TL;DR

- Blockchain in fintech makes financial records that are distributed and can't be changed, which cuts out middlemen and cuts expenses by 40–80% and settlement times from days to minutes.

- Some real-world uses are cross-border payments that happen in seconds, digital identity verification that cuts KYC costs by 30-50%, and tokenized assets that make investments that were exclusively available to rich people available to everyone.

- Smart contracts in finance automate things like insurance claims and loan approvals. This might save the financial markets $100 billion a year in operating costs.

- Decentralized finance (DeFi) produces banking services without banks, and its value has grown to over $80 billion, but it comes with a lot of hazards because of smart contract problems and the fact that there is no way to get your money back.

- Some of the biggest problems are unclear regulations, the fact that Bitcoin can only handle 7 transactions per second compared to Visa's 1,700, the difficulty of integrating with older systems, and a lack of skilled workers that slows down implementation.

The financial services industry has spent decades constructing systems that operate, but here's the thing: they work slowly, cost a lot, and have a lot of middlemen who take their cut. By eliminating middlemen, accelerating transactions, and producing transparent records that everyone can rely on, blockchain in fintech promises to completely alter that equation.

You're not alone if you've heard of blockchain but are still unsure about its precise role in financial technology. Without using technical terms, this tutorial explains blockchain technology in fintech and demonstrates how it is changing everything from loan approvals to cross-border payments. Whether you're a business owner trying to figure out if blockchain is important to your operations or a finance professional looking at new technologies, you'll leave knowing both the opportunities and the real problems.

What is Blockchain in Fintech, and How Does it Work?

In its most basic form, a blockchain is a digital record that is shared by a network of computers, or nodes. A transaction or other piece of data cannot be removed or changed after it has been added to the chain.

The Core Components

Consider a shared Google Sheet that no one can change once a row is added, and everyone has a copy of it. That's basically the premise, which is constructed on three main pillars:

- Blocks: These are collections of verifiable transaction information. Once a block has data, it is closed and added to the chain.

- Chains: A unique code, called a "hash," connects each new block to the one before it. Because of this linking, if someone tries to change one block, the hash will change, making the whole chain useless right away. This makes the ledger unchangeable.

- Decentralization: The ledger is not kept on a single central server (such as a bank's database). Instead, copies are sent to the whole network of participants. This eliminates the "single point of failure" and renders the system trustless; you no longer need to trust a bank; instead, you rely on the math and the network.

The Fintech Implication

The power of blockchain in fintech is its capacity to generate trust without a central authority. Banks, clearing houses, and payment processors are the trustworthy middlemen in traditional finance. By replacing these middlemen with code and consensus, blockchain promises lower transaction costs, faster settlement times, and more openness.

Key Blockchain Use Cases in Fintech

Blockchain applications in fintech range from front office to back-end operations, radically altering how money moves and assets are managed.

1. Cross-Border Payments

Cross-border transfers that are done the old-fashioned way usually involve a lot of banks and middlemen (correspondent banking), which can lead to very high fees and settlements that take days.

- The Blockchain Solution: Blockchain-based networks enable peer-to-peer money transfers without the need for middlemen. This approach greatly reduces transaction costs and enables instant settlement. Businesses can also represent a fiat currency on the blockchain by tokenizing their assets, which enables very instantaneous value transfers across borders.

2. Digital Identity and KYC/AML

Banks put a lot of time and money into adhering to anti-money laundering (AML) and know your customer (KYC) laws. Verification is done independently by each institution, which leads to duplication and conflict.

- The Blockchain Solution: Blockchain makes it possible to create a digital identity solution in which a person's authenticated identity documents are safely and cryptographically stored on the chain. By giving a bank access to the user's certified identification, the user maintains control and avoids having to have their identity validated again. In addition to improving security, this expedites onboarding and lowers compliance expenses.

3. Smart Contracts in Finance

A smart contract in finance is self-executing code that is stored on the blockchain. The conditions of the agreement are encoded directly into lines of code.

- How it Works: When pre-defined requirements are met (for example, monies are deposited and a delivery confirmation is received), the contract automatically executes the following step (for example, payment is released or ownership is transferred). This eliminates the need for lawyers or escrow agents by automating things like insurance payouts, derivative settlements, and collateral management, resulting in a totally automated application of blockchain in finance.

4. Decentralized Finance (DeFi) and Asset Tokenization

The rise in popularity of decentralized finance (DeFi) is among the most intriguing aspects of the blockchain in the fintech industry. DeFi wants to bring back traditional financial services like lending, borrowing, and trading on a public blockchain that anyone can use from anywhere.

- Tokenization of Assets: This means turning the rights to own a real-world asset, like real estate, stocks, or art, into a digital token on a blockchain. This process makes trading assets faster, cheaper, and more open, and it also makes ownership more fractional and liquidity much higher.

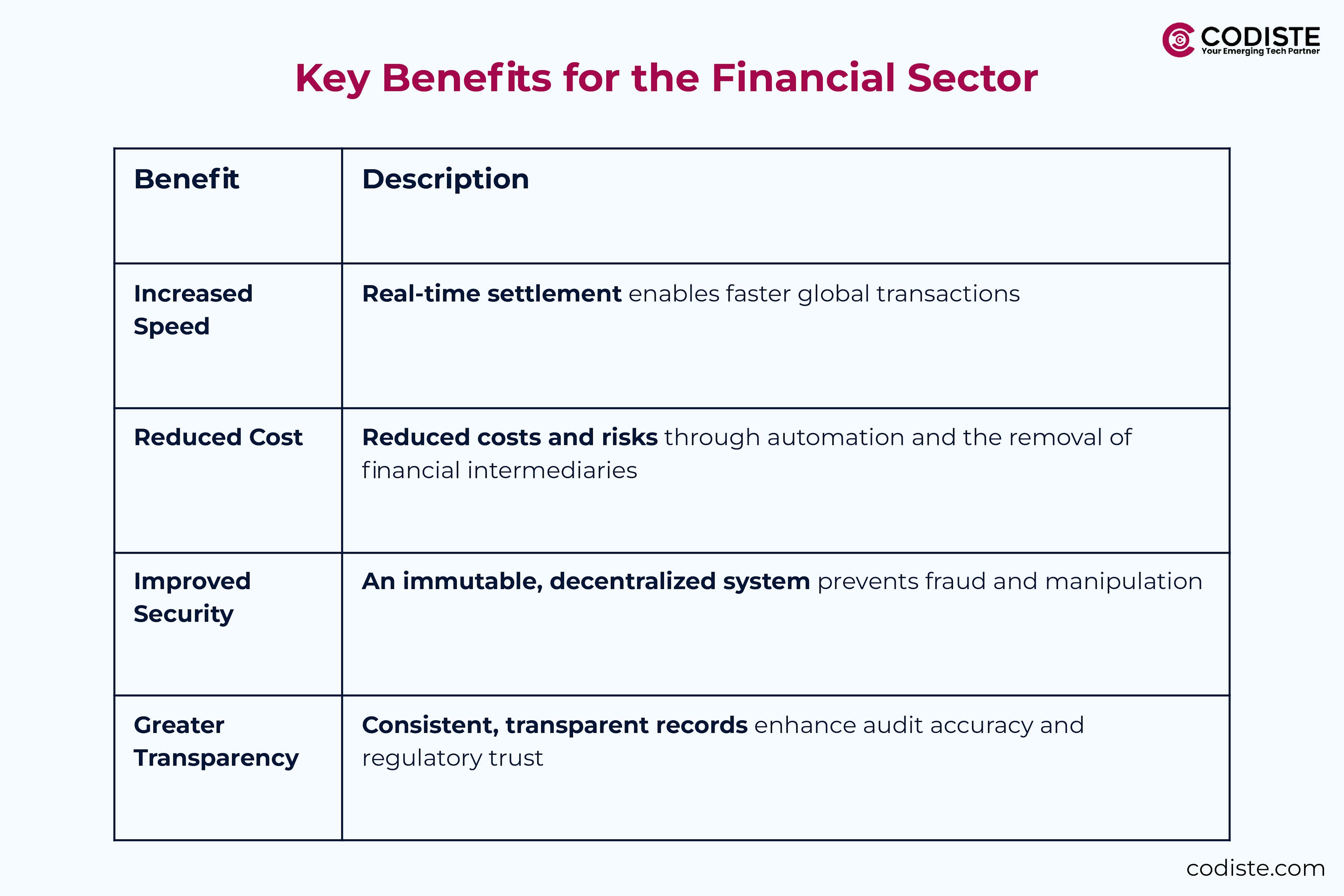

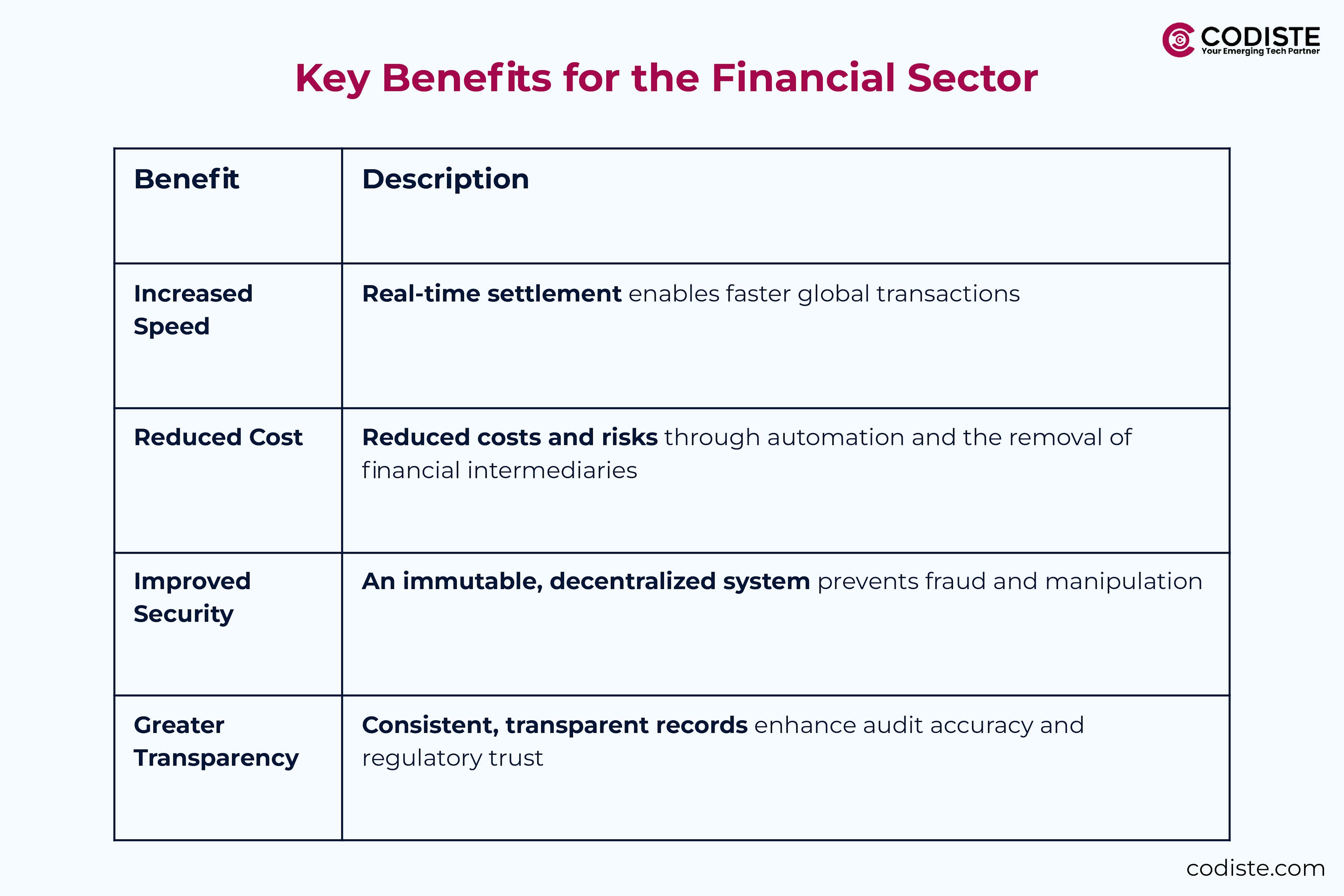

The Real Benefits and Why They Matter to Your Business

Businesses that strategically use blockchain technology in the fintech industry benefit from direct competitive advantages.

- Speed improvements: Speed increases are noticeable and quantifiable. Blockchain settles securities in minutes, whereas traditional systems take two to three days. This is significant because quicker settlement lowers counterparty risk and releases funds that would otherwise be held in reserve during clearing periods. Cutting settlement times by just one day can result in billions of dollars in working capital for a big financial institution.

- Cost reduction: Getting rid of middlemen and automating manual tasks are two ways to cut costs. Every middleman in a financial deal adds costs and makes things more complicated. Blockchain can cut the number of people who need to be involved in a transaction from five or six to just two: the sender and the receiver. Depending on the situation, this can cut costs by 40% to 80%. When everyone uses the same ledger, the costs of reconciling the back office go down a lot because there are no differences that need to be fixed by hand.

- Enhanced security: The distributed structure and cryptographic foundations of blockchain make it more secure. Hackers can't target a single database because blockchain spreads data across thousands of nodes. It would be too expensive for established blockchains to attack most of the nodes at once and compromise the network. Blockchain's clear and unchangeable record-keeping stops a lot of fraud, which costs banks billions of dollars every year.

- Greater transparency: Customers and regulators trust you more when you are more open. It's easy to show that you're following the rules because audit trails are full and automatic. Customers can see exactly where their money is and how it's being used, which meets the growing need for financial transparency.

The Challenges of Implementation

Conclusion

Blockchain in fintech is basically a new way to build trust. It makes things easier by creating a shared, verifiable, and tamper-proof ledger that traditional finance can't match. This technology is the basis for a faster, cheaper, and safer financial future. It includes things like using smart contracts to automate complicated settlements in finance and decentralization in finance (DeFi) to make access more equal. The first step to understanding the financial revolution is to learn these basics.