Your fraud detection team is drowning. What used to be manageable review queues have become endless streams of alerts, half of which turn out to be false positives that frustrate legitimate customers. Your compliance officers are burning out from manually processing KYC documents, and your CEO is asking pointed questions about operational costs scaling faster than revenue.

Does this sound familiar? You are not the only one. As AI in fintech organisations grow, traditional rule-based risk systems become operational bottlenecks rather than protective barriers.

Most new fintech companies start out with simple tools for finding fraud and reviewing things by hand. These function well for 1,000 transactions a month, but what happens when there are 100,000? Or a million?

The math becomes unsustainable fast:

Traditional systems create three critical pain points that compound as you scale:

Operational overhead spiraling out of control: Your team spends more time investigating legitimate transactions than catching actual fraud. What started as a two-person fraud team now requires eight people just to keep up with daily volumes.

Customer friction killing conversion rates: Legitimate customers get blocked, creating friction in your onboarding funnel. Studies show that 27% of customers abandon their application after a single false fraud flag.

Compliance complexity eating resources: Your rules-based system can't keep up with new rules or new patterns of risk, even while AML and KYC rules need more and more complex monitoring.

Artificial intelligence for fraud detection goes beyond simply substituting algorithms for spreadsheets. It's about making systems that can change and learn from every transaction, every encounter with a consumer, and every attempt at fraud to make risk profiles that are more and more complex.

Here's how top financial companies are utilizing AI in fraud detection to alleviate operational overload:

Instead of relying on static rules, AI fraud detection systems analyze hundreds of behavioral signals simultaneously. A payment processor might track:

The system learns what "normal" looks like for each customer segment and flags deviations that human analysts would miss. One BNPL company reduced false positives by 84% after implementing behavioral AI, while catching 23% more fraudulent transactions.

Traditional systems use fixed thresholds: transactions over $5,000 get flagged, and new customers from certain countries get extra scrutiny. AI risk assessment systems create dynamic risk scores that adapt based on context.

The same $5,000 transaction might receive different risk scores based on:

This contextual approach dramatically reduces false positives while maintaining security. A digital bank saw its manual review queue drop by 67% after implementing adaptive scoring.

Because traditional systems only work in batches, they often find fraud hours or days after it happens. Automated fraud detection works in real time, looking at transaction patterns as they happen.

Key advantages include:

Let's examine how different types of fintech companies are implementing AI risk management solutions:

Credit ratings and proof of income are very important for traditional lending. AI-enhanced systems look at dozens of extra data points to get a better idea of how risky something is.

Alternative data sources include:

One peer-to-peer lending platform increased approval rates by 31% while reducing default rates by 18% using AI for investment decisions. They're now processing 4x more loan applications with the same underwriting team size.

Payment fraud is no longer just about st

olen credit cards. Fraudsters today use fake identities, account takeovers, and coordinated attacks that old systems can't catch.

Machine learning for fraud detection helps payment processors identify:

A major payment processor reduced fraud losses by $47 million annually after implementing AI-driven fraud detection, while reducing legitimate transaction blocks by 52%.

Know Your Customer and Anti-Money Laundering compliance consume enormous resources at digital banks. Manual document verification, name screening, and transaction monitoring require armies of compliance officers.

Regulatory compliance in fintech transforms through:

One neobank cut the time it took to process KYC from 3–5 days to less than 4 hours while keeping the accuracy at 99.7%. Their compliance team now works on more complicated instances instead of just checking documents.

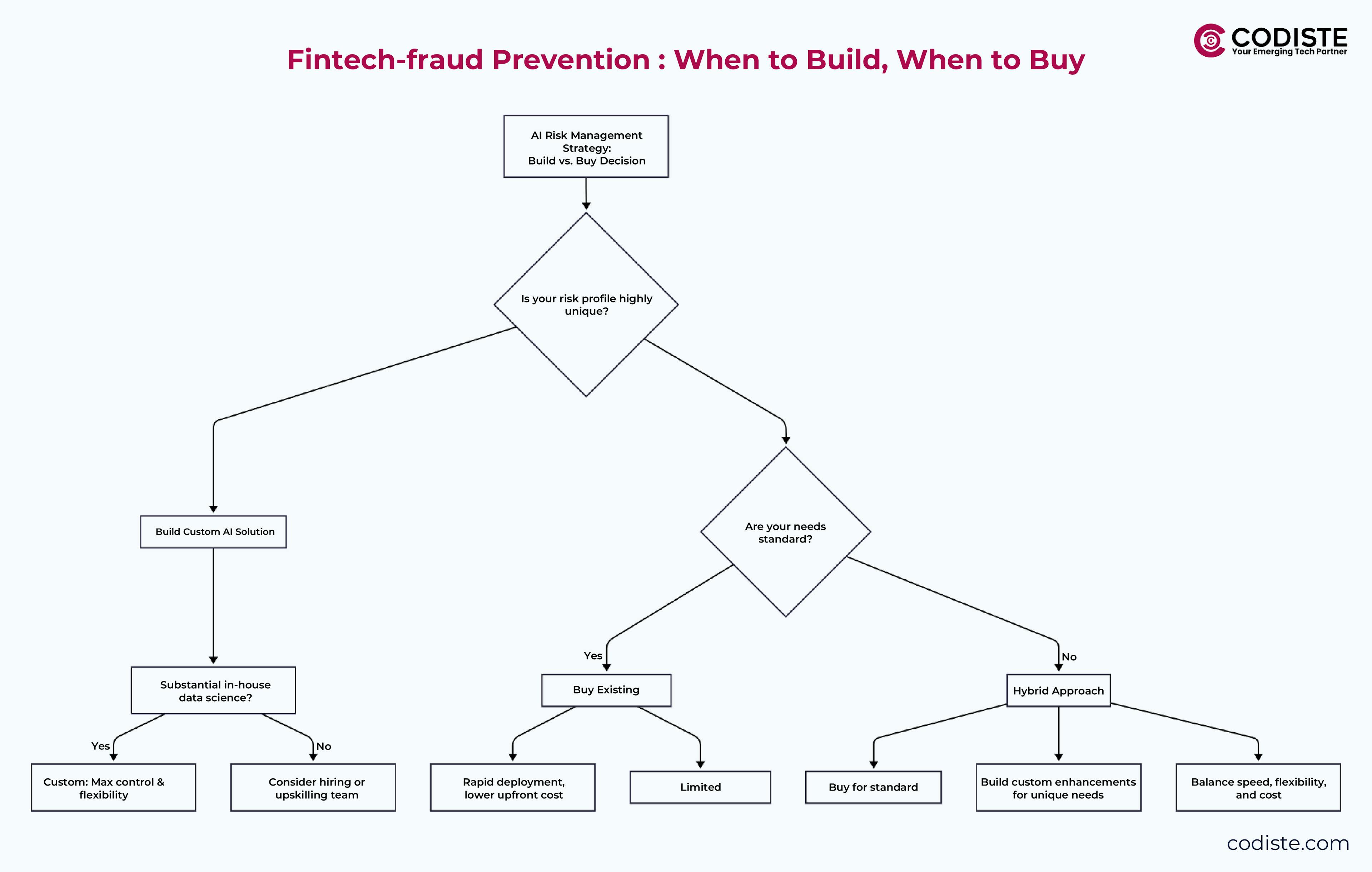

As AI shows its worth in risk management for fintech, CEOs must make a big choice: make their solutions, buy ready-made platforms, or make a mix of the two.

Custom development makes sense when:

Building custom involves a lot of money up front, but it gives you the most freedom. Plan on 12 to 18 months for the first development and ongoing data science resources.

Off-the-shelf solutions work best for:

Top systems like DataVisor, Featurespace, and Sift offer fraud detection services that may be set up in weeks instead of months. Costs per month usually run from $10,000 to $100,000, depending on how many transactions there are.

Many successful fintechs combine purchased platforms with custom enhancements. Use commercial solutions for standard fraud detection while building custom models for unique business logic.

Hybrid benefits include:

Read more:

AI in Fintech: The Ultimate Guide for Innovators

AI in Banking: Applications, Benefits and Examples

AI in Credit Scoring: Unlocking Lending for Underbanked Markets

Choosing the Top 10 Fintech Development Companies for AI-Driven Growth

How Generative AI is Changing Financial Services

AI-Powered Fraud Detection: What Fintech CTOs Need to Know

Neobank 3.0: How AI Is Redefining Digital Banking in Fintech

The Basics of Selecting the Right Fintech App Development Partner

Neo Banking vs Traditional Banks: Who Wins the Fintech Innovation Game?

Transforming your risk operations doesn't happen overnight. Here's a practical roadmap for implementing AI-driven fraud detection and risk management:

Audit your current systems and identify specific pain points:

Establish data infrastructure requirements:

Start with highest-impact, lowest-risk applications:

Key metrics to track during pilot phase:

Expand AI coverage to additional risk areas:

Focus on operational transformation:

AI risk management investments should deliver measurable improvements across multiple dimensions. Here are the key metrics successful fintechs track:

A mid-sized lending platform reported the following improvements after 12 months of AI implementation:

There are some problems that can come up when using AI in risk management automation tools that can stop projects in their tracks if they aren't dealt with correctly:

Before training the model, put money into cleaning and validating the data. Set up ongoing checks on the quality of the data and put in place ways to find bias.

For judgments that are really risky or out of the ordinary, keep human oversight. Set up explicit steps for escalation and do regular reviews of how well the model is working.

Plan for integration needs and set aside money for specialized API development. Think about gradual rollouts that don't cause too much trouble for current workflows.

Fraud monitoring continues to evolve, and emerging trends will shape how fintech companies approach fraud detection and operational efficiency:

Ready to explore how AI can transform your fintech risk management operations? At Codiste, we help fintech companies implement intelligent fraud detection services and compliance automation systems that scale with growth while reducing operational overhead. Our team has experience building custom AI solutions for lending platforms, payment processors, and digital banks. Schedule a consultation to discuss your specific risk management for fintech challenges and explore tailored AI solutions.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.