AI in fintech is moving from experimental to essential for competitive survival

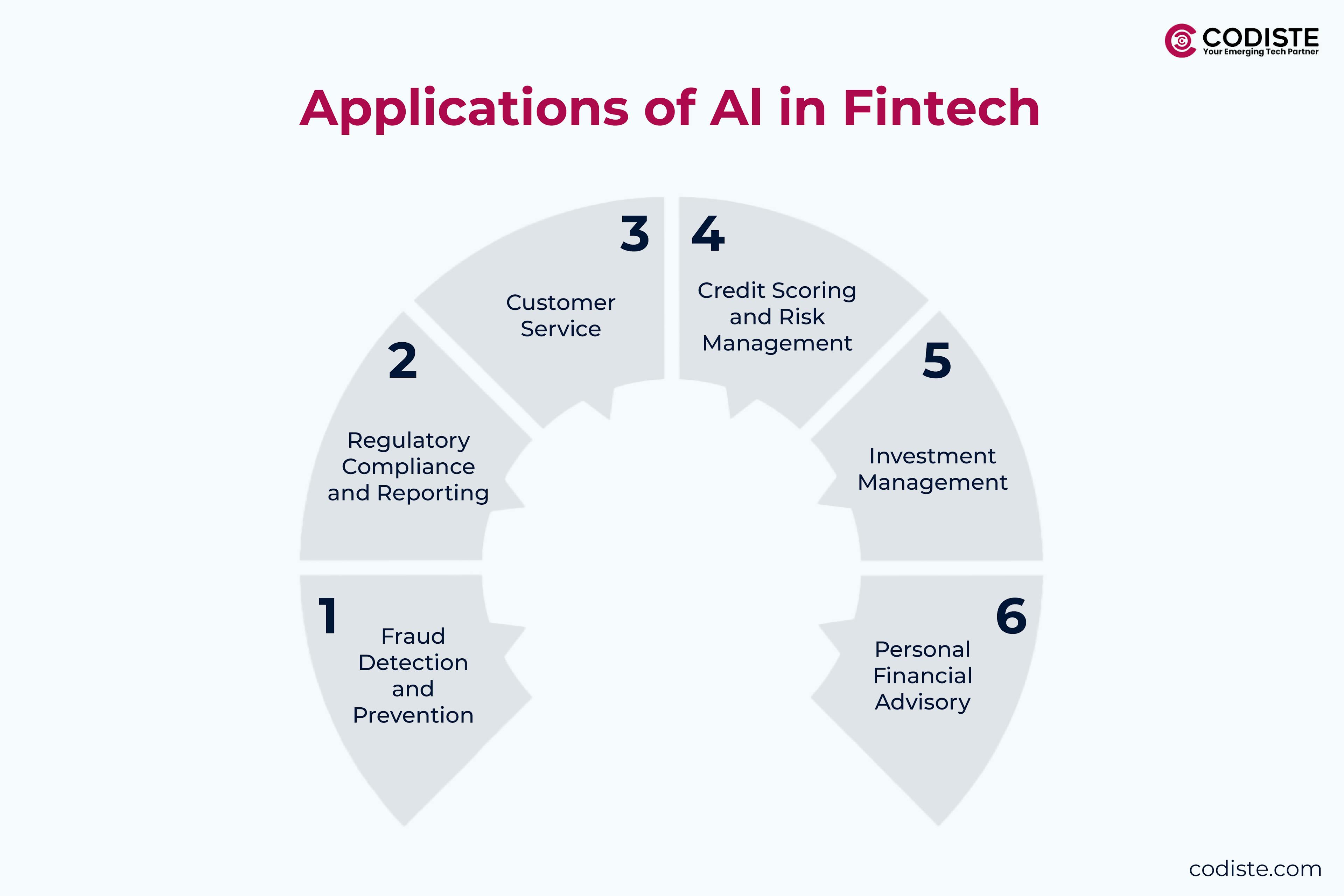

Fintech AI use cases are changing the way banks do business, compete, and help consumers. AI in fintech is going beyond test projects and into the main parts of the business that have a direct effect on revenue and risk management. These include rapid loan approvals and predictive fraud detection.

Here's the reality: traditional manual processes that once took days now happen in seconds. Credit decisions that relied on limited data points now analyze thousands of variables. Customer service that operated on business hours now provides 24/7 intelligent support.

The competitive gap is widening fast. AI applications in fintech companies are capturing market share while traditional players struggle with legacy systems and manual workflows.

Consider these market dynamics:

The companies moving first are setting new industry standards. The ones waiting are facing customer churn and operational inefficiencies that compound monthly.

Machine learning credit scoring has fundamentally changed how lenders assess risk and approve applications. Traditional credit scoring relied on limited historical data. AI models now analyze over 10,000 data points in real-time.

AI-powered financial services can approve or reject loan applications within minutes. The process works like this:

Fintech automation with AI extends beyond traditional credit bureaus. Lenders now analyze:

AI-driven financial technology adjusts interest rates based on comprehensive risk profiles. Instead of fixed rate tiers, AI enables personalized pricing that reflects actual risk while maximizing profitability.

This approach reduces loan defaults by 23% while increasing approval rates for previously underserved segments.

AI compliance monitoring addresses the biggest headache for fintech leaders: staying ahead of regulatory changes while managing operational risk.

Artificial intelligence banking use cases include systems that:

Real-time transaction monitoring powered by AI catches suspicious activity before losses occur. Traditional rule-based systems generated false positives 70% of the time. AI models reduce this to under 15%.

AI fraud detection systems analyze transaction patterns, user behavior, and network effects simultaneously. They identify:

Fintech generative AI use cases extend to regulatory reporting and risk documentation. AI generates compliance reports, audit trails, and regulatory filings with 99% accuracy while reducing preparation time by 80%.

Ready to explore how AI applications in fintech can transform your operations?

AI chatbots financial services have evolved from basic FAQ responders to sophisticated financial advisors capable of handling complex customer needs.

Natural language processing banking enables conversational interfaces that understand context, intent, and emotional tone. These systems can:

AI applications in fintech now include real-time financial coaching. The AI looks at how money is spent, finds ways to make things better, and gives you suggestions that you may use.

Customers receive insights like:

AI ensures a consistent customer experience across mobile apps, web platforms, and call centers. Customer context follows them across touchpoints, eliminating the need to repeat information or re-authenticate repeatedly.

Read more:

AI in Fintech: The Ultimate Guide for Innovators

AI in Banking: Applications, Benefits and Examples

AI in Credit Scoring: Unlocking Lending for Underbanked Markets

Choosing the Top 10 Fintech Development Companies for AI-Driven Growth

How Generative AI is Changing Financial Services

AI-Powered Fraud Detection: What Fintech CTOs Need to Know

Neobank 3.0: How AI Is Redefining Digital Banking in Fintech

The Basics of Selecting the Right Fintech App Development Partner

Neo Banking vs Traditional Banks: Who Wins the Fintech Innovation Game?

The financial benefits of AI in fintech uses cases become clear when examining operational metrics and customer acquisition costs.

Fintech software development company partnerships become critical for successful AI implementation. Here's how leading organizations approach AI adoption:

The use cases of ai in fintech are becoming table stakes, not competitive advantages. Companies that delay AI adoption face:

Customers gravitate toward faster, more personalized experiences. AI-powered financial services companies report 40% higher customer satisfaction scores and 25% lower churn rates.

Manual processes become increasingly expensive relative to AI-driven financial technology. Cost gaps widen as AI becomes more efficient and accessible.

AI compliance monitoring tools help businesses keep one step ahead of changes in the law. Manual compliance systems have a hard time keeping up with changing rules in different places.

Top fintech professionals prefer working with companies that embrace innovation. Organizations seen as laggards face recruitment difficulties and higher turnover rates.

The window for comfortable AI adoption is closing. Fintech generative AI use cases will define market leaders over the next 18 months.

Codiste's fintech AI development team has helped 50+ financial services companies implement machine learning fintech solutions that deliver measurable ROI within 6 months. Let's discuss your specific AI in fintech use cases and build a roadmap that fits your timeline and budget.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.