When a fast-growing US neobank found itself spending $2.3 million annually on AML compliance while still failing three consecutive audits, the board faced a choice: hire 15 more compliance analysts or find a smarter system. They chose the latter, and within nine months of deploying Codiste's AML compliance suite, their regulatory costs dropped to $750,000. That 67% reduction didn't just save money. It eliminated the existential risk of a regulatory shutdown.

Here's the thing: traditional AML systems weren't built for digital-first banks processing 50,000 micro-transactions daily. The neobank's legacy platform flagged 12% of transactions as suspicious, burying analysts in false positives while actual money laundering patterns slipped through. Codiste rebuilt the compliance infrastructure from scratch, and the results speak louder than any sales pitch.

Most AML compliance software was designed when banks processed 500 transactions per hour, not 500 per minute. This neobank, serving gig workers and small businesses, handled payment volumes that legacy systems couldn't interpret. Their compliance team spent 70% of their time investigating false alarms triggered by rule-based filters that couldn't distinguish between a freelancer's legitimate multi-country payments and structuring behavior.

The financial bleeding happened in three places.

But the real danger wasn't the budget. It was the audit failures. When examiners found gaps in transaction monitoring and inadequate suspicious activity reporting, the neobank faced potential enforcement actions that could have frozen operations. Their board calculated that a consent order would cost $15 million in penalties and remediation. That's when they reached out to Codiste.

Read more: AML Compliance for Neobanks: The Complete Guide to Regulatory Requirements

The Codiste AML compliance suite runs on adaptive machine learning instead of static rules. What this really means is the system learns normal behavior patterns for each customer segment, then flags true anomalies instead of every cross-border payment.

The architecture has three layers. The identity verification layer uses biometric matching and document authentication to complete KYC in under 90 seconds, feeding clean customer data into the system. The transaction monitoring layer analyzes payment patterns in real time, applying risk scores based on 47 behavioral signals like velocity, counterparty history, and geographic anomalies. The case management layer auto-prioritises alerts, routing high-risk cases to senior analysts while clearing obvious false positives without human review.

For the neobank, Codiste integrated directly with their core banking system via API, pulling transaction data in real time without batch delays. The implementation team mapped the bank's customer segments (freelancers, e-commerce sellers, small LLCs) and trained separate risk models for each. A freelance graphic designer receiving payments from 12 different countries isn't suspicious. The same pattern from a single-owner LLC with no web presence is.

Read more: Neo Banking vs Traditional Banks: Who Wins the Fintech Innovation Game?

The system also automated regulatory reporting. Instead of analysts manually compiling Suspicious Activity Reports each month, the suite generates draft SARs with evidence packages, cutting report preparation time from 8 hours to 45 minutes. For Currency Transaction Reports, the process became entirely automated, with the system filing directly to FinCEN.

Start planning your next steps today with Codiste.

The neobank fintech leaders of tomorrow are making their foundational decisions right now.

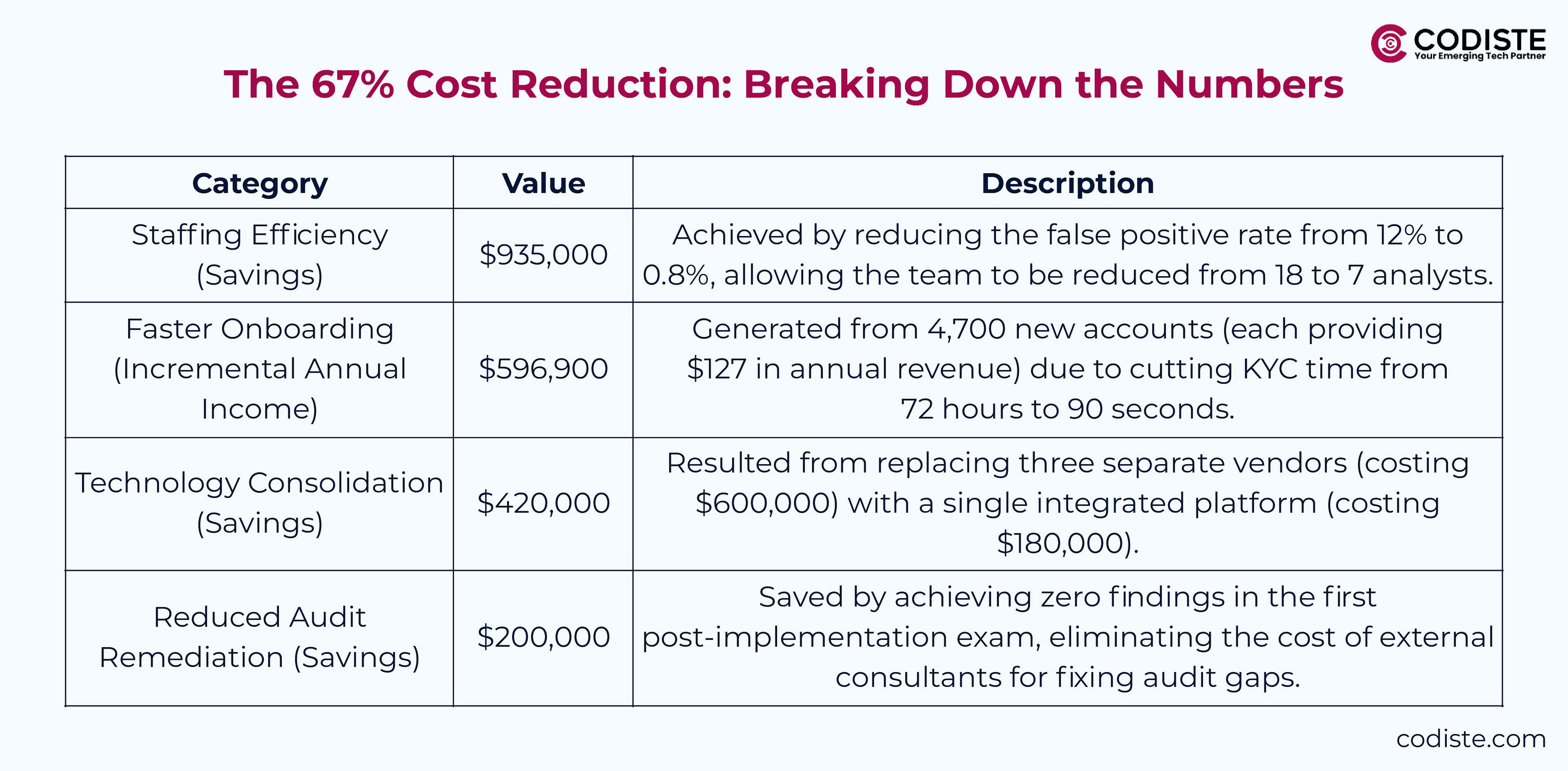

Nine months after deployment, the neobank's compliance budget dropped from $2.3 million to $750,000 annually. Here's where the savings came from:

The CFO calculated the payback period at 11 months, factoring in the $320,000 implementation cost. By month 18, the ROI hit 340%.

Read more: The Neobank USA Regulatory Playbook: Building Compliant AI-Powered Banking Solutions

Codiste's team started with a two-week discovery phase, analyzing 90 days of transaction data to understand the neobank's risk profile. They identified that 73% of false positives came from freelancer accounts with international clients, a pattern the old system couldn't differentiate from trade-based money laundering.

The build phase took 12 weeks. Codiste configured risk models for each customer segment, tested the system against historical suspicious activity, and ran parallel processing with the legacy platform to validate accuracy. The hardest part wasn't the technology. It was convincing the compliance team to trust machine learning outputs.

Read more: Integrating AI into Your Fintech Stack: A CTO's Implementation Guide

The Chief Compliance Officer insisted on a four-week shadow period where analysts reviewed every system decision. After the AI correctly identified two missed structuring schemes the old system had overlooked, and cleared 2,000 legitimate transactions the old system would have flagged, the team gained confidence. Full cutover happened in week 16.

One near-disaster: during week three of live operation, the system flagged 600% more alerts than expected. Turned out the model misinterpreted payroll patterns from a new corporate client. Codiste's team retrained the algorithm within 48 hours, and false positives dropped back to target levels. That incident proved the value of having engineers who understand both compliance and machine learning.

Every digital financial institution faces the same tension: grow fast or stay compliant. Legacy AML compliance software forces a choice. Modern platforms like Codiste's AML compliance suite eliminate the tradeoff.

The broader fintech industry is watching. When one neobank can reduce compliance costs by two-thirds while improving detection accuracy, it changes the unit economics of digital banking. Suddenly, serving underbanked populations becomes profitable because compliance doesn't require an army of analysts.

Regulators are watching too. The OCC and FinCEN have both published guidance encouraging banks to adopt AI-driven compliance tools, recognizing that human-only processes can't keep pace with digital transaction volumes. Banks that move early gain a competitive advantage. Those who wait risk becoming the cautionary tale in someone else's case study.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.