to raise initial fund through NFT selling team has gone above and beyond with all suggetions with their expertise Highly recommended for Blockchain professional studio.

Patrick Riley

CEO | Apollo

Codiste dedication goes beyond delivering the product; they are involved in the entire process from concept to final product as Multichain Decentralised Crypto Launchpad No Code Token creator DEX and even in presenting to potential customers. Their flexibility and instant communication through Slack make them an indispensable part of my team.

Morris Lee

Founder | Area Company LLC

Working with Nishant & Codiste Team was super productive, the team is technical, easy to communicate with, and very professional. Highly recommended.

Naga Samineni

Co-Founder | MetaKeep

Nishant & Codiste Team has worked with our team on Blockchain and it was a great experience. They helped our customers with Web3 wallet integration. We have partnered with Codiste Team for long term now and they're a great and highly techical team to be a strategic partner with. Highly recommended for Blockchain development.

Sofiane Bennacer

Founder | The Scribbled Lab

100% satisfaction rate. That is what I get partnering with Codiste. They delivered our MVP in just 8 weeks, with dedicated support and communication. This makes them an invaluable ally for anyone seeking AI solutions.

Abolade Olusanya

Founder | CRM Growth

What sets Codiste apart is their ability to understand complex requirements and deliver tailored solutions that drive real results. They were always prompt, communicative, and transparent throughout the project, which made the entire process seamless and stress-free.

Shelle Fantastic

Head of Sale | Corum8

Blockchain, AI service from Nishant & Codiste Team it was productive, Team Technical knowledge on Blockchain, AI and domain expertise for Healthcare and Sportstech is commendable. i was more than happy to work with a very calm and enthusiastic team.

Smart Recommendations

Have a Project?

Reach out to our technical support team for immediate assistance and expert guidance.