Many times, businesses face a conundrum, and this is not something new either; it's the common old problem of support tickets piling up and response times stretching into hours, and every delayed interaction chipping away at user trust.

Here's the thing: AI chatbots in customer service aren't just another tech trend for the neobanking industry; in fact, they're becoming essential infrastructure. 48% of US bank executives plan to use generative AI to enhance customer-facing chatbots, and the reasons are crystal clear: operational efficiency, cost control, and user satisfaction at scale.

This guide breaks down exactly how customer service automation can transform your neobank's support operations without sacrificing the personalized experience your users expect.

Let's talk numbers. Neobank customer acquisition costs range from $5 to $15, but retaining those users often costs more when support experiences fall short. Every frustrated user who churns because of slow support response represents lost LTV that could reach thousands of dollars.

Traditional support models create three critical bottlenecks:

Neobanks generated over $40 billion in global revenue in 2023, but those succeeding long-term are the ones solving support scalability early.

You've probably tested basic chatbots before. Maybe you built decision trees, programmed FAQ responses, or deployed rule-based systems that left users more frustrated than helped.

Traditional chatbots vs AI-powered customer service represent a fundamental shift in capability:

PayPal experienced a 20% decrease in customer support costs and 25% increase in user engagement after implementing AI chatbots. The difference isn't just efficiency; it's user experience quality.

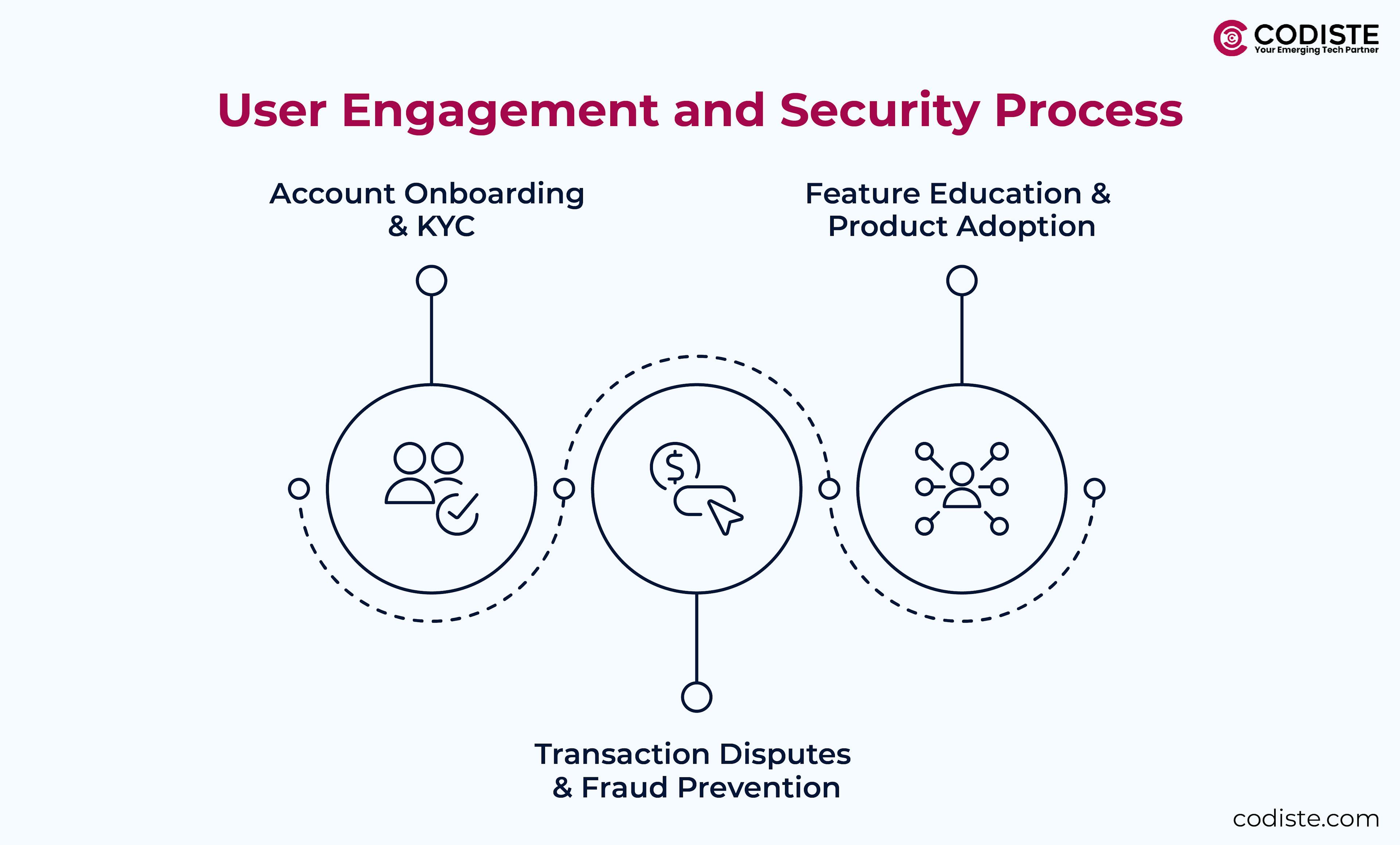

Let's break down specific use cases where neobank customer experience gets dramatically improved through intelligent automation:

Your onboarding flow probably generates the most support tickets. Users get stuck on document uploads, verification steps, or account activation.

AI automation handles:

Result: Faster activation rates, fewer abandonment points.

Financial disputes require nuanced handling that traditional chatbots can't manage.

Advanced chatbots provide:

Users often underutilize neobank features simply because they don't understand them.

AI-driven support offers:

Read more:

AI in Fintech: The Ultimate Guide for Innovators

AI in Banking: Applications, Benefits and Examples

AI in Credit Scoring: Unlocking Lending for Underbanked Markets

Choosing the Top 10 Fintech Development Companies for AI-Driven Growth

How Generative AI is Changing Financial Services

AI-Powered Fraud Detection: What Fintech CTOs Need to Know

Neobank 3.0: How AI Is Redefining Digital Banking in Fintech

The Basics of Selecting the Right Fintech App Development Partner

Neo Banking vs Traditional Banks: Who Wins the Fintech Innovation Game?

Digital banking automation requires more than conversational AI. Here's what makes the difference:

78% of customer service agents agree that customers are open to being served by AI, but only when security standards meet banking expectations.

Ready to Transform Your Neobank's Support Experience?

You're facing a classic fintech decision: internal development, third-party integration, or hybrid approach. Here's how to evaluate your options:

Best for: Large neobanks with significant AI/ML teams

Pros:

Cons:

Best for: Growing neobanks prioritizing speed-to-market

Pros:

Cons:

Best for: Established neobanks with specific differentiation needs

Pros:

Automated customer support success isn't just about deflection rates. Track metrics that correlate with business outcomes:

The average chatbot conversation lasts 1 minute 38 seconds versus 15 minutes 21 seconds for live chat handovers, and that efficiency compounds quickly across thousands of interactions.

Problem: Trying to automate every support interaction from day one

Solution: Start with high-volume, low-complexity queries. Gradually expand the scope based on performance data.

Problem: Clunky transitions from bot to human agents lose context

Solution: Build seamless escalation paths that transfer conversation history and user context.

Problem: AI models degrade without regular updates and new data

Solution: Establish feedback loops that continuously improve responses based on user interactions.

Problem: Deploying chatbots without proper regulatory consideration

Solution: Build compliance checkpoints into every automated workflow from the start.

Month 1-2: Initial Deployment

Month 3-6: Optimization Phase

Month 6-12: Scaling Impact

Post Year 1: Strategic Advantage

AI Fintech Solutions Neobank implementations must navigate complex compliance requirements. Key considerations include:

Working with experienced AI banking support providers helps navigate these complexities without slowing deployment.

Your support team's current pain points won't solve themselves. The question isn't whether to implement AI-powered customer service, it's when and how.

Consider these decision criteria:

Implement AI chatbots now if:

Wait and optimize current systems if:

Machine learning in customer service and generative AI in fintech aren't future possibilities, they're competitive necessities. The neobanks winning market share today are the ones delivering instant, accurate, 24/7 digital banking help that users prefer over traditional support channels.

Your users expect banking to be seamless, instant, and available whenever they need it. AI automation for neobanks makes that expectation achievable without destroying your unit economics.

If you're ready to explore how neobank fintech leaders are scaling support without scaling costs, it's time to evaluate AI-powered solutions seriously. With Codiste the technology is proven, the ROI is measurable, and your users are waiting for the experience upgrade. Book A Call Now

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.