In today's quickly changing world, the insurance business is facing many challenges. Customers want better service and new technology is making things different. In 2024, insurance companies need to work hard to make their operations run smoothly, spend less money, and make customers happy. One big way they can do this is by using Artificial Intelligence (AI) in the insurance industry.

AI in the insurance industry is a very powerful tool that can help insurance companies in lots of ways. It can make processes faster and easier by automating tasks. AI in insurance companies can help to make better decisions by analysing large amounts of data quickly. With AI, insurance companies can spot patterns and trends that humans might miss. Another big benefit of AI is that it can improve the customer experience.

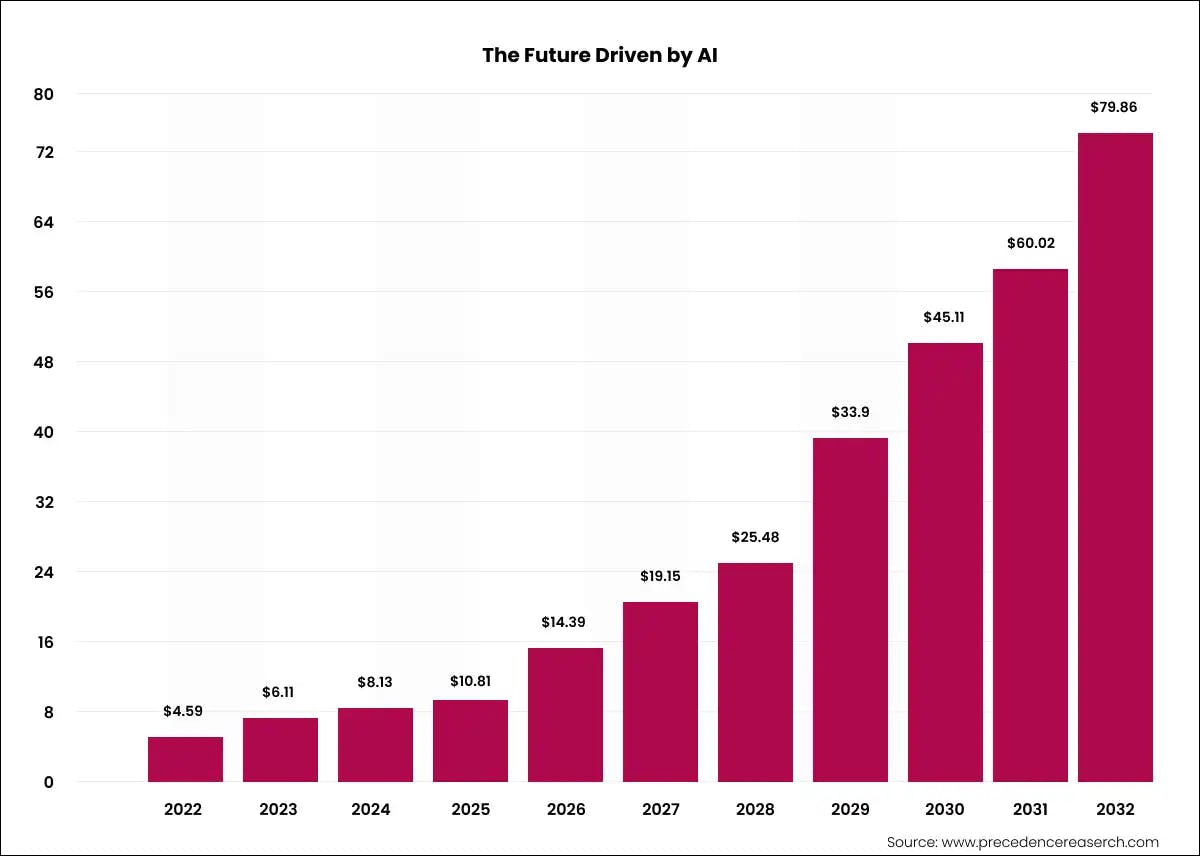

With the global AI in the insurance market projected to reach .77 billion by 2030, growing at a staggering CAGR of 33.06% (source: Markets and Markets), adopting AI has become a strategic imperative for insurers seeking to gain a competitive edge.

Insurance firms now utilise artificial intelligence technology widely. A Deloitte survey revealed that over 90% of these companies have adopted or are adopting AI solutions. This innovative technology enhances operations through automation and data analysis. However, some key processes remain human-driven for reliability and ethical compliance. AI integration streamlines workflows, optimising efficiency while preserving personalised customer experiences.

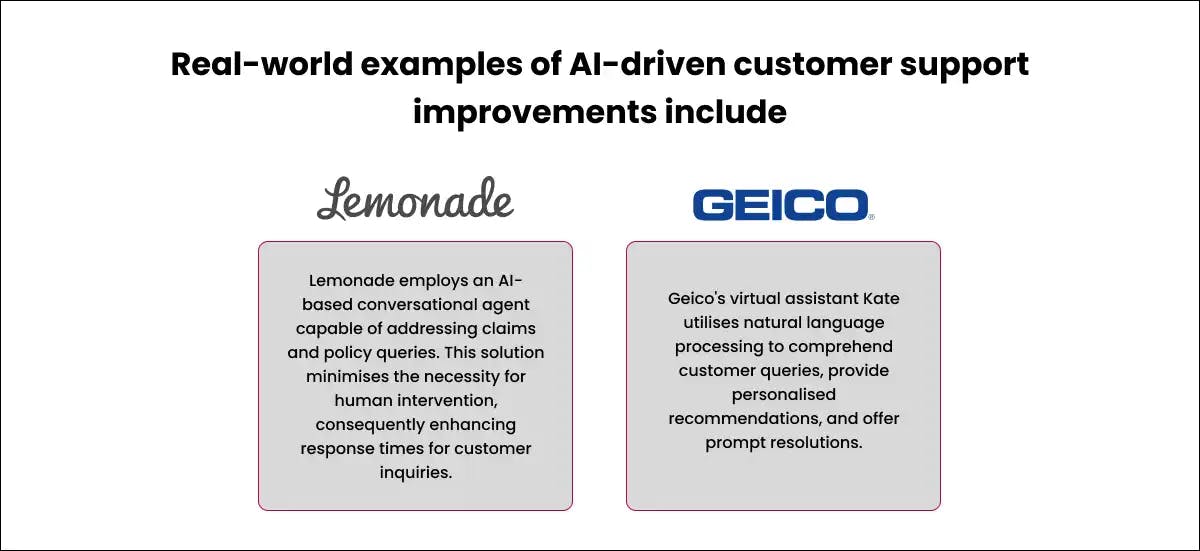

Real-world examples of insurance companies that have successfully integrated AI into their operations include:

Automated claims processing is one of the most important applications of Artificial Intelligence in the insurance industry. AI algorithms can analyse vast amounts of data, including policy documents, claim forms, and supporting documentation, to quickly and accurately assess claims.

AI systems in insurance now comprehend intricate data, such as claim forms and paperwork, similarly to people. These systems analyse information along with policy guidelines, historical records, and related sources. Connecting all these pieces of information, the AI can figure out if a claim is valid and what coverage applies. Additionally, these AI systems are incredibly good at spotting patterns and anything out of the ordinary that could indicate fraudulent activities.

According to a study by Accenture, insurers that have implemented AI for claims processing have seen a reduction in processing time by up to 70%. For example, Fukoku Mutual Life Insurance in Japan reported a 30% increase in productivity and a 50% reduction in claims processing time after implementing an AI-based system.

AI enables insurers to proactively identify fraud initially through advanced analytics that detects anomalies and patterns across vast datasets. This allows them to flag high-risk claims for further investigation and prevent fraudulent payouts.

Artificial intelligence algorithms excel at uncovering suspicious activities by meticulously analysing immense data sets. This includes claims records, customer details, and external information sources. By identifying irregularities, discrepancies, and deviations from normal patterns, AI can highlight potential fraudulent cases requiring further scrutiny.

Predictive analytics in insurance plays an integral role in curbing fraudulent claim payouts. Predictive analytics in insurance companies helps them predict user intent and lower risk using AI/ML and behavioral data. Using historical/behavioral data, AI algorithms identify patterns associated with fraudulent claims. These insights enable the creation of predictive models that evaluate the likelihood of fraud for each new claim. Consequently, insurers can prioritise investigations and allocate resources judiciously.

Insurance firms utilising AI for fraud detection have reaped significant quantitative benefits, including cost savings and enhanced fraud detection rates. For example, Zurich Insurance, a Swiss insurance company, reported a 10% increase in fraud detection rates after implementing an AI-based fraud detection system, saving millions in potential payouts.

Such human errors in the traditional assessment processes can be handled effectively through the integration of an AI system in the insurance industry. AI systems, through their advanced data analysis, eliminate bias in data. It includes bias occurrence due to cognitive limitations, emotional influences, and other environmental factors.

Advanced data analysis of AI systems helps insurers process claim assessments fairly and quickly.

AI-powered chatbots and virtual assistants can provide 24/7 customer service, answering common queries, guiding customers through the claims process, and escalating complex issues to human agents when necessary. Automated systems developed using AI for insurance business improve user interactions while reducing personnel expenses—their implementation streamlines operations, optimising client satisfaction and business.

According to a report by McKinsey, the widespread adoption of AI in the insurance industry could lead to operational cost savings of up to 1 trillion by 2030. This includes savings from automated claims processing, underwriting, and other administrative tasks.

Artificial intelligence automates mundane responsibilities, lessening manual burdens and operating expenditures. Mechanising repetitive assignments like data entry, document processing, and routine customer queries enhances proficiency. Additionally, minimising human mistakes results in further fiscal conservation.

Artificial intelligence enhances the accuracy of evaluating possible risks. It scrutinises a vast array of data sources, encompassing customer details, historical claim records, and external data streams like social media and Internet of Things devices. This leads to more informed underwriting decisions.

With more precise risk assessments, AI enables insurance companies to price policies accurately. The pricing reflects the true risk associated with each customer or policy. Employing a transparent pricing strategy enhances financial returns, while upholding ethical standards.

Automating underwriting procedures through artificial intelligence significantly expedites policy issuance, thereby minimising expenses and timeframes. For example, Zurich Insurance reported a 50% reduction in underwriting time after implementing an AI-based system.

Insurance companies utilise AI to increase customer acquisition and retention. Data examination reveals habits and tendencies, allowing services and goods designed specifically for individuals' wants and likes. Companies utilise this method to offer specialised options, prices, and advertising campaigns aimed at particular customers. Personalization enhances customer satisfaction, boosting retention and attracting new clients seeking tailored insurance solutions. Using AI for deep insights into customer data, insurers can create highly relevant, appealing products and experiences.

Artificial intelligence in insurance can gain an edge in reducing claim resolution costs. AI in the insurance industry simplifies tasks, drives employee productivity, cuts expenses, improves customer service, etc.

Codiste, being an AI solutions provider, adopts and delivers AI solutions for the insurance industry to help streamline operations. Their skilled team, including data analysts, machine learning developers, and AI specialists, crafts tailored AI solutions for insurance companies. At Codiste, their AI team also has expertise in developing customer-facing apps, advanced analytics systems, and implementing the latest features and functionalities. Connect with us to discuss your AI-powered systems for insurance requirements.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.