EMZO's Backstory

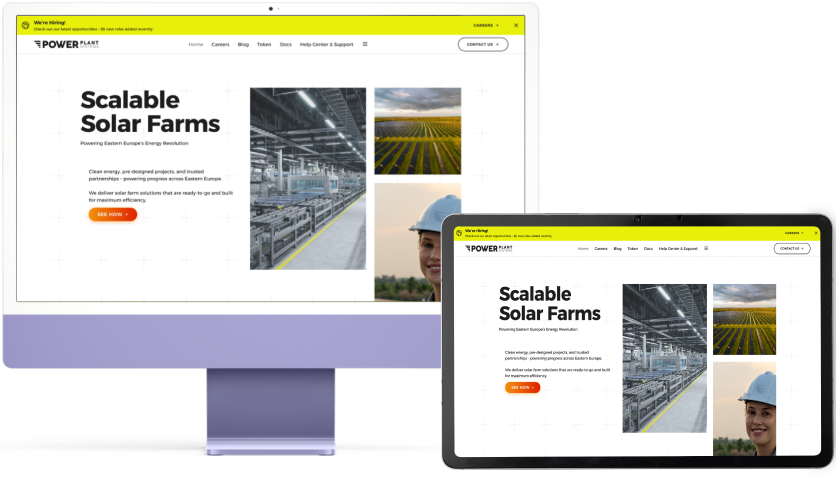

EMZO provides fractional ownership of solar farm enterprises through tokenization, making sustainable energy investments accessible to more investors and offering actual financial rewards. This case study shows how EMZO uses blockchain to open up renewable energy financing and green investment.

The Challenge EMZO Faced

Numerous major barriers lie in the way of the renewable energy sector's broad investment participation:

High Entry Barriers

Conventional renewable energy projects demand large capital, therefore, only institutional investors or wealthy individuals can participate.

Geographic Limitations

Investors' ability to diversify their portfolios and have a global impact is typically limited to projects within their borders.

Liquidity Constraints

raditionally, investments in renewable energy may lock up capital for long periods with few chances for secondary markets.

Transparency Issues

When it comes to project performance and return distribution, traditional energy investment models sometimes lack transparency.

Accessibility Gaps

Professional-grade renewable energy investment opportunities are difficult for small investors to obtain.

Emzo was looking for an option that would retain revenue and promote sustainable growth while democratising access to investments in renewable energy.

Codiste's Solution

A comprehensive tokenisation platform, EMZO has been established to connect digital assets to actual renewable energy projects:

01

TOKENIZATION INFRASTRUCTURE

- EMZO tokens representing fractional ownership in solar farm projects

- Blockchain-based verification and ownership tracking

- Smart contract governance of investment terms and distributions

02

STAKING MECHANISM

- Token staking protocol linked to energy production

- Reward distribution system based on staking duration and volume

- User-friendly interface for staking management

03

GOVERNANCE FRAMEWORK

- Proposal submission and voting system

- Community participation in project selection and management

- Transparent decision-making processes

04

INVESTMENT PORTAL

- User dashboard for portfolio monitoring

- Performance analytics and reporting

- Transaction history and reward tracking

Target Audience

EMZO serves two primary investor segments:

ANGEL INVESTORS

Early-stage sustainability-focused investors diversifying their portfolios into renewable energy assets to have a positive financial and environmental impact.

SMALL RETAIL INVESTORS

Accessible, physical asset-backed tokens allow environmentally concerned people who were previously prevented from owning renewable energy to match their investments with their principles.

Tech Stack Used

A contemporary technological stack built for user experience, scalability, and security was used.

Webflow

React JS

Node JS

AWS SQL

Arbitrum

The architecture specifically addressed:

Security

Protected investor assets

through blockchain verification

and encryption

Scalability

Designed to accommodate a

growing user base and project

portfolio

Usability

Created intuitive interfaces

accessible to non-technical

investors

Transparency

Implemented on-chain

verification of project

performance and distributions

Emzo's Core Functionalities

The platform delivers several essential features:

TOKEN STAKING/UNSTAKING:

- A flexible mechanism for committing tokens to projects

- Variable reward rates based on staking parameters

- User-controlled liquidity management

REWARD DISTRIBUTION:

- Automated distribution of returns from energy production

- Transparent tracking of project performance

- Claiming the interface for receiving distributions

PROPOSAL MANAGEMENT:

- Community-driven governance of new project selection

- Voting mechanisms weighted by token ownership

- Transparent proposal submission and evaluation

COMMUNITY ENGAGEMENT:

- Forums for investor discussion and education

- Project updates and performance reporting

- Educational content about renewable energy investments

Implementation Process

The project was executed in around 6 months following a structured development approach:

Discovery and

Requirements

Detailed analysis of client

needs and market

opportunities

Technical

Architecture Design

Planning the integrated

system across web and

blockchain components

Smart Contract

Development

Creation and auditing of

token and staking

contracts

Web Platform

Development

Implementation of Webflow

website and React

application

Backend

Integration

Development of Node.js

services and AWS SQL

database structures

Testing and Security

Auditing

Comprehensive validation

of both technical

functionality and security

protocols

Deployment and

Launch

Staged rollout to

initial investor

community

The Final Project Outcome

The EMZO platform delivers significant benefits:

For Investors

ACCESSIBILITY

Opening renewable energy investment to participants with minimal capital requirements

LIQUIDITY OPTIONS

Providing greater flexibility than traditional energy investments

TRANSPARENCY

Offering blockchain-verified reporting on project performance

GLOBAL PARTICIPATION

Enabling cross-border investment in sustainable energy projects

For the Renewable Energy Sector

Project Acceleration

Creating new funding pathways for renewable projects

Market Expansion

Bringing new investor segments into the green energy market

Capital Formation

Potentially increasing the pace of renewable energy development

Community Engagement

Building direct connections between energy producers and investors

Project’s Key Highlights

EMZO differentiates itself through three key value propositions:

Asset-Backed Tokenization

In contrast to many cryptocurrency initiatives that lack physical support, EMZO tokens explicitly represent ownership in functional solar farm assets that produce energy and income in the real world.

Democratized Access

Fractional investment is made possible by EMZO, which allows investors to own renewable energy projects regardless of their location or funding basis.

Dual-Return Model

Through the staking mechanism linked to energy output, investors get regular income distributions in addition to the possible appreciation of token value.

Future Roadmap

The EMZO platform has potential for continued evolution:

Project Expansion

Incorporation of additional renewable energy types beyond solar farms

Geographic Diversification

Extension into new regions and energy markets

Enhanced Governance

Development of more sophisticated community participation mechanisms

Impact Tracking

Implementation of environmental benefit measurement alongside financial returns

Conclusion

In the growing DeathTech business, BE4igo's secure and simple mobile app addresses legacy management's practical and emotional challenges. The software shows how well considered digital technologies can address very human needs, especially in delicate areas like end-of-life planning. The product stands out in a crowded market with its security, specialized user groups, and vast functionality. BE4igo's broad plan balances logical and emotional intelligence in digital legacy management as the field of digital end-of-life planning grows.

The Clients Opinion

Vai Gupta

CTO & Co-Founder | The Real Estate Investment platform

They truly do everything up to a very high standard. Codiste pvt ltd has successfully delivered a functional app praised in many publications for its neatness and speed. They have frequently communicated via Slack and managed the project efficiently using Jira. Their extensive knowledge and humble attitude have been hallmarks of their work.

Gavin Langston II

CEO | DiveWallet

I am pleased to say that working with Codiste has been a positive experience for our community. The project is now complete and the feedback we have received on the platform has been overwhelmingly positive. Throughout the project, the team maintained open communication lines regularly updating us on progress and following the agreed timeline. They delivered an app with impressive functionalities and accepted every challenge we gave them. Overall we are satisfied with the outcome.

Annemarie Maidment

CEO | Medizen App

Codiste pvt ltd delivered the project within the given timeline and budget. Their communication and collaboration were outstanding using Slack Lucidhart and Miro. The team was reliable well-organized and proactive.

Zushan Hashmi

CoFounder | Ninza NFT

They communicated clearly and outlined the product roadmap for us. It has been very easy to work with them. Made us profitable on NFT Marketplace that made an amazing journey.

Michael Lawton

Founder | ML Estimation

They communicate clearly and outline the product roadmap for us. It has been very easy to work with them. Made us profitaable on NFT Marketplace and which made amazing journey.

Isla Munro-Hochmayr

Founder | FTW Dao

Codiste Team was very much helpful and they went detailed oriented and successfully launched our venture investment platform which helped us to achieve to raise initial fund through NFT selling team has gone above and beyond with all suggetions with their expertise Highly recommended for Blockchain professional studio.

Patrick Riley

CEO | Apollo

Codiste dedication goes beyond delivering the product; they are involved in the entire process from concept to final product as Multichain Decentralised Crypto Launchpad No Code Token creator DEX and even in presenting to potential customers. Their flexibility and instant communication through Slack make them an indispensable part of my team.

Morris Lee

Founder | Area Company LLC

Working with Nishant & Codiste Team was super productive, the team is technical, easy to communicate with, and very professional. Highly recommended.

Naga Samineni

Co-Founder | MetaKeep

Nishant & Codiste Team has worked with our team on Blockchain and it was a great experience. They helped our customers with Web3 wallet integration. We have partnered with Codiste Team for long term now and they're a great and highly techical team to be a strategic partner with. Highly recommended for Blockchain development.

Sofiane Bennacer

Founder | The Scribbled Lab

100% satisfaction rate. That is what I get partnering with Codiste. They delivered our MVP in just 8 weeks, with dedicated support and communication. This makes them an invaluable ally for anyone seeking AI solutions.

Abolade Olusanya

Founder | CRM Growth

What sets Codiste apart is their ability to understand complex requirements and deliver tailored solutions that drive real results. They were always prompt, communicative, and transparent throughout the project, which made the entire process seamless and stress-free.

Shelle Fantastic

Head of Sale | Corum8

Blockchain, AI service from Nishant & Codiste Team it was productive, Team Technical knowledge on Blockchain, AI and domain expertise for Healthcare and Sportstech is commendable. i was more than happy to work with a very calm and enthusiastic team.