Generative AI in fintech is moving beyond the hype. Everyone is talking about ChatGPT writing emails, but financial services companies are quietly utilizing AI in fintech solutions that transform the way customers interact with them, automate complex workflows, and introduce entirely new ways to conduct business.

McKinsey reports that generative AI applications in fintech could generate $200-340 billion annually across banking alone.

But what does this really mean for your product roadmap, the way customers interact with your business, or how well your business runs?

Let's cut through the clutter and examine how generative AI in financial services, from fraud detection to customer service.

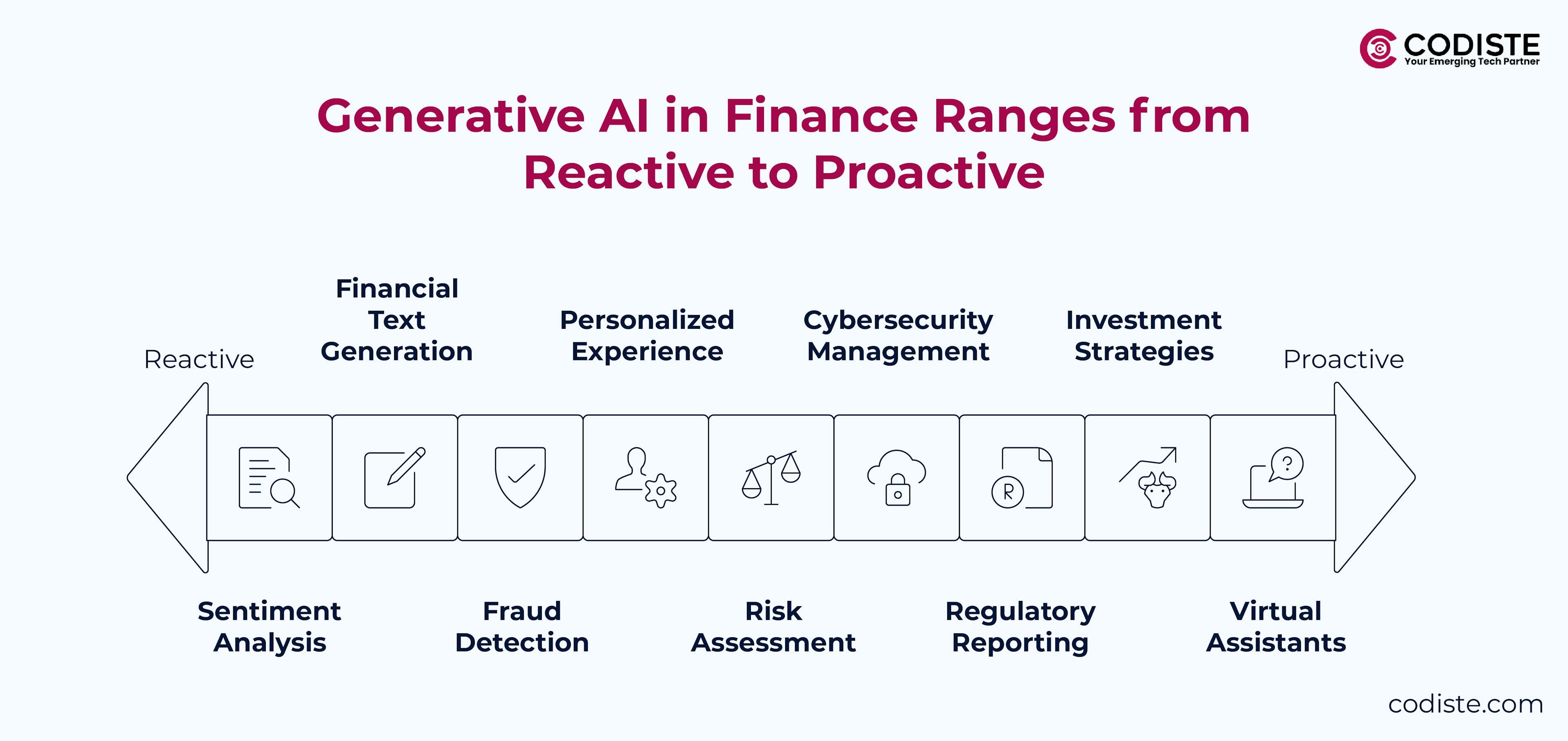

Generative AI fintech applications go far beyond traditional rule-based automation. Unlike previous AI in fintech waves focused on prediction and classification, generative models create new content, synthesize complex information, and engage in human-like conversations.

Here's what separates generative AI for fintech from earlier AI approaches:

The key difference is adaptability. Traditional AI systems require extensive training for specific tasks. Generative AI Tool solutions can handle novel situations and generate contextually appropriate responses across multiple financial domains.

Banking with Generative AI is already happening at scale. Let's examine concrete applications that are driving results today.

24/7 Customer Support powered by generative AI handles 80% of routine inquiries without human intervention. These systems are different from chatbots that follow decision trees because they know the context and give personalized answers.

JPMorgan Chase's AI assistant handles more than 50,000 customer interactions every day, answering complicated account questions that used to need human agents. The system generates explanations for fees, transaction histories, and product recommendations in natural language.

The combination of generative AI and fintech makes it possible to give hyper-personalized financial advice to a lot of people. Wealth management platforms generate custom investment reports, tax strategies, and portfolio explanations tailored to individual client situations.

Key applications include:

AI in fintech use cases for fraud prevention now include sophisticated narrative generation. Instead of simple alerts, systems generate detailed fraud reports explaining suspicious patterns in plain English for compliance teams.

Modern fraud detection systems create:

Customer onboarding represents one of the most promising generative ai use cases in fintech. Traditional KYC processes involve multiple forms, document uploads, and verification steps that create friction and abandonment.

Generative AI in Financial onboarding transforms this experience through intelligent document processing and conversational guidance.

Instead of rigid form fields, customers describe their financial situation in natural language. The AI generates appropriate forms, extracts relevant information, and creates structured data for compliance systems.

AI in financial risk assessment now includes narrative explanations that help compliance teams understand complex customer profiles. The system generates risk summaries that connect data points into coherent assessments.

During onboarding, fintech generative AI analyzes customer inputs to generate tailored product recommendations with detailed explanations of benefits and features specific to their situation.

Beyond customer-facing applications, Generative AI fintech solutions revolutionize internal workflows across financial institutions.

Financial analysts spend 60% of their time creating reports and presentations. Use Cases of Generative AI in operations include:

Engineering teams use generative AI fintech tools to accelerate development cycles:

Generative AI in Financial Services helps manage the documentation burden of regulatory compliance:

According to Deloitte, by 2026, financial services will account for 25% of corporate generating AI spending, or $85 billion yearly.

The generative AI in fintech market is experiencing unprecedented investment. Current investment patterns show:

In 2024, venture capital funding for AI in fintech businesses with generative applications totalled $4.2 billion, a threefold increase over prior years.

When using generative AI tools in the financial services industry, security and legal regulations must be carefully followed. Financial organisations have special problems when it comes to data protection, model explainability, and regulatory monitoring.

According to laws like the CCPA, GDPR, and PCI DSS, financial data must be handled carefully. Generative AI in Financial applications must ensure:

Regulators increasingly demand explainable AI decisions, particularly for credit, insurance, and investment recommendations. Banking with Generative AI systems must provide:

Are you ready to take a shot at the applications of generative AI applications in fintech? Start with low-risk, high-impact use cases that show benefit right away.

Choose initial AI in fintech use cases that meet these criteria:

Generative AI for fintech requires robust technical foundations:

Building fintech generative AI capabilities requires new skillsets:

The Generative AI in fintech revolution is just beginning. As the technology advances and legal frameworks form, early adopters who begin experimenting now will have a competitive edge.

The question is about understanding whether AI in fintech will transform your industry ,or whether you'll lead that transformation or follow others who moved first. Companies that begin exploring generative AI use cases in fintech today position themselves to capture the largest market opportunities as this technology reaches mainstream adoption.

If you're ready to explore how Generative AI in Financial Services can transform your product or operations, Codiste's main job is to help fintech companies plan and carry out the use of AI. Our staff knows what technical options and legal requirements are needed for financial AI initiatives to be effective.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.