The insurance industry stands at the center of a technological development driven by artificial intelligence (AI). AI in the insurance industry, a notion that has existed for many years, has recently taken remarkable strides due to advancements in machine learning, deep learning, and the vast availability of data. This progress has enabled AI to approach its long-anticipated capabilities of replicating human-level abilities like perception, reasoning, learning, and problem-solving.

According to a recent report, more than 50% of claims activities will be replaced by automation, with algorithms handling initial claims routing and IoT sensors replacing traditional manual methods of first notice of loss. So, it is becoming clear that insurance companies that fail to adopt AI will be unable to beat their competitors. Contrary to that, insurance companies adopting AI and integrating their operations will find new opportunities.

The rapid development of AI, particularly in the areas of machine learning and deep learning neural networks, has been turbocharged by the availability of the massive data sets required to "train" these systems to identify complex patterns and insights. The proliferation of data from sources like connected IoT devices, wearables, telematics, online data streams, etc. provided the fuel to Artificial Intelligence models developed for insurance companies.

Combining advanced AI with these rich data sources allows insurers to break free of historical constraints around customer underwriting, risk assessment, and pricing that rely on limited data captured at just a single point in time. With AI and machine learning, a customer's evolving risk profile can be continuously re-evaluated based on their real-world behaviours, environmental factors, and another context - opening the door to new dimensions of personalization, accuracy, and responsiveness.

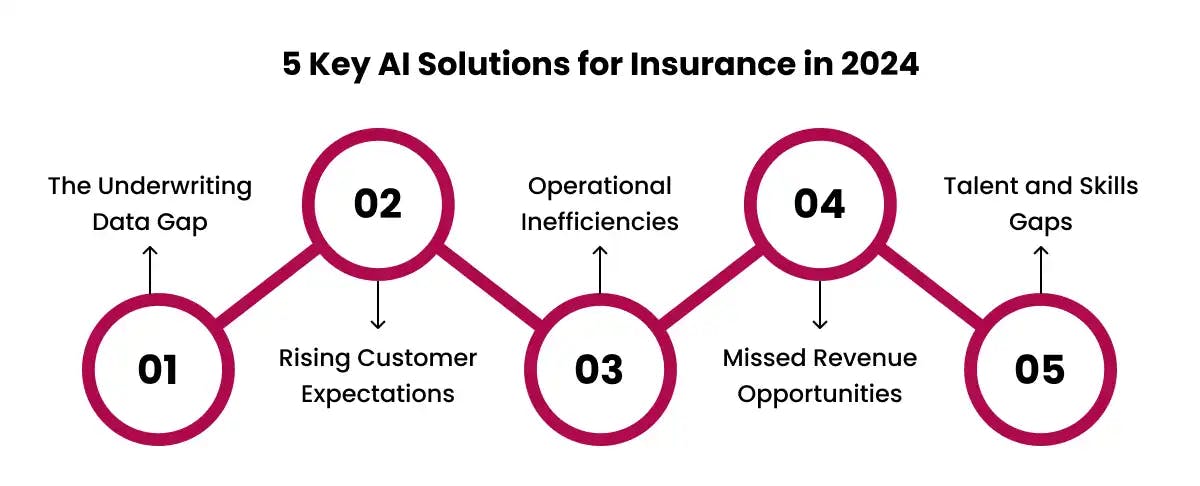

Here are five key problems that AI can help insurance companies solve as they head into 2026:

Traditional underwriting is constrained by only having data on a customer at a single point in time when the policy is issued. It fails to account for changes in the customer's lifestyle & behaviours that could impact their risk profile over the lifetime of the policy. AI-driven continuous underwriting powered by data from connected devices and IoT sensors can provide a steady stream of insights into a customer's habits and environment, allowing for real-time risk adjustments and personalised pricing.

Customers today expect the same level of personalization, transparency, and on-demand service that they get from digital giants like Amazon, Netflix, and Uber. Traditional insurance models unable to meet these expectations. With AI, insurers can hyper-personalise product offerings, customer journeys, and services based on a 360-degree view of each customer's specific needs, behaviours, and preferences.

Highly repetitive and manual processes like data entry, triage, submission handling, and basic claims processing are ideally suited for automation through AI and robotic process automation (RPA). Automating these tasks can drastically improve operational efficiency, reduce errors, and allow human employees to focus on higher-value activities that require emotional intelligence, creativity, and critical thinking.

Life insurers in particular have struggled with profitability over the past decade due to factors like low interest rates and outdated product portfolios. AI can help explore new revenue streams through innovative new product lines like parametric insurance, dynamic pricing models, value-added services, and solutions tailored to different life stages and the growing millionaire/middle-class markets.

By 2030, as much as 44% of insurance work could be automated, causing a dramatic shift in the skills and roles required. Insurers will need technology talent to build and deploy AI solutions as well as human talent with strong digital, data, and analytical capabilities to work alongside AI assistants. Closing this talent gap and reskilling existing employees will be critical.

AI is bringing innovative solutions to the insurance sector, despite its early adoption stage. Already, AI in the insurance industry is transforming various operations:

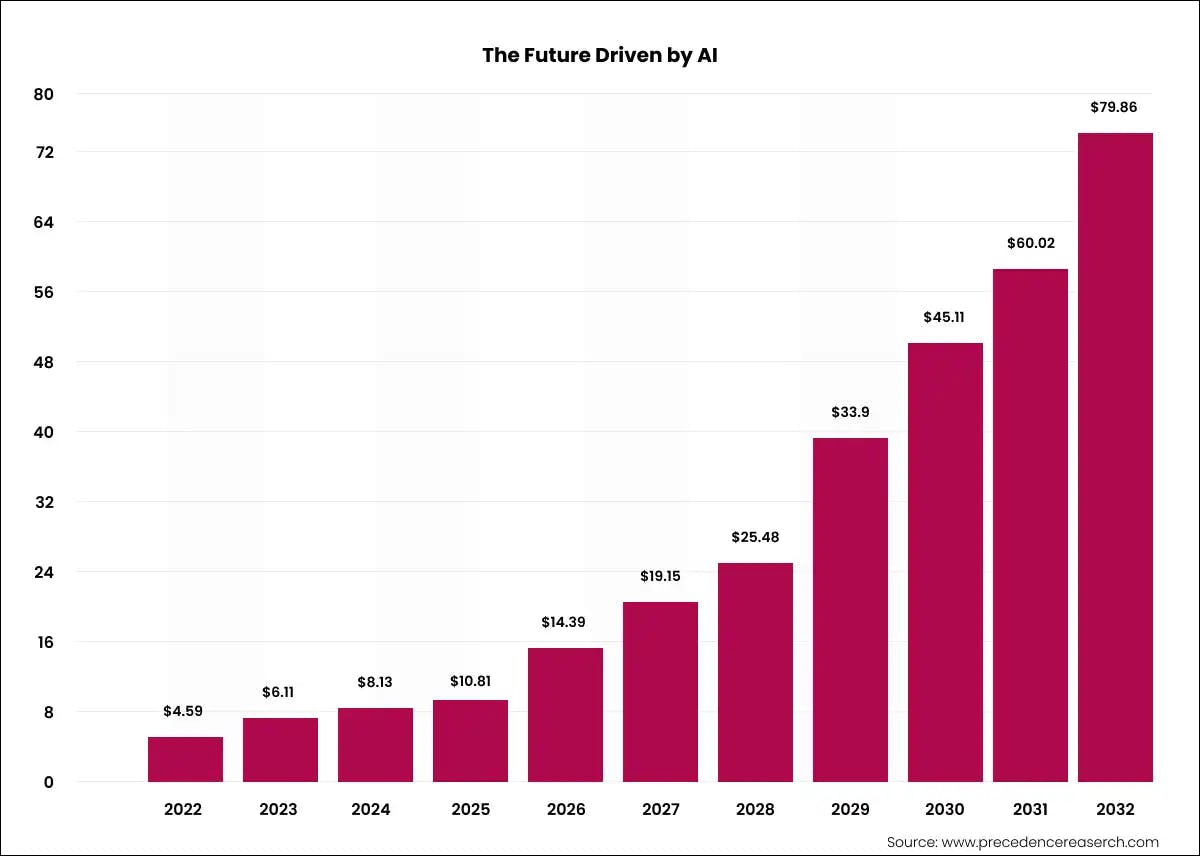

The examples above are just the tip of the iceberg when it comes to AI's capabilities in insurance. The global artificial intelligence (AI) in insurance market size is expected to be worth around USD 79.86 billion by 2032. Leading insurers are already deploying AI solutions, but we are still in the very early stages. Advanced innovations like quantum machine learning could one day allow AI to tackle extremely complex problems that conventional systems can't by using quantum computing capabilities. Neuromorphic computing chips modelled after the human brain could lead to massively more powerful AI. Emerging AI guidelines and ethical frameworks will need to be embraced to safely and responsibly govern the growing real-world impacts of AI systems.

Insurance companies must prioritise adopting AI technologies like machine learning in 2025 and beyond - and doing so strategically by addressing data readiness, talent and skills gaps, cultural change, and responsible AI governance. Those insurance companies already beat the competitors by shifting early to this technology and will be well-positioned to thrive in the coming AI-driven future. Those that successfully integrate AI across their value chains will be able to reimagine not just the insurance experience, but their entire business models for the coming AI era.

If you are ready and want to implement AI technologies in the insurance business, let’s connect with Codiste, a reliable machine learning Development Company for developing and implementing AI solutions into your industry. We not only offer customised AI solutions for the Insurance industry but also for many others like Finance, Retail, and so forth. Our best AI Constaltion helps you in fraud detection to streamline claim processes and 24/7 customer services. Connect with our team of experienced AI consultants and AI engineers who help you with AI/ML solutions with a focus on safety and security. Contact Now!

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.