Artificial Intelligence (AI) has unravelled the possibilities for growth in all industries. The insurance industry is not an exception. AI has transformed the insurance industry massively in all traditional insurance practices, particularly in claims processing.

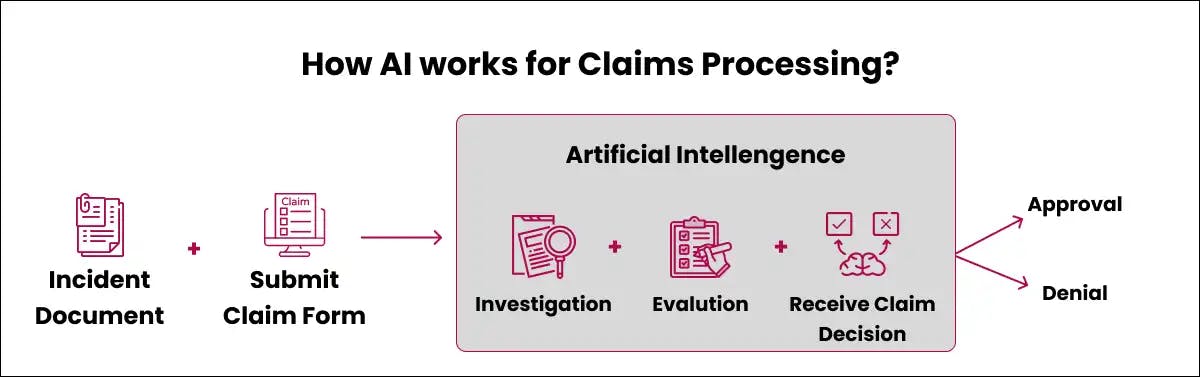

Here is a quick rundown on AI in insurance claims:

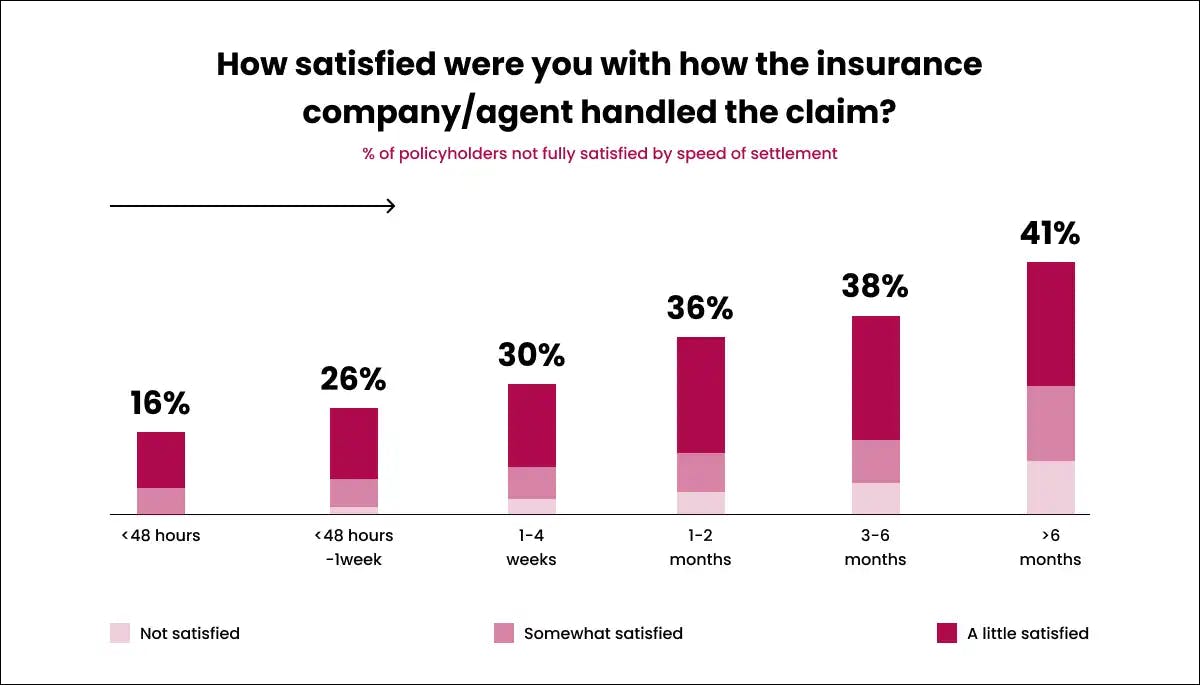

With such speed in the claim cycle and high claim accuracy, insurance companies will eventually gain better customer satisfaction rates. The below given pictorial view shows how insurance policyholders are satisfied when their claim gets it right.

The speed of claim settlement plays a major role in the satisfaction rate among the policyholders. This is why insurance companies prefer AI for their insurance claim processing.

Okay, let’s take a look at how AI solves the problems of traditional claim processing in brief.

Traditional claims processing also known as paper-driven processes involves a lot of complexities making it cumbersome. It requires extensive human intervention to rectify errors leading to high administrative costs and delays in claim processing. Also, there would be no assurance of 100% error rectification in the manual handling of claims.

AI-powered claim processing streamlines the process and delivers a hassle-free experience to both insurers and policyholders through automation. With the help of a centralised information-sharing system, AI helps insurers strike the right strike balance between paying the right claims promptly and detecting fraudulent ones.

The American-based strategy and management firm McKinsey predicts that in 2030 AI will play a vital role in insurance claim processing to meet the demands of policyholders and insurance companies.

The introduction of AI-powered Chatbots in claim registration will be the perfect example of how AI and ML speed up the claim process straightforwardly. It reduces the errors and incomplete data at registration itself and ensures all the essential documents aren’t missed by policyholders.

When it comes to insurance claims, transparency is the major factor that establishes the trust between policyholders and insurance providers. However, in the point of policyholders, the claims handling process is always shrouded in mystery about their claim status and leaving them in the dark. For many policyholders this would be their million-dollar question:

Well, the main reason would be the lack of transparency during the claims handling process and the communication gaps between policyholders and insurance providers. If the insurer manages to inform the progress of claims, policyholders will be aware of the potential outcomes and plan accordingly.

AI in the insurance industry helps insurers establish a transparent claims-handling process and have constant communication with policyholders by providing real-time updates through AI integration. An AI system automates the claim processing by giving clear and timely status updates to the policyholders. This paves the path for building trust and enhancing customer satisfaction.

Many insured people and insurers often wonder why some claim assessments are not accurate. Well, the presence of bias in the data will lead to inaccurate claims assessments or an inability to determine coverage.

Bias in data may occur due to systematic errors or personal prejudices, and sometimes a different or the same professional makes different decisions for similar cases at different times.

Such human errors in the traditional assessment processes can be handled effectively through the integration of an AI system in the insurance industry. AI systems, through their advanced data analysis, eliminate bias in data. It includes bias occurrence due to cognitive limitations, emotional influences, and other environmental factors.

Advanced data analysis of AI systems helps insurers process claim assessments fairly and quickly.

Fraudulent claims will have a severe impact on genuine claimants in many ways like high premium costs and delays in claims settlement. If you wonder how fraudulent claims affect my claim processing, take a look.

Fraudulent claims result in an increase in premiums for honest customers due to the cost of investigating suspected fraud. Additionally, insurance companies are trying to strike a balance between investigating potential fraud and processing legitimate claims quickly and efficiently.

Insurance companies can introduce AI to solve the problem of fraudulent claims. Machine learning and AI algorithms identify the claim data patterns quickly and spot fraudulent or dubious requests in real time. This reduces the insurer's money a lot from spending on investigating fraudulent claims.

Often, claimants experience impersonal customer service during traditional claim processing. It happens mainly because claim handling is a typical data-intensive process. If you are one of those who feel that talking to customer service feels so impersonal and unhelpful, well, here is the answer.

In the traditional claims handling process, insurers may hire third-party call centres that will have certain limitations on accessing the claimant's information. This will delay claim acknowledgment and claim settlement process. Introducing personalised support with AI chatbots and virtual assistance will ease things for both insurers and policyholders.

AI systems in the insurance industry speed up the claims process by accessing the claimant’s information from a centralised information system. Also, it helps insurers retain honest policyholders by providing hyper-personalised insurance plans and knowledgeable support around the clock.

Having AI for claims processing helps insurance companies streamline and process claims settlements much faster at lower costs. The AI system extracts pertinent data about the claimant from the centralised information-sharing system through NLP - Natural Language Processing and image recognition. This enables insurers to speed up the claims process with increased efficiency. Want to know more about how AI in insurance works for claim processing? Let’s connect with our AI experts to discuss more about how to re-evaluate risk models, claims volume, pricing strategies, and more. At Codiste, our AI consultant also help the insurance industry to automate the entire process, from application submission to claim processing with no/zero human errors. This helps the insurance industry to save much cost and time as well and ultimately, it helps to serve customers with possible services.

Every great partnership begins with a conversation. Whether you’re exploring possibilities or ready to scale, our team of specialists will help you navigate the journey.