Bottom Line: Fintech onboarding transformation is possible, but requires partners who understand both AI fintech solutions capabilities and local regulatory requirements

The CEO examined the dashboard, getting more and more displeased. Their neobank in the UAE had everything going for it: good rates, a great mobile experience, and stable support. But the numbers told a different story.

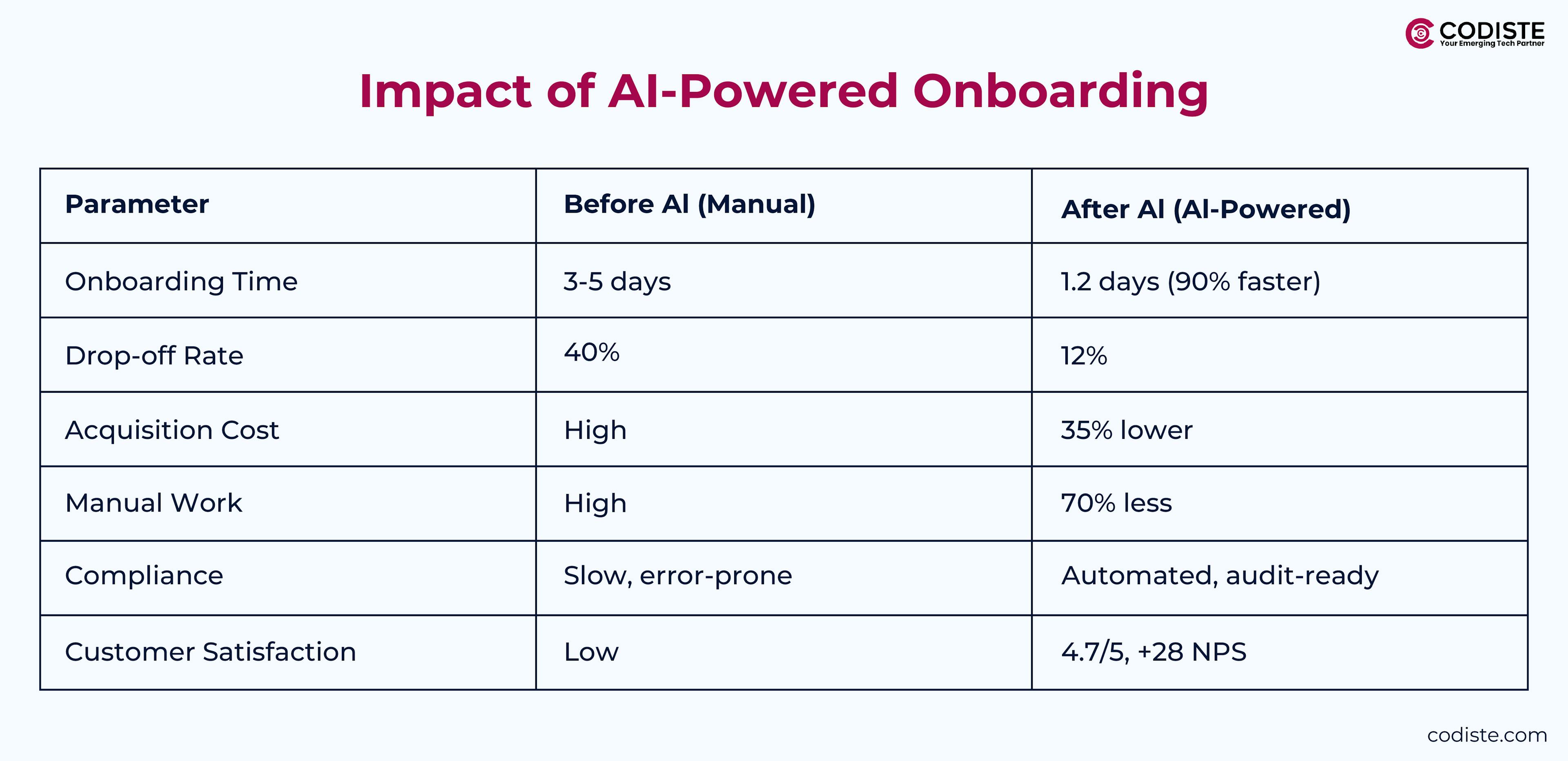

"We're losing 40% of customers during onboarding," the Head of Operations reported. "They start strong, then hit our KYC process and just disappear."

Sound familiar? Here's the thing: this wasn't about lazy customers or market conditions. The underlying issue was a tedious, fragmented onboarding procedure that took 3 to 5 days to finish. That timeline was hurting conversions in a market where digital-first customers want things right away.

What happened next changed everything. Within six months, this neobank transformed its onboarding from a conversion killer into its competitive advantage. Drop-off rates plummeted. Customer satisfaction soared. Most importantly, they cut customer onboarding time reduction by 90% while maintaining full UAE regulatory compliance.

Let's break down exactly how they did it.

UAE's financial landscape presents unique challenges. The regulatory framework is rigorous, and rightfully so. Banks must verify identity through Emirates ID, conduct thorough KYC checks, and maintain detailed audit trails for every customer interaction.

But here's where it gets tricky. Traditional onboarding processes in the region typically involve:

The result? Customer acquisition costs were skyrocketing while conversion rates tanked.

Before approaching Codiste, this neobank fintech had tried conventional approaches:

What they really needed was a solution that understood both the technical requirements and regulatory nuances of the UAE market.

We designed a comprehensive AI solution for fintech system that tackled every friction point in their onboarding funnel. Here's how it worked:

Our AI development team integrated Sumsub as a third-party tool to handle Emirates ID, passport, and visa documents with speed and precision. But we didn’t stop at OCR.

What we built is a security-first AI onboarding pipeline designed to go beyond just extracting text.

Unlike most KYC flows that stop at OCR, ours also layers in real-time fraud detection and risk scoring. It’s not just about reading documents-it’s about evaluating the intent and integrity behind every application.

Instead of blanket approval processes, our AI evaluates each application using:

The system makes sure that every decision about automating the onboarding process follows UAE Central Bank rules by automating the development of audit trails and regulatory reports. It comes with built-in compliance handling that cuts down on manual work, audit risk, and other costs of doing business.

The compliance architecture makes sure that all customer interactions follow the rules by using Automated Audit Reporting that is in conformity with FATF and UAE AML/CFT rules. Data Residency Compliance for GCC (AWS Middle East Regions) makes ensuring that all client data stays inside the limits of the region, as required by regional regulations.

Our solution meets international standards for data protection by keeping data flows that work with GDPR, PCI-DSS, and ISO 27001 throughout the entire onboarding process. The system also has Continuous Transaction Monitoring (CTM) for AML, which lets you see suspicious activity right once after an account is activated.

Six months post-implementation, the results spoke for themselves:

Onboarding Time Reduction:

Operational Efficiency Gains:

Customer Experience Improvements:

Schedule a strategic consultation with our fintech AI team

The transformation went beyond just faster onboarding. Here's what really changed:

Competitive Positioning: They became the fastest neobank in the UAE market for account opening, turning digital onboarding in banking into a key differentiator.

Scalability Without Overhead: Customer acquisition volume increased 3x without proportional increases in operations staff.

Regulatory Confidence: Automated compliance reporting cut the time it took to get ready for an audit by 80% and got rid of mistakes made by people when submitting to regulators.

Data-Driven Insights: The AI in banking system gave businesses a never-before-seen look at how customers act and what risks they face, which helped shape their whole business plan.

This case investigation gives you three important pieces of information if you're a CTO, founder, or operations manager who is having trouble with onboarding:

It's not an issue of whether AI can change how fintech onboarding works; it's a question of whether you're working with a partner who knows the rules and needs of your industry.

This neobank in the UAE isn't the only one. They had the same problems that fintechs in the area had: meeting client expectations while staying compliant with regulations and keeping prices down.

The key was working with a team that knew both the technical possibilities and the regulatory realities of their market through the use of fintech solutions development with AI.

Want to see how similar AI fintech solutions could impact your onboarding metrics? Our fintech specialists can walk you through a customized assessment of your current processes and show you exactly what's possible.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.