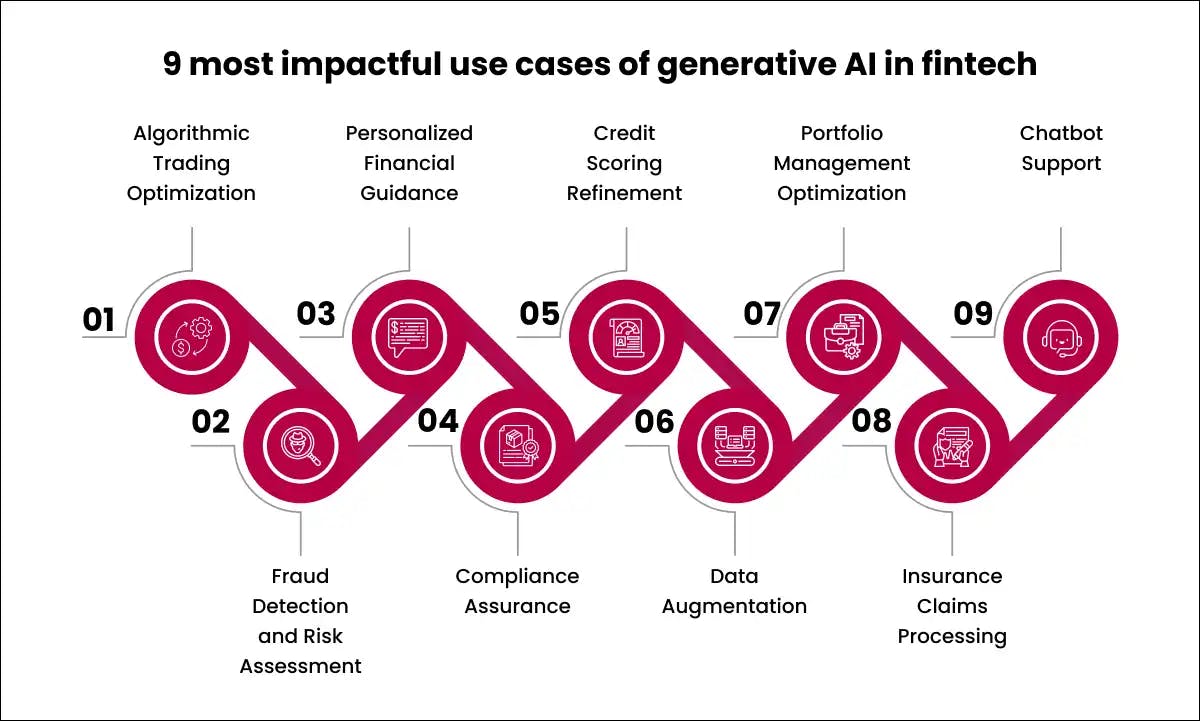

The financial technology industry is experiencing a significant change propelled by the rise of generative artificial intelligence. This advanced technology empowers financial technology providers to reimagine services through unprecedented customization, automated complicated tasks, and data-supported strategic AI decisions. This technology is sculpting how fintech companies connect with customers by understanding their specific needs and optimising workflows and operations through AI-powered automation.

Its adaptable uses cover numerous avenues of financial services. AI assistants exhibit great capabilities with a facility for nuanced analysis, conceptual modelling, and synthetic content generation for aiding the development of personalised solutions, predictive insights, and new opportunities across the fintech sector.

Generative AI takes algorithmic trading to the next level by continuously analysing market data, detecting hidden patterns, and making split-second decisions to execute the ideal trades. The system takes in tons of messy data to get useful insights into the best times to trade and what to invest in.

Generative AI tests heaps of algorithm mixes on past data. Traders using Gen AI tools get an advantage with this. They get higher profits, lower risks, and can handle changes in the market better.

Let us now find out 2 tools that can help you with this:

Generative AI solutions offer immense fraud detection possibilities with adaptive deep learning capabilities that overtake rules-based or legacy AI systems. Analyzing transactional behavior, spending patterns, risk indicators, and customer data, generative AI rapidly flags anomalies associated with fraud to enable real-time prevention before sizable damage is done.

Furthermore, AI agents can conduct comprehensive risk evaluations by absorbing past data, present patterns, and probable changes. Through predictive modeling and situation examination, it calculates the chance and effect of threats recognized. This leads to educated risk reduction tactics as opposed to monetary, governing, and cyber risks.

Let us now find out 2 tools that can help you with this:

Generative AI can offer highly personalised financial planning recommendations by analyzing a consumer's income, savings, spending behavior, and financial goals. For example, it can suggest custom budgets and investment strategies matching an individual's risk tolerance and growth objectives.

Considering future earnings and costs thoughtfully, forward-thinking AI can also recommend sensible choices to help individuals meet their objectives. Fundamentally, it serves as a personalised guide empowering people to make well-informed financial decisions.

Let us now find out 2 tools that can help you with this:

Monitoring regulatory guidelines alongside company data continuously, generative AI identifies potential compliance violations and lapses.

Generative AI is also a handy tool for fintech firms operating in various countries and states. It tracks critical times such as registration renewals, submission deadlines for papers, and rule adjustments. Giving warnings to FinTech compliance teams about these times and guidelines enables them to address issues promptly. This avoids hefty penalties and harm to the business's image.

At its core, generative AI serves as an automated helper for compliance teams. It grasps the intricate network of reporting rules, freeing staff to concentrate on more crucial tasks. Fintech companies can use AI to stay on top of compliance across all products and markets.

Let us now find out 2 tools that can help you with this:

Traditional credit scoring mechanisms often struggle with biases and inadequate data, leading to misleading or unfair conclusions. Powered by alternative data analysis, including telco, utility bills, and other financial transactions, generative AI minimises this gap.

It evaluates good financial behavior as well as anomalies to reach more inclusive credit scoring. This augmentation of legacy scoring systems enables responsible lending to underserved consumer segments by factoring contextual insights alongside established credit data.

Let us now find out 2 tools that can help you with this:

Generative AI proves extremely beneficial for data augmentation purposes within fintech. Analyzing past customer, transaction, investment, and regulation records, researchers examine patterns to artificially create new yet plausible examples that similarly distribute the real data.

Expanding datasets and increasing variability in data assists in developing more resilient artificial intelligence models to boost decision-making across risk assessment, fraud identification, automated processes, suggested solutions, and additional areas. More comprehensive data results in a more precise understanding.

Let us now find out 2 tools that can help you with this:

Analysing investment strategies, risk appetite, market dynamics, economic indicators, geopolitical shifts, and predictive analytics, generative AI generates optimised investment portfolio recommendations tailored to unique investor profiles.

This personalised guidance backed by data insights and simulated projections outpaces traditional portfolio development approaches. It empowers investors to capitalize on lucrative opportunities per their investment goals.

Let us now find out 2 tools that can help you with this:

Ingesting documentation and extracting essential information using OCR and NLP techniques, generative AI cuts through tedious manual reviews of insurance claims. Through automatic analysis, the validation of legitimate claims can be expedited. Initially, fraudulent submissions are flagged for closer examination.

We can double-check important facts by connecting applicable external resources. This process allows insurers to quickly resolve policyholder claims at lowered expenses while still guaranteeing precise results.

Let us now find out 2 tools that can help you with this:

Financial technology chatbots are progressing towards engaging in conversations resembling those of people by incorporating Generative AI. An elegant comprehension of context, multidimensional dialogues, and retention of recollections enhance interactions to provide customer care and account aid.

Through analyzing customer data, chatbots are able to provide individualised guidance on finances like spending, savings, and investments. They can also alert clients about possible fraud. This encourages self-reliance while lessening the workload for customer support agents.

Let us now find out 2 tools that can help you with this:

Generative AI is redefining every facet of financial services with formidable data processing muscle and creative capabilities. Over time, as this evolving technology expands its research, it will become more integrated within the banking, insurance, investment advising, and regulatory sectors to uncover more beneficial applications. The potential uses range from giving more individuals entry to highly customised services tailored to each unique situation.

However, to fully capitalize on generative AI while circumventing pitfalls, fintechs must ingrain trust and ethics within adopted solutions. As financial services continue adapting, principles of equity, openness, and obligation to answer for one 's actions must form the basis for new developments to reasonably progress innovation.

No doubt, generative AI (GenAI) delivers powerful financial institutions (FIs), and thus, many institutions are searching for companies offering Gen AI solutions for financial institutions. If you are looking for the best Generative AI development company, Contact Codiste. AI developers at Codiste have expertise in sorting through the data silos and protecting the processes from data threats.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.